Traders all for tech shares will discover that every presents totally different worth propositions.

There is not any doubt that over the previous decade, the tech sector has been probably the most rewarding for buyers. The truth is, 9 of the world’s 10 Most worthy corporations are actually tech corporations, with every of them having a market cap of no less than $1.4 trillion (as of Oct. 15).

There are loads of tech shares that make for excellent investments, however the most effective methods to make the most of the tech sector’s progress is by investing in a tech-focused exchange-traded fund (ETF). These ETFs present publicity to the tech sector whereas minimizing the dangers that include investing in particular person tech shares.

Two tech ETFs which might be widespread selections are the Invesco QQQ Belief ETF (QQQ 0.73%) and the Vanguard Data Know-how ETF (VGT 0.25%). Every does a great job at offering publicity to the tech sector, however for those who had to decide on one, which one ought to you choose?

Picture supply: Getty Photographs.

What every ETF focuses on

QQQ is an ETF that mirrors the Nasdaq-100. The Nasdaq-100 is a subset of the Nasdaq Composite, containing the most important 100 non-financial corporations buying and selling on the Nasdaq inventory alternate. Though it is not a pure-tech ETF, the tech sector makes up over 60% of the fund.

However, VGT is extra of a pure-tech ETF. It accommodates 314 corporations, all from the knowledge know-how (tech) sector. A lot of the corporations are large-cap corporations, however there are mid-cap and small-cap tech shares included.

The 2 ETFs share 4 corporations of their high 10 holdings:

| Firm | Proportion of QQQ | Proportion of VGT |

|---|---|---|

| Nvidia | 9.56% | 17.16% |

| Microsoft | 8.34% | 13.35% |

| Apple | 8.03% | 13.09% |

| Broadcom | 5.85% | 4.47% |

Information sources: Invesco and Vanguard. Invesco holdings as of Oct. 10. Vanguard holdings as of Sept. 30.

Each ETFs are weighted by market cap, which is why these megacap tech shares account for such a big portion of the ETFs.

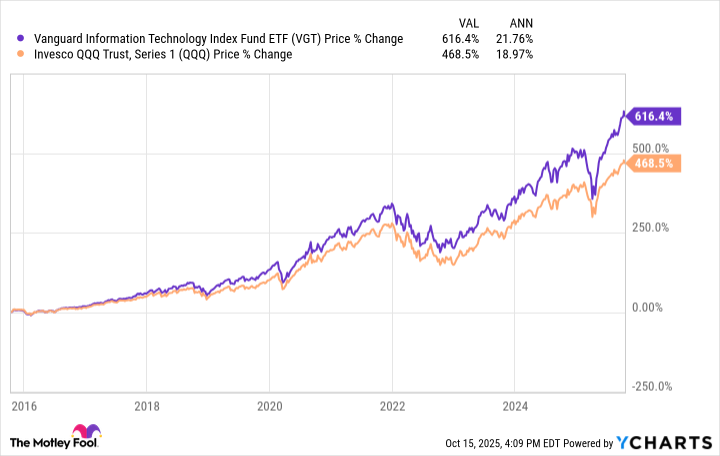

How every ETF has carried out within the final decade

Each QQQ and VGT have had very spectacular returns over the previous decade, however VGT has outperformed QQQ by 616% to 468% in that span. This works out to 21.8% and 19% common annual returns, respectively.

A lot of VGT’s outperformance has come prior to now yr, significantly with the explosion in progress from Nvidia, which accounts for a big a part of the ETF.

So, which ETF is the higher alternative for buyers eager to put money into tech?

There are a few issues that stand out about VGT. First, its efficiency over the previous decade in comparison with QQQ’s. Moreover, it is cheaper than QQQ, with a 0.09% expense ratio in comparison with QQQ’s 0.2% expense ratio. That 0.11% distinction appears small on paper, nevertheless it provides up over time to an actual distinction in returns. In case you had been to take a position $500 month-to-month into every and common 10% annual returns, you’d pay over $4,200 extra in charges in 20 years with QQQ.

All that stated, I nonetheless lean towards QQQ being the higher choice as a result of it is extra diversified than VGT. I would not contemplate both of them “diversified” in a conventional sense, however 4 corporations — Nvidia, Microsoft, Apple, and Broadcom — accounting for 48% of VGT is trigger for warning for my part.

This heavy focus has labored out in VGT’s favor, however the identical factor that made it soar may make it tumble if these corporations expertise a pullback (which is not far-fetched, given their excessive valuations). As these corporations carry out, so does VGT for probably the most half.

QQQ can be closely weighted in these corporations, nevertheless it has different non-tech corporations in its holdings that may assist decide up the slack if the tech sector goes by means of a down interval. With QQQ, you get publicity to a number of the world’s high tech corporations, but efficiency is not solely reliant on their efficiency. That is a greater strategy for long-term buyers.

Stefon Walters has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.