Nvidia (NVDA 2.63%) has basically owned the info heart computing market, which is a big deal, contemplating the lots of of billions of {dollars} being spent on synthetic intelligence (AI) infrastructure. Nvidia is among the major benefactors of this funding, though a few of its rivals, like AMD (AMD 1.15%), are additionally benefiting.

Nonetheless, the lead that Nvidia has surmounted appears to be like unassailable, however all it takes is one innovation, and AMD could possibly be neck and neck with Nvidia.

So, which of those two is the higher AI inventory for 2025?

Nvidia’s lead within the information heart market could also be insurmountable

Nvidia’s GPUs and software program have turn out to be the trade normal in information facilities. Whereas AMD’s GPUs appear like they’ll compete on paper, Nvidia’s software program, CUDA, units it aside. This software program permits GPUs to course of a number of calculations concurrently and deal with the sheer computing duties that AI computing requires.

As a result of the trade has basically adopted CUDA software program versus AMD’s ROCm, it is unlikely that AMD will ever be capable to surmount Nvidia’s lead within the information heart race. The switching prices of shifting from one provider to a different when the infrastructure is already arrange for one is an enormous consideration and is the first hurdle for anybody switching.

Nvidia’s lead over AMD may be seen in each of their financials. Every has an information heart division, and Nvidia’s lead is sort of spectacular. In This fall 2024, AMD’s information heart income was $3.9 billion, up 69% 12 months over 12 months. Nvidia hasn’t reported its This fall outcomes but, as its monetary calendar is shifted by one month. Consequently, utilizing AMD’s Q3 outcomes gives a greater comparability.

In Q3, AMD’s information heart income was $3.5 billion, up 122% 12 months over 12 months. These are spectacular outcomes by themselves, but pale compared to Nvidia’s.

In Q3 FY 2025 (ending Oct. 27), Nvidia’s information heart income was $30.8 billion, up 112% 12 months over 12 months. That signifies Nvidia’s information heart enterprise is round 10 occasions the dimensions of AMD’s, which is an enormous lead. We’ll be taught extra about Nvidia’s This fall outcomes when it stories on Feb. 26, however with all of the speak from massive tech firms about AI spending, it is more likely to report nice numbers.

Nvidia has constructed an enormous moat with large switching prices, which basically blocks AMD from taking a significant quantity of its information heart enterprise. Nonetheless, if AMD is considerably cheaper as a inventory, the low cost could possibly be sufficient of a motive to spend money on AMD, as its information heart enterprise remains to be rising strongly, being a lot smaller than Nvidia.

AMD would not have a reduction to Nvidia

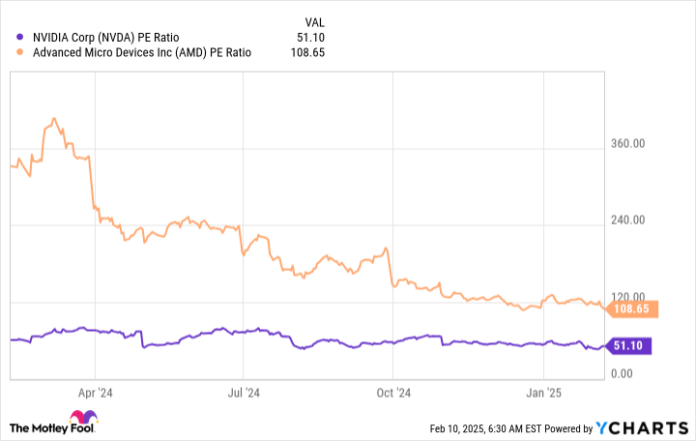

As a result of each firms are absolutely worthwhile, utilizing an earnings-based metric just like the price-to-earnings (P/E) ratio is smart.

NVDA PE Ratio information by YCharts

From this attitude, AMD’s inventory appears to be like far costlier than Nvidia’s, which it’s. Nonetheless, each firms are present process robust development, and AMD’s revenue image is ready to enhance all through 2025, so utilizing a ahead P/E ratio can be a good suggestion.

NVDA PE Ratio (Ahead) information by YCharts

From this attitude, AMD is cheaper than Nvidia. Nonetheless, the discrepancy between these two valuation ranges can largely be attributed to the company-wide development fee. Contemplating that Nvidia is predicted to develop income by 52% in FY 2026 (ending January 2026) and AMD is predicted to develop at a 24% tempo, this distinction appears cheap.

Nvidia is rising quicker and dominating an important computing market proper now. Whereas AMD remains to be a nice firm, I do not assume there’s any motive to personal AMD over Nvidia. Greatest-in-class shares normally outperform their friends by a large margin, particularly after they begin from the same valuation level.