Can Amazon nonetheless ship market-beating returns after hovering close to all-time highs on the finish of 2024?

E-commerce pioneer Amazon (AMZN -0.86%) belongs within the small handful of shares I would think about shopping for at any time. On the identical time, grasp buyers like Warren Buffett insist that even nice firms must be purchased solely at cheap costs.

As 2024 winds down, Amazon shares have gained greater than 46% this 12 months. The inventory trades simply 6% beneath its all-time excessive, which was set two weeks in the past. Is Amazon nonetheless a purchase at these hovering share costs, or must you let the inventory quiet down earlier than taking one other look in 2025?

Is Amazon inventory overpriced?

Cease me in case you’ve heard this earlier than: Amazon’s inventory appears costly.

The web retailer and cloud computing innovator has certainly reached a lofty perch on Wall Road. It is one in every of the vaunted “Magnificent Seven” shares, with a $2.27 trillion market cap. Shares are altering arms at 47 instances earnings (P/E) and 53 instances free money movement (P/FCF). There’s simply no different means to take a look at it — Amazon’s inventory is not low cost proper now.

This market-beating inventory by no means appears low cost

Then once more, this inventory by no means looks as if a cut price. It would not actually matter what metrics you apply to the chart — Amazon shares really feel costly more often than not.

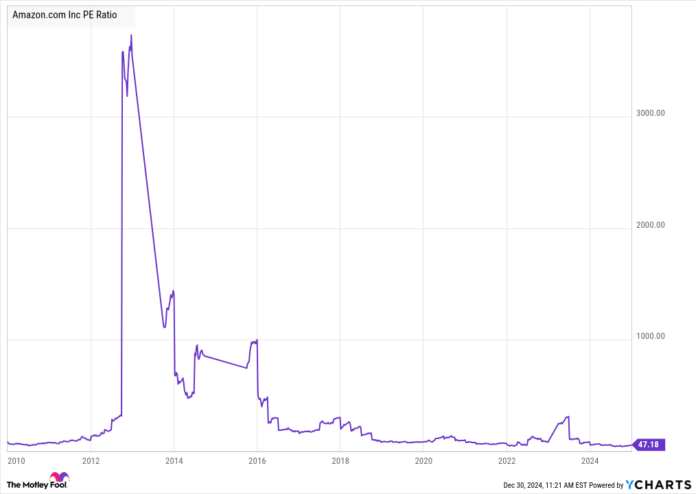

The chunky price-to-earnings ratio is concerning the lowest it has been within the final 15 years:

AMZN PE Ratio information by YCharts

The money movement ratio can be low from a historic perspective. On this view, Amazon inventory felt reasonably priced after the subprime meltdown of 2008-2009 and once more because the cloud computing section turned worthwhile within the mid-2010s, however Amazon additionally depleted its money earnings in 2013 and 2021. Information heart gear, world-class transport companies, and upgraded headquarters may be costly.

Ultimately, Amazon’s common P/FCF during the last decade and a half stands at 108:

AMZN Value to Free Money Circulation information by YCharts

And I actually do not need to remind you that the inventory delivered distinctive returns anyway, proper? The S&P 500 (^GSPC -0.43%) rose 424% within the 15-year interval I’ve highlighted, however Amazon raced forward with a 3,070% achieve:

“Excellent timing” is an actual factor. No person is aware of tips on how to obtain it.

I agree that it makes a distinction whenever you nail the proper time to purchase any explicit inventory. Should you grabbed Amazon shares on the precise day in June 2009 as a substitute of six months later, you’d have a 5,550% return in your pocket as a substitute. That is a a lot better consequence.

However no one is aware of tips on how to pinpoint these good buy-in dates. Warren Buffett is the primary to confess that he cannot see “what the inventory market goes to do within the subsequent six months, or the subsequent 12 months, or the subsequent two.”

That uncertainty applies to the market as a complete and to every particular person inventory. The most effective any investor can do is choose up shares of nice firms when it appears to make sense, then let the underlying enterprise ship worthwhile development and shareholder returns in the long term. That is adequate for billionaires like Buffett, and greater than positive for me. It’s best to think about the same method, too.

Sure, you should purchase Amazon in the present day

Perhaps this is not the most effective time ever to purchase Amazon inventory. However it’s additionally not a dangerous time.

Wanting forward, Amazon ought to profit from a stronger economic system, the continued synthetic intelligence (AI) increase, and its not too long ago launched drone supply system. I am speaking a few world-class innovator with a versatile marketing strategy, and the inventory might by no means appear reasonably priced however nonetheless supplies successful returns over time.

So that you should not again up the truck, guess the farm, or put your entire nest egg into Amazon inventory in the present day. Nevertheless, you would possibly wish to begin a modest Amazon place if you have not but, utilizing price-mitigating methods resembling shopping for in thirds or working an automatic dollar-cost averaging plan.

The street forward could also be bumpy, however you do not wish to watch from the sidelines as Amazon retains treating its shareholders to market-beating returns within the lengthy haul.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Amazon. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure coverage.