Buyers might discover selecting between these two tech shares tough.

Amid the continued synthetic intelligence (AI) increase, shares of Nvidia (NVDA 3.51%) and Tremendous Micro Pc (SMCI 3.67%) have set the inventory market on fireplace in 2024, racking up beneficial properties of 166% and 197%, respectively, as of this writing. Due to the booming demand for the AI-enabling {hardware} they promote, they’ve skilled gorgeous accelerations of their income and earnings development.

Nvidia’s dominance within the AI chip market has translated into phenomenal development, and Tremendous Micro Pc is not far behind. Knowledge middle operators are flocking to its modular server options to mount the AI chips that Nvidia and different firms promote. Nonetheless, if you’re trying so as to add an AI inventory to your portfolio and wish to select between one in all these two, which one do you have to be shopping for proper now?

The case for Nvidia

Nvidia reportedly managed a whopping 94% of the AI chip market on the finish of 2023. The corporate’s outcomes for the primary quarter of its fiscal 2025 (which ended on April 28) counsel that its dominance has it on target for one more 12 months of terrific development.

Income rose a surprising 262% 12 months over 12 months to $26 billion. Its spectacular pricing energy led to a 461% surge in adjusted earnings to $6.12 per share. Administration’s income steering of $28 billion for the present quarter means that its high line is on monitor to leap 107% 12 months over 12 months, which might be an acceleration from the 101% development it delivered in the identical interval final 12 months.

Nonetheless, rising development avenues within the nascent AI market point out that Nvidia may find yourself doing even higher than that. As an example, governments throughout the globe are reportedly pouring big quantities of cash into AI infrastructure, and sovereign investments in AI expertise are anticipated to contribute $10 billion to Nvidia’s high line this fiscal 12 months, as in comparison with nothing within the earlier one.

Extra particularly, governments need to make massive language fashions (LLMs) in native languages primarily based on country-specific information. On Nvidia’s Could convention name, administration identified that Japan, France, Italy, and Singapore are already investing in AI infrastructure. It expects extra nations to affix the bandwagon. “The significance of AI has caught the eye of each nation,” mentioned CFO Colette Kress.

Saudi Arabia, as an illustration, is reportedly trying to make investments $40 billion in AI initiatives, whereas China’s AI-focused spending is forecast to exceed $38 billion by 2027. In the meantime, key Indian firms equivalent to Tata Group and Reliance Industries are counting on Nvidia’s chips to coach LLMs.

Briefly, Nvidia’s buyer base is diversifying past the main cloud infrastructure suppliers which were deploying its chips in massive numbers to coach and deploy AI fashions. Spending on AI chips is anticipated to develop greater than 10-fold over the following decade, producing $341 billion in income in 2033 in comparison with $23 billion final 12 months. The stage appears set for Nvidia to keep up its great development because it takes strong steps to make sure that it stays the dominant participant on this house.

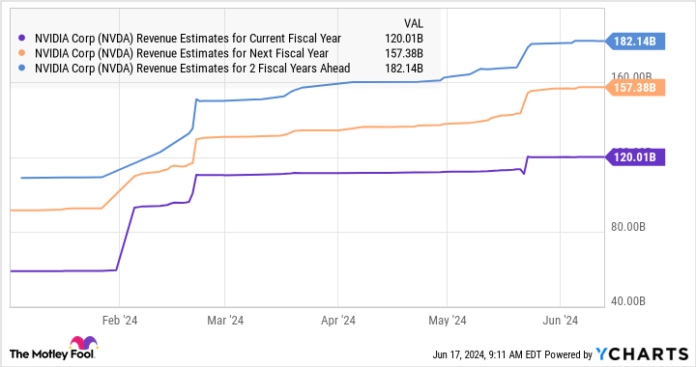

That is why analysts forecast that the corporate’s high line will continue to grow at a wholesome tempo from fiscal 2024’s studying of practically $61 billion.

NVDA Income Estimates for Present Fiscal 12 months information by YCharts.

So, Nvidia ought to stay a high AI inventory because the race to develop AI purposes by firms and governments alike has created a secular development alternative.

The case for Tremendous Micro Pc

Supermicro’s development is entwined to some extent with that of Nvidia. Knowledge middle operators require server rack options of the sort that Supermicro sells to mount the processors bought by Nvidia and different chipmakers. So, it’s not stunning that demand for Supermicro’s servers has merely taken off.

In its fiscal 2024 third quarter, which ended March 31, its income jumped 200% 12 months over 12 months. Non-GAAP web revenue per share, in the meantime, jumped by a whopping 307%. So, Supermicro is not all that far behind Nvidia relating to how AI has supercharged its fortunes. The corporate is guiding for income of $14.9 billion within the present fiscal 12 months, which ends this month. This could be a giant leap over the $7.1 billion in income it reported in its fiscal 2023.

Extra importantly, analysts expect its high line to just about double over the following couple of fiscal years.

SMCI Income Estimates for Present Fiscal 12 months information by YCharts.

The great half is that Supermicro can maintain a wholesome tempo of development past the following couple of fiscal years. That is as a result of the demand for AI servers is anticipated to increase at a compound annual charge of 25% by means of 2029. The market is anticipated to generate annual income of just about $73 billion after 5 years, up from $17.5 billion in 2022.

Supermicro is rising at a quicker tempo than the AI server market proper now. Because it seems, its development is quicker than that of extra established firms equivalent to Dell Applied sciences, which has bought $3 billion value of AI servers previously three quarters. Supermicro generated $9.6 billion in income previously three quarters and will get greater than half its income from promoting AI-related server options.

Supermicro has been in a position to make a dent within the AI server market regardless of the presence of larger gamers. Additionally, with the strikes that the corporate has been making to extend its production-utilization charge and its manufacturing capability, it may nook a much bigger share of the AI server market sooner or later.

Like Nvidia, even Supermicro appears like a strong long-term AI play. However is it value shopping for over Nvidia?

The decision

Each Nvidia and Supermicro are high-growth firms benefiting huge time from the proliferation of AI. So buyers’ selection about which inventory they might wish to purchase proper now’s going to boil all the way down to the valuation. Supermicro is considerably cheaper than Nvidia so far as their earnings and gross sales multiples are involved.

SMCI PE Ratio information by YCharts.

Nonetheless, when it comes to the value/earnings-to-growth (PEG) ratio, the story is a little more attention-grabbing. That metric is a forward-looking valuation decided by dividing an organization’s trailing earnings a number of by the earnings development that it’s anticipated to ship over a future interval. Any (constructive) PEG ratio beneath 1 is seen by most buyers as indicating a discount inventory. And on that metric, each Nvidia and Supermicro are undervalued.

SMCI PEG Ratio information by YCharts.

So by no less than one forward-looking measure, each Nvidia and Supermicro are engaging buys proper now for anybody trying so as to add a development inventory to their portfolios. Extra importantly, each these firms appear able to delivering the excellent development that the market expects from them, due to the profitable alternatives they’re sitting on. And that is why buyers can take into account shopping for both inventory, regardless of the terrific beneficial properties they’ve clocked to date this 12 months.