Nvidia (NVDA -2.09%) and Palantir (PLTR -3.72%) have been two of the best-performing shares available on the market this 12 months, and synthetic intelligence is the most important purpose.

Nvidia wants little introduction at this level. The chip inventory has come to dominate the marketplace for knowledge heart GPUs (graphics processing models) within the AI increase, which has pushed its inventory worth up roughly 10 occasions for the reason that begin of 2024. Palantir, in the meantime, has emerged as the most important winner in software program from AI as its expertise with deep knowledge mining, generally known as knowledge fusion, has paid off, particularly for the reason that launch of its synthetic intelligence platform (AIP) final 12 months.

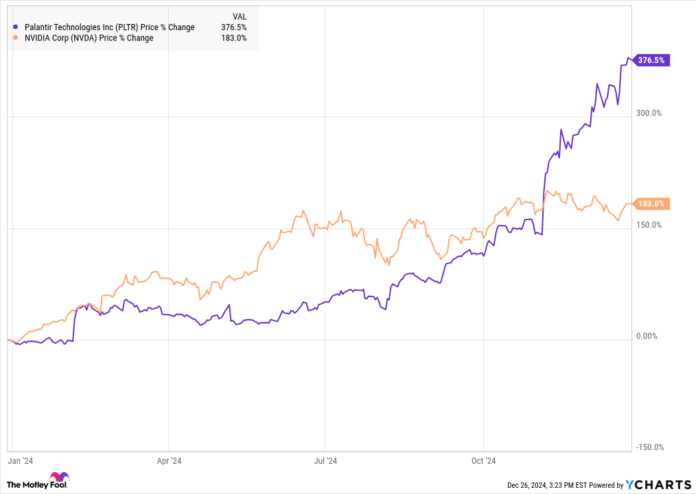

Because the chart under reveals, each shares have soared this 12 months.

So, which is the higher purchase as we speak? Let’s get into the small print on what every inventory has to supply.

Picture supply: Getty Pictures.

Enterprise mannequin: Nvidia vs. Palantir?

Nvidia has established itself because the main chip design firm, because of its prowess in AI and its investments in areas like its CUDA software program library, which give it a aggressive benefit.

Because of its huge lead in AI-focused parts like the brand new Blackwell platform, Nvidia at present generates huge revenue margins with a usually accepted accounting ideas (GAAP) working margin of 62% within the third quarter.

The corporate has constructed an all-star tradition centered on innovation, and it appears prone to stay forward of the competitors on AI chips. It will depend on foundries like Taiwan Semiconductor Manufacturing Firm for manufacturing and is susceptible to cyclicality and broader considerations a few bubble in AI. The semiconductor trade is notoriously cyclical and costs and stock ranges can change rapidly. Due to this fact, Nvidia’s biggest danger is probably going a change in trade dynamics that might threaten its progress quite than a aggressive menace.

Palantir received its begin serving U.S. intelligence businesses after 9/11, serving to them join knowledge factors to seek out threats they in any other case would have missed. Palantir has since expanded its product suite to specialise in a variety of enterprise wants, together with cryptocurrency, knowledge safety, and the prevention of cash laundering.

Its principal software program platforms embrace Gotham, Foundry, Apollo, and Synthetic Intelligence Platform (AIP). Gotham and Foundry are centered on taking huge quantities of data and making it right into a helpful dataset.

Apollo is a layer for industrial prospects that enables them to run their software program in practically any setting, and AIP works with Gotham and Foundry to make use of machine studying to speed up insights.

Palantir has a comparatively small variety of high-paying prospects, that means it offers in giant contracts. The dimensions and complexity of its contracts imply the corporate faces comparatively little competitors from different software program firms. As a substitute, it sees the interior software program improvement efforts of its prospects as its largest competitor.

Like Nvidia, Palantir can be liable to a sectorwide pullback, although its aggressive place appears resilient, given the specialised nature of its enterprise.

Financials: Nvidia vs. Palantir?

Each Nvidia and Palantir have delivered spectacular outcomes, however one firm is clearly rising sooner than the opposite.

Nvidia reported 94% income progress within the third quarter to $35.1 billion, with $19.3 billion in internet earnings, up 109% from the 12 months earlier than.

Palantir, however, reported 30% income progress to $726 million with sturdy leads to the U.S. and its industrial phase. Web earnings jumped 103% to $149.3 million as its margins quickly scaled up.

Valuation: Nvidia vs. Palantir?

Palantir’s explosive progress this 12 months has come largely from a number of expansions. Consequently, the inventory is buying and selling at a sky-high valuation. Palantir now trades at a price-to-sales ratio of 75 and a price-to-earnings ratio of 411 based mostly on GAAP earnings.

Nvidia inventory seems to be extra cheap. It at present trades at a price-to-sales ratio of 31 and a price-to-earnings ratio of 55.

Which is the higher purchase?

Each of those firms have so much to supply buyers, particularly if demand for AI continues to develop, however taking a look at each shares holistically, Nvidia is the higher purchase.

Palantir’s enterprise is actually intriguing. It is demonstrated its worth to prospects and appears to have a significant aggressive benefit. Nevertheless, its valuation presents a major danger because the inventory might simply plunge if it misses expectations.

Nvidia, however, additionally seems to be poised for related progress however with much less draw back danger.

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia, Palantir Applied sciences, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.