Each tech corporations are capturing clients hungry for his or her AI options.

Synthetic intelligence (AI) holds unimaginable potential to alter industries. Some have likened AI to the largest transformational know-how for the reason that web.

Loads of corporations try to capitalize on AI’s secular development. Two are Palantir Applied sciences (PLTR 2.98%) and C3.ai (AI 1.12%). The previous makes use of AI to derive insights from information, and the latter gives organizations with turnkey and customized AI software program.

The AI market is anticipated to increase quickly from a projected $184 billion this yr to $827 billion by 2030. Given this development, is Palantir or C3.ai the higher AI funding for the lengthy haul? This is a have a look at every to achieve a conclusion.

The case for Palantir

Palantir has been serving to the U.S. authorities analyze information since 2003, nevertheless it simply launched its synthetic intelligence platform (AIP) in 2023. With its inception, AIP helped to spur the enlargement of Palantir’s non-government enterprise.

Within the second quarter, Palantir skilled 33% year-over-year gross sales development to $307 million in its industrial division. This contributed to the agency’s Q2 income reaching $678 million, a 27% bounce up from the earlier yr.

Not solely is Palantir’s income rising, however its monetary well being can be wonderful. It exited Q2 with a web revenue of $135.6 million, up from $27.9 million in 2023. It additionally boasted Q2 adjusted free money move (FCF) of $149 million, a rise from the prior yr’s $96 million.

AIP efficiently attracted industrial clients as a result of the platform allows companies to go from an AI idea to real-world implementation in as little as just a few days. This capacity is not any small feat, and in line with Palantir’s CTO, Shyam Sankar, “therein lies our total alternative available in the market.”

As a follow-up to AIP’s success, Palantir launched a brand new product constructed on AIP known as Warp Velocity. This resolution is supposed to deal with bottlenecks within the manufacturing business by leveraging AI to enhance provide chains and a corporation’s manufacturing processes.

If Palantir can efficiently deal with this large market, which represented practically $3 trillion in U.S. gross home product (GDP) final yr, it might basically rework its fortunes.

A have a look at C3.ai

C3.ai started in 2009 as an power administration firm and transitioned to AI software program in 2019. Its power business roots enabled the agency to type a three way partnership with power large Baker Hughes to ship AI tech to the oil and fuel sector. This allowed C3.ai to seize clients comparable to Shell and ExxonMobil.

C3.ai’s software program platform can tackle varied conditions the place AI can assist a enterprise, comparable to fraud detection for banks. The corporate generated 84% of its income from subscriptions in its 2025 fiscal first quarter, which ended July 31. The rest got here from providers comparable to coaching and buyer assist.

AI demand led to speedy income development for the corporate. In its fiscal Q1, gross sales hit $87.2 million, a 21% year-over-year enhance. This extends the double-digit income development C3.ai loved in its 2024 fiscal yr when gross sales reached $310.6 million, a 16% year-over-year enhance.

The agency additionally produced Q1 FCF of $7.1 million, a considerable enchancment over the prior yr’s destructive FCF of $8.9 million. But, C3.ai just isn’t worthwhile. Its Q1 web loss totaled $62.8 million.

As well as, the corporate’s partnership with Baker Hughes is contracted to finish in April 2025. This can be a key relationship for C3.ai, with some estimates suggesting Baker Hughes accounts for over a 3rd of C3.ai’s income.

Deciding between C3.ai and Palantir

Selecting Palantir or C3.ai as the higher funding is not easy. Whereas each get pleasure from robust income development, C3.ai’s lack of profitability would appear to make Palantir the higher AI enterprise to put money into. But, Palantir’s success drove up its inventory value, with shares skyrocketing over 150% prior to now 12 months.

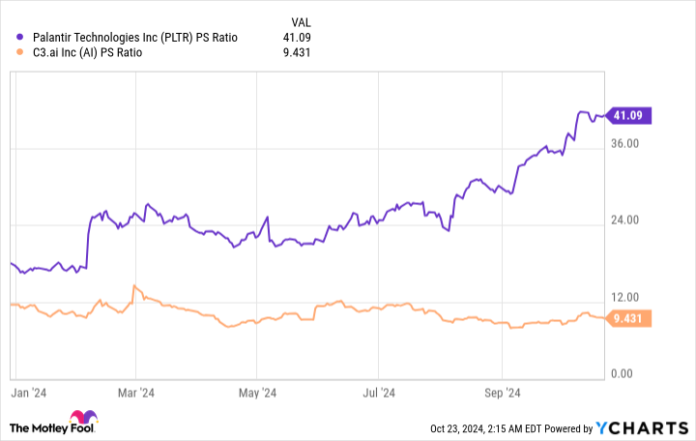

At this level, the agency’s shares look fairly expensive when evaluating its price-to-sales (P/S) ratio to C3.ai. The P/S ratio tells you ways a lot traders should pay per share for a greenback’s price of income.

Knowledge by YCharts. PS Ratio = price-to-sales ratio.

Wall Road agrees. The consensus amongst Wall Road analysts is a “maintain” ranking with a median share value goal of $28 for Palantir inventory. Provided that shares commerce for round $43 on the time of this writing, Wall Road’s value goal signifies a perception that Palantir shares are overpriced.

That mentioned, C3.ai is way from a purchase. Like Palantir, the consensus amongst Wall Road analysts is a “maintain” ranking for C3.ai inventory, with a median share value goal of $22.

Including to that is uncertainty across the renewal of C3.ai’s partnership with Baker Hughes. Consequently, any determination round shopping for C3.ai shares ought to be delayed till this partnership state of affairs is resolved.

If not for Palantir’s sky-high valuation, it will be the higher AI funding over C3.ai, given its superior financials and AIP’s success and future potential with Warp Velocity. However right now, it is best to attend for a drop in Palantir’s share value earlier than deciding to purchase.