ASML (ASML -1.28%) is called a pacesetter within the semiconductor trade. The corporate is the one maker of maximum ultraviolet (EUV) lithography machines are important to the chipmaking course of.

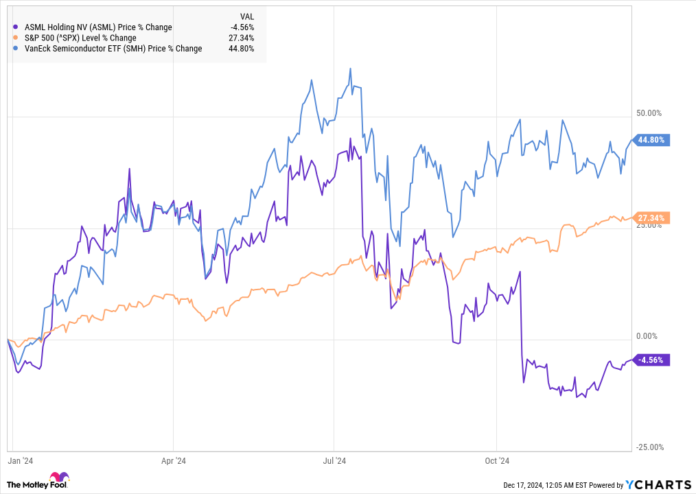

Nonetheless, that aggressive benefit hasn’t helped the inventory a lot this yr. Whereas friends like Taiwan Semiconductor Manufacturing have soared this yr, ASML has gotten left behind within the synthetic intelligence (AI) increase. 12 months to this point by way of Dec. 16, the inventory is down 5%, badly underperforming the S&P 500 and the broader chip sector.

The chart under exhibits the comparability.

Nonetheless, a pullback can typically arrange a shopping for alternative. So is ASML a purchase at the moment? Let’s have a look.

The place ASML stands now

The sell-off in ASML inventory is comprehensible. The corporate disenchanted buyers in its third-quarter earnings report because it lower its steering for 2025. That was resulting from weak demand in China following an earlier increase resulting from an order backlog. The corporate expects China income to normalize to about 20% of whole income in 2025, down from near 50% in 2024.

ASML’s enterprise is extremely cyclical as the corporate makes very costly machines and it solely sells about 100 of them each quarter. Which means a downturn or delay within the trade can have important results on its outcomes.

Along with the slowdown in China, the corporate can be being affected by export restrictions from the U.S. on sending superior expertise to China. It disenchanted buyers with weak reserving outcomes, because it solely booked 2.6 billion euros’ price of recent orders. That could possibly be a warning about future demand.

Picture supply: Getty Photographs.

Regardless of these headwinds, the corporate has returned to year-over-year development, with income up 12% in Q3 to 7.47 billion euros. Earnings per share additionally moved up from 4.81 to five.28 euros.

Whereas ASML’s core enterprise could also be beholden to the cyclical nature of the semiconductor trade, the corporate’s EUV expertise provides it a major benefit. ASML is the world’s solely maker of EUV lithography machines, the subsequent iteration of the deep ultraviolet (DUV) machines that deal with most semiconductor manufacturing at the moment.

Nonetheless, EUV machines enable for the manufacturing of the superior chips which are gaining popularity within the AI period, and that development ought to solely proceed. Moreover, the corporate is about to profit from the increase in new semiconductor foundries, pushed by AI, the CHIPS Act, and the necessity to geographically diversify away from Taiwan.

ASML now expects income of 30 billion to 35 billion euros in 2025 and 44 billion to 60 billion euros in 2030. The corporate continues to see important alternative in AI, noting that world semiconductor gross sales are anticipated to high $1 trillion by 2030. That means 9% compound annual development.

In the meantime, the corporate is more likely to stay the one maker of EUV machines. It has a technological lead over its opponents, and the analysis and improvement and manufacturing would price billions and could possibly be cost-prohibitive.

Is ASML a purchase?

After disappointing buyers by slicing its steering for 2025, ASML appears to have comparatively little draw back at its present value level.

The inventory trades at a price-to-earnings ratio of 39, which is not low cost, however margins look set to develop subsequent yr based mostly on its steering. The corporate is forecasting a gross margin of 51% to 53% subsequent yr and 56% to 60% by 2030 as EUV machines signify extra of its enterprise.

Lastly, ASML expects double-digit EUV lithography development yearly by way of 2030, which ought to make the inventory a winner on the present valuation.

2024 has been a forgettable yr for ASML, however the enterprise’ aggressive benefits look sturdy. It ought to profit from the expansion of AI, enlargement of foundries, and broader development within the semiconductor trade. The inventory appears like a sensible purchase on the present valuation.

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ASML and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.