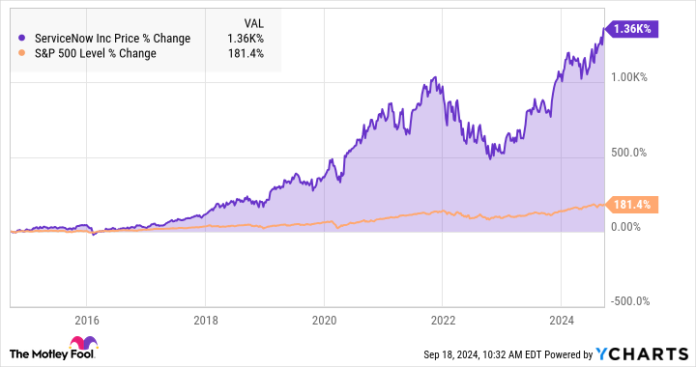

Workflow automation specialist ServiceNow (NOW 3.24%) is crushing the market. The inventory has greater than doubled in two years whereas the S&P 500 market index rose by 45%.

From an extended perspective, ServiceNow traders loved features of 1,360% during the last decade, far forward of the broader market’s 181% features. The unreal intelligence (AI) growth is working wonders for this firm, with companies which are constructed round superior AI automation:

That is nice for longtime shareholders, however new traders could also be discouraged by ServiceNow’s excessive share costs. The corporate has by no means carried out a inventory cut up, so these shares commerce at $890 per share as we speak.

Is it time for ServiceNow to announce its first-ever inventory cut up? Let’s assessment the professionals and cons of taking that step.

Why inventory splits matter

Inventory splits serve three major functions:

- A lower cost makes the inventory extra accessible to some traders. When your funding finances is low and you do not have entry to buying and selling fractional shares, it will probably take time to save lots of up for the acquisition of a single high-priced stub.

- Inventory-based compensation is one vital instance of this impact. For firms that make heavy use of issuing inventory choices to their staff, a lower cost gives administration with extra granular management over this partial paycheck substitute. A single possibility contract pertains to 100 shares of the underlying inventory, and that provides up in a rush when every share is price almost $1,000.

- Inventory splits convey the message that the corporate’s leaders count on share costs to rise even greater. This can be a vote of confidence for the corporate’s enterprise prospects and monetary energy — consider it as a low-cost advertising and marketing transfer.

That is about it. Inventory splits do not create further worth for brand spanking new or present shareholders since they merely divide up the identical pie of possession into a special variety of slices. The whole portion in your plate stays the identical.

ServiceNow’s versatile method to stock-based compensation

ServiceNow depends on stock-based compensation. Within the second quarter of 2024, 18.6% of the corporate’s working bills and value of income consisted of share-based compensation.

The inventory worth does have an effect on ServiceNow’s worker compensation insurance policies to a point. A lower cost offers its managers and board of administrators extra detailed management over how a lot every employee or govt is paid.

That being mentioned, this firm does not all the time subject choices. Based on ServiceNow’s monetary filings, a few of these awards are issued within the type of name possibility contracts, whereas others are restricted inventory items with time-based vesting schedules. This best-of-both-worlds method lowers the affect of wealthy share costs and stock-splitting concepts, in comparison with an organization with a stock-based compensation system based mostly strictly on inventory choices.

Why this is not one of the best time for a ServiceNow inventory cut up

ServiceNow has posted stellar inventory features for 12 years however by no means bothered to do the stock-split macarena. There could also be some sensible advantages from reducing that beefy inventory worth, however it’s not one thing that comes up usually (or ever) within the firm’s earnings calls.

A ten-for-1 inventory cut up would drop ServiceNow’s share worth beneath the $100 mark whereas giving traders a public present of swagger and confidence. Would that be useful?

Properly, the inventory already trades close to all-time highs. Trailing gross sales have almost doubled (up 93%) in three years. The corporate generated $3.1 billion in free money movement from $10 billion of top-line gross sales within the final 4 quarters.

ServiceNow does not must go fishing for investor approval with the intention to increase the inventory’s valuation ratios. Shares are already altering palms on the lofty valuation of 161 occasions earnings and 59 occasions free money movement. Asking for extra is a stretch at this level.

At a look, ServiceNow might appear to be an apparent stock-split candidate, however I am not so positive {that a} cut up would do a lot for the corporate. A spotlight-stealing present of confidence could possibly be extra useful if the hovering inventory slides again a bit. At that time, a cut up may increase each investor and worker morale.

Nevertheless, that is not what is going on on as we speak, and I would be shocked to see ServiceNow announce a inventory cut up beneath these circumstances. The reply may change if the inventory ever takes a steep worth reduce, ideally for no good purpose.

Anders Bylund has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ServiceNow. The Motley Idiot has a disclosure coverage.