The newest FOMC information indicators a transparent dovish tilt amongst U.S. Federal Reserve officers, with the newly launched minutes displaying that further fee cuts are possible earlier than the tip of the yr. Most members judged that it will be “applicable to ease coverage additional over the rest of 2025,” marking a notable shift from the cautious tone that dominated a lot of the yr.

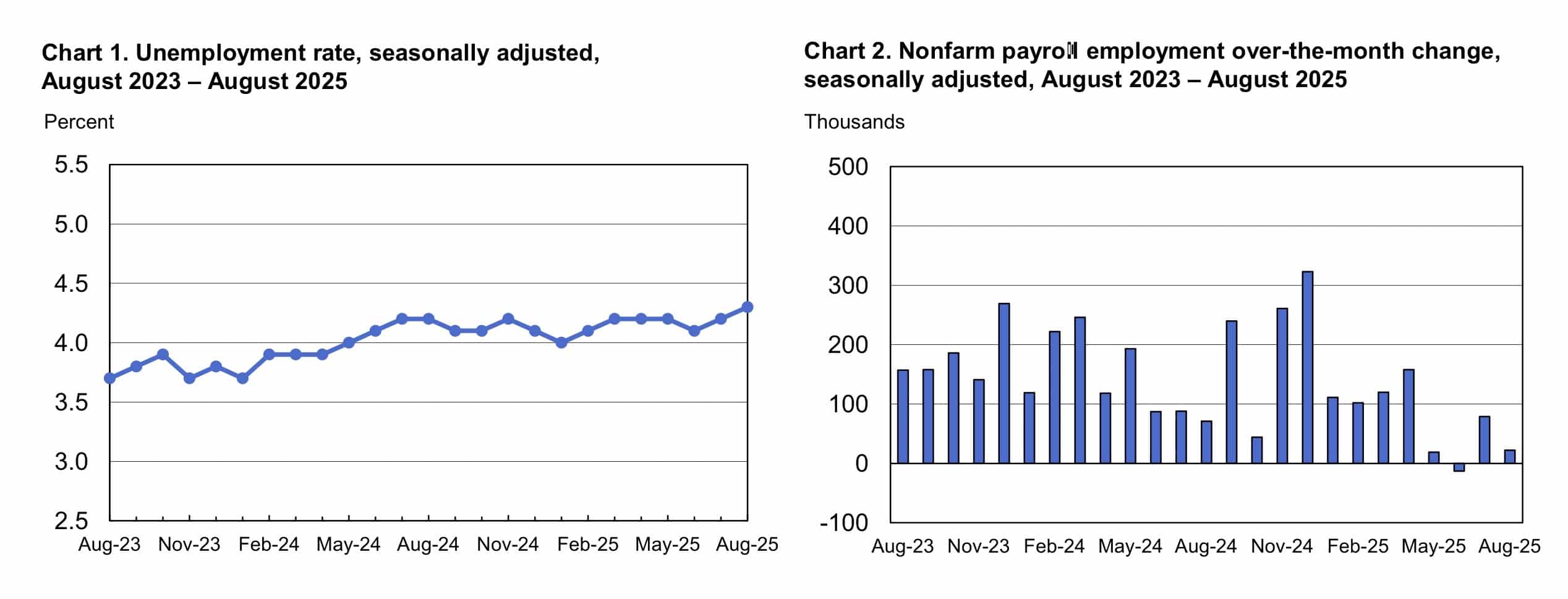

Whereas the central financial institution stays formally dedicated to its 2% inflation goal, the tone of the September assembly minutes suggests the Fed is changing into extra involved about slowing employment than lingering inflation. The primary fee lower in September—by 25 foundation factors—was pushed by indicators of a softening labor market, with job good points slowing and the unemployment fee ticking increased.

EXPLORE: 15+ Upcoming Coinbase Listings to Watch in 2025

FOMC Information: Two Extra Fee Cuts Anticipated in 2025

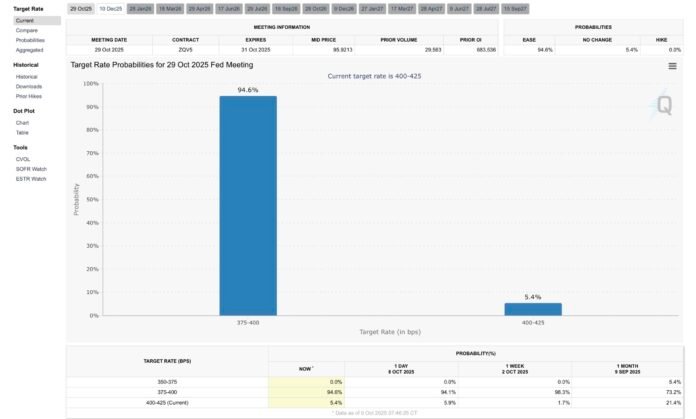

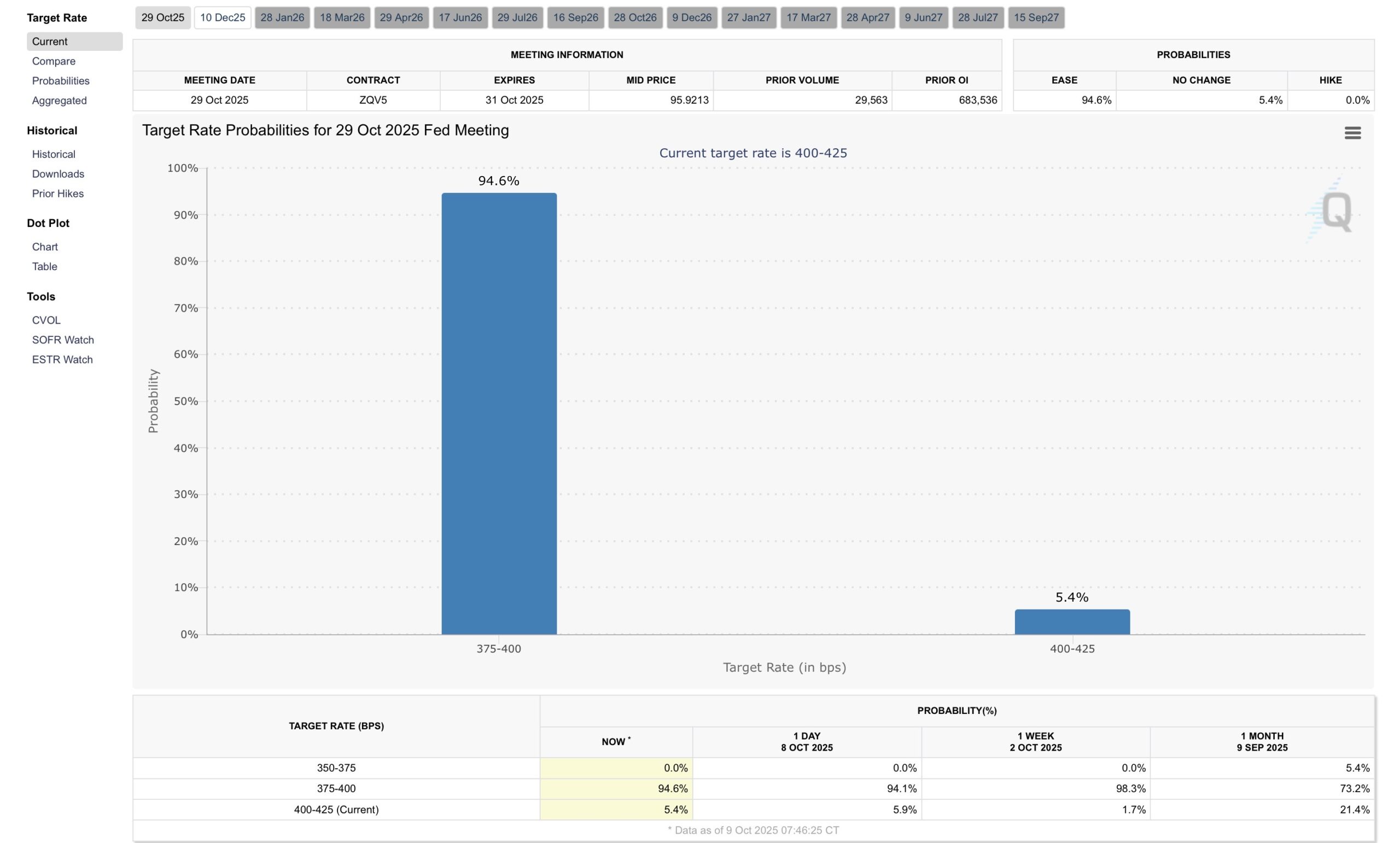

In keeping with the Fed’s median estimate, two further 25-basis-point (bps) cuts are anticipated earlier than year-end, possible on the October and December FOMC conferences. Market expectations largely align with that view. CME FedWatch information at the moment exhibits a 92.5% likelihood of a 25-bps lower on the October 29 assembly.

The softer tone had a direct impression on threat property. Bitcoin rose following the discharge of the minutes, briefly pushing above $124,000 earlier than settling round $123,500. The broader crypto market capitalization stays above $4.19 trillion.

Crypto merchants usually view decrease rates of interest as bullish, as simpler financial coverage tends to extend liquidity and threat urge for food throughout each conventional and digital asset markets. The expectation of additional easing has due to this fact strengthened sentiment in crypto, particularly after months of combined indicators from the Fed.

DISCOVER: Gold Worth Hits $4K ATH, Leaves Nasdaq In The Mud — Is the Bull Cycle Toast?

The Employment vs. Inflation Debate

The FOMC’s twin mandate, maximizing employment and sustaining secure costs, has once more grow to be a balancing act. The minutes confirmed members had been divided over whether or not to prioritize addressing draw back dangers to employment or proceed urgent on inflation.

Most members agreed that the coverage stance ought to transfer towards a extra impartial degree given the current labor information. They famous that inflation dangers had “both diminished or not elevated,” though a number of members remained cautious, arguing that loosening too rapidly may reignite worth pressures.

Kansas Metropolis Fed President Jeffrey Schmid reiterated that inflation stays “too excessive” and stated he would like a extra measured tempo of easing. In distinction, newly appointed Governor Stephen Miran, the one official who dissented in favor of a bigger 50-bps lower in September, stated he’s “sanguine in regards to the inflation outlook” and helps a extra aggressive strategy to easing.

This cut up underscores a key uncertainty: whether or not the present fee degree remains to be restrictive. Some members argued that the actual coverage stance could now not be considerably tight, whereas others imagine the financial system may nonetheless profit from additional easing to offset labor market weak spot.

EXPLORE: 16+ New and Upcoming Binance Listings in 2025

Implications for Bitcoin and Crypto

For crypto markets, the Fed’s flip towards simpler coverage reinforces a well-recognized narrative: that Bitcoin and different decentralized property thrive when actual yields fall and liquidity expands. Former hedge fund supervisor James Lavish famous that whereas the Fed is “nonetheless involved about rising inflation,” its willingness to chop charges anyway highlights why “sound cash like BTC issues greater than ever.”

Merchants reacted rapidly to the FOMC information, with Bitcoin leaping above $124,000 earlier than stabilizing close to $123,500. In earlier cycles, easing phases have usually coincided with renewed upside in risk-on property, together with crypto. Nevertheless, merchants stay cautious after September’s post-FOMC volatility, when Powell’s feedback briefly triggered a sell-off regardless of the speed lower.

With the following Fed assembly approaching and financial information releases delayed by the continued authorities shutdown, Powell’s upcoming speech will function the one main coverage sign this week. Each Wall Road and crypto markets are bracing for potential volatility.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- FOMC information confirms the Fed’s softer stance, with two extra fee cuts anticipated in 2025.

- Simpler coverage from the Fed lifted Bitcoin above $124,000, reinforcing optimism throughout the broader crypto market.

The put up FOMC Information: Members to Ease Coverage Extra This 12 months – What it Means For Crypto? appeared first on 99Bitcoins.