Within the third quarter alone, Warren Buffett and his workforce at Berkshire Hathaway have offloaded a staggering 235 million shares of Financial institution of America (BAC). The conglomerate’s share gross sales have been notable, as Berkshire’s earlier stake was greater than 10%, which required public disclosure through Type 4 to the Securities and Alternate Fee (SEC) each time it made a sale.

Rising rates of interest in recent times have taken a toll on Financial institution of America’s bond portfolio, and it presently sits on $89.4 billion in unrealized losses. Nevertheless, with rates of interest anticipated to fall over the following 12 months, Financial institution of America stands to learn. When you’re pondering of investing within the financial institution or presently maintain the inventory, contemplate the next.

Motive to promote Financial institution of America

Investing in banks may be complicated, particularly with fluctuating rates of interest. That is as a result of banks borrow cash quick time period, primarily by means of buyer deposits, and lend out that cash long run. In consequence, a financial institution’s profitability hinges on the distinction between the curiosity earned on loans and the curiosity paid on deposits, making banks’ cyclical shares delicate to rate of interest adjustments.

Current spikes in rates of interest have been a blended bag for Financial institution of America. On the one hand, internet curiosity revenue surged to $56.9 billion, rising 33% throughout the two years led to 2023. Nevertheless, the financial institution has additionally skilled a dramatic enhance in unrealized losses inside its mortgage portfolio, ballooning from $14 billion in 2021 to $102 billion final 12 months.

Unrealized losses do not should be realized losses so long as the financial institution can maintain the property in query to maturity. Nevertheless, these losses could possibly be realized when a financial institution has to promote its securities to lift capital or cowl deposit withdrawals. This danger was highlighted by the state of affairs confronted by Silicon Valley Financial institution (a subsidiary of SVB Monetary). The financial institution suffered a run on its deposits in March 2023, forcing it to liquidate underwater property to lift capital. This led to deep losses, forcing federal regulators to grab the financial institution.

Whereas these unrealized losses can seem alarming, they do not essentially spell doom for Financial institution of America, which boasts a steady, strong $1.9 trillion deposit base throughout varied consumer teams, geographies, and industries.

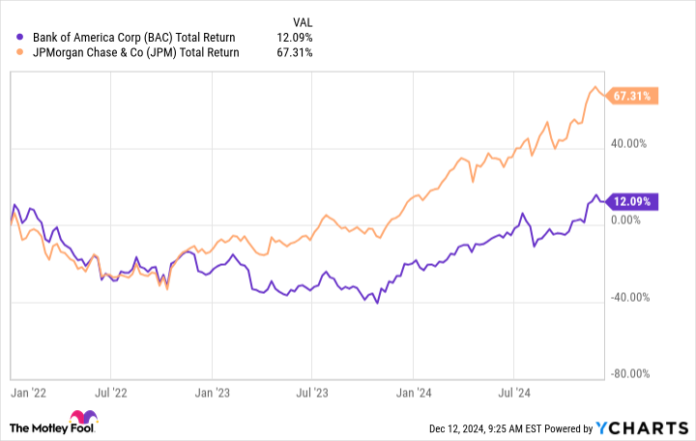

Nevertheless, the chance price of getting capital tied up in lower-yielding investments hinders its revenue potential. Examine this to different banks, like JPMorgan Chase, which stockpiled money in 2021 for probably increased charges and have been one of many largest beneficiaries and greatest performers throughout this rate of interest cycle.

BAC Whole Return Stage information by YCharts

Buyers who’ve soured on the way in which Financial institution of America has dealt with its mortgage portfolio could discover at the moment a great time to take some income.

Motive to purchase or maintain Financial institution of America

Final 12 months, the Federal Reserve paused its rate of interest climbing cycle and it lately started decreasing its benchmark rate of interest. This prompted Financial institution of America’s internet curiosity revenue to fall about 3% by means of the primary three quarters of this 12 months. Nevertheless, falling rates of interest have additionally helped it scale back its unrealized losses to $89.4 billion on the finish of the third quarter.

One constructive is that the securities in its held-to-maturity (HTM) portfolio proceed to mature and run off. In accordance with Chief Monetary Officer Alastair Borthwick, about $9 billion was free of its HTM portfolio within the third quarter, permitting the financial institution to reinvest this capital at increased rates of interest (in comparison with pre-2022 ranges). This, coupled with a steepening yield curve, places the financial institution able to extend internet curiosity revenue subsequent 12 months.

Not solely that, however the latest election outcomes might bode nicely for banks. That is as a result of buyers are optimistic a couple of pickup in funding banking exercise together with much less stringent Basel III endgame reforms, which can present banks with extra capital than initially anticipated.

BAC PE Ratio information by YCharts

Financial institution of America is buying and selling on the barely increased finish of its common valuation, at 16.7 instances earnings and 1.74 instances tangible e-book worth, however I do not assume buyers ought to be too involved about Buffett’s share gross sales. Buffett could possibly be promoting for varied causes, together with bringing Berkshire under its 10% possession threshold or liberating up capital to prepare at hand over the reins of the funding portfolio to his workforce at Berkshire.

Whereas its efficiency naturally ebbs and flows with the U.S. financial system and prevailing market circumstances, Financial institution of America has proven resilience. The inventory is on the pricier aspect of its valuation, so the upside could also be extra restricted, but it surely stays a stable financial institution inventory to proceed holding long-term.