Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth has dropped 4% up to now 24 hours, slipping to round $2,744, as promoting stress will increase, and Veteran dealer Peter Brandt has warned that Ethereum’s decline is probably not completed but.

Brandt factors to a breakdown from a symmetrical triangle on the 24-hour Ethereum chart, a sample he describes as a well known bearish sign that always results in additional losses when confirmed. In line with him, the breakdown signifies that sellers stay in management, particularly in an atmosphere of skinny market liquidity and continued capital outflows.

These circumstances make it more durable for Ethereum to get better, as even small promote orders can push costs decrease. Brandt provides that the shortage of robust shopping for curiosity means rallies are more likely to be short-lived except market circumstances enhance. He additionally locations Ethereum’s weak spot inside a broader market context.

Brandt highlights a right-angled broadening sample on the whole cryptocurrency market capitalization chart. Following the current market crash, the whole crypto market worth has already dropped to round $2.82 trillion. He warns that if this sample continues, whole market capitalization might fall towards $2.41 trillion.

ETF Outflows and Weak Sentiment Deepen Bearish Strain

This could symbolize a further 15–20% decline from present ranges and will hold main cryptocurrencies reminiscent of Bitcoin, Ethereum, and XRP below continued stress. Ethereum’s poor technical outlook matches weakening sentiment throughout the broader crypto market. The second-largest cryptocurrency has misplaced greater than 46% of its worth over the previous few months, reflecting each international macro uncertainty and challenges particular to the crypto sector.

One of many greatest elements hurting sentiment has been regular outflows from spot Ethereum exchange-traded funds, which counsel that institutional traders have gotten extra cautious. On Thursday alone, spot ETH ETFs recorded practically $156 million in web outflows.

Constancy’s FETH noticed the biggest withdrawals at $59.2 million, adopted by BlackRock’s ETHA with $54.9 million. Grayscale’s ETHE and ETH merchandise additionally skilled important outflows of $13.1 million and $26.5 million, respectively. These continued redemptions reinforce considerations that institutional demand for Ethereum stays weak within the close to time period.

Ethereum Worth Breaks Out Beneath Key Assist

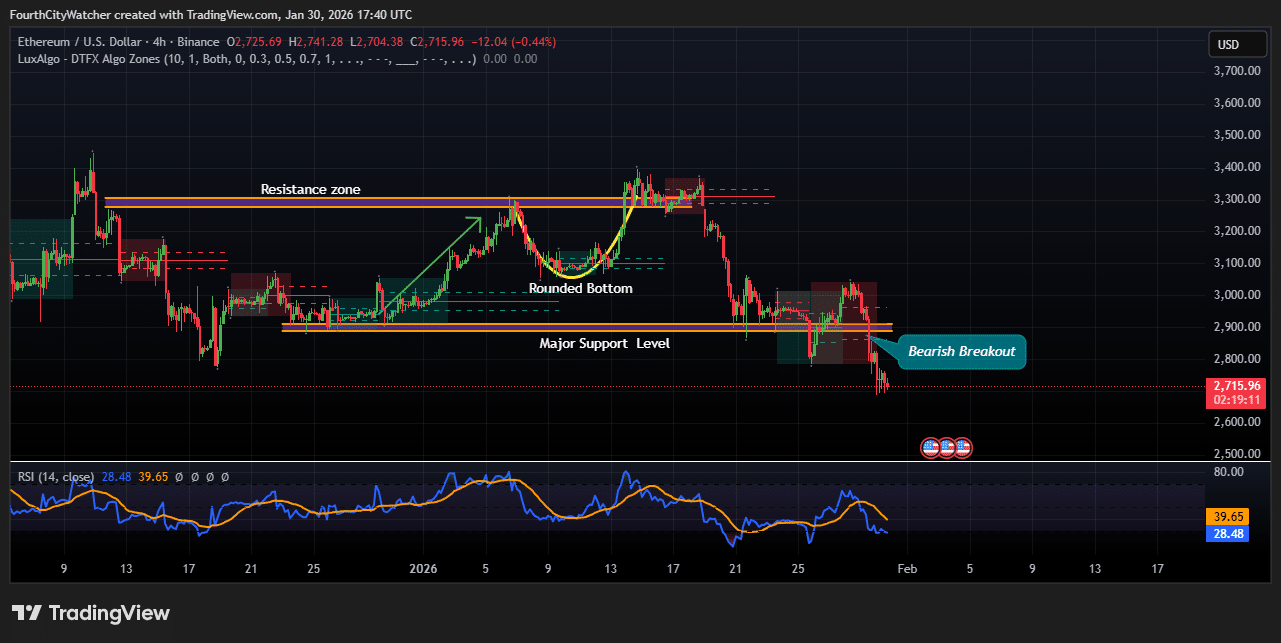

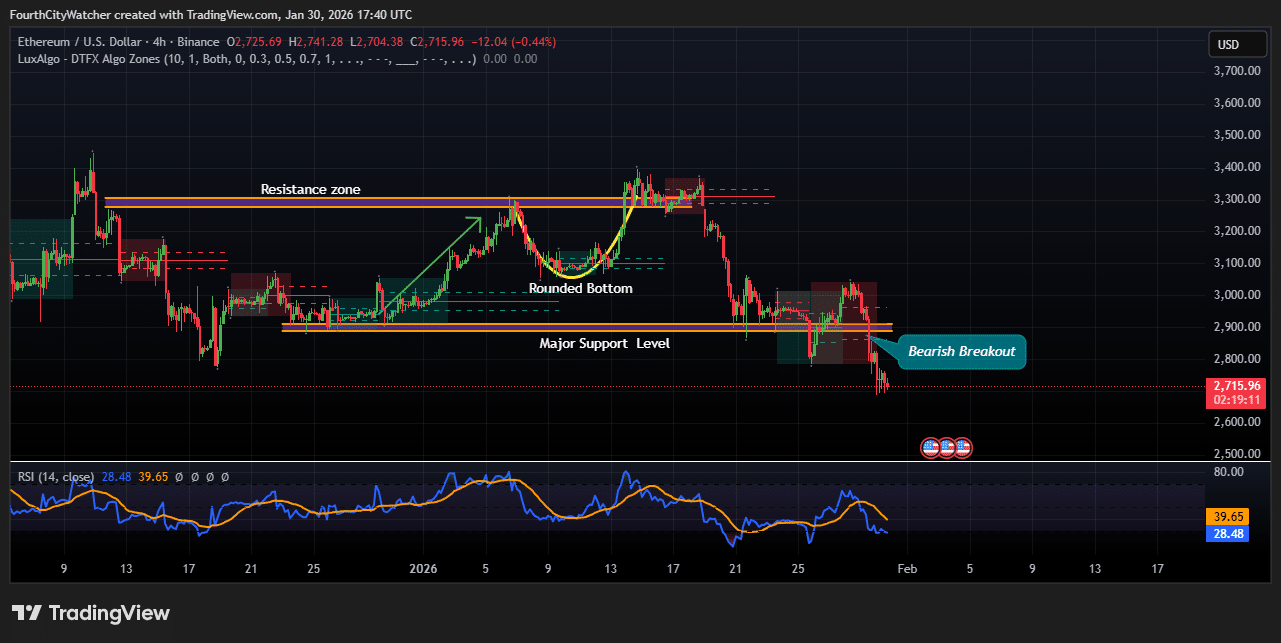

Ethereum (ETH/USD) on the 4-hour timeframe is displaying a transparent shift in market construction, with bearish momentum now dominating after a decisive breakdown beneath key help. Worth motion highlights a failed restoration try that transitioned into a robust bearish continuation.

Initially, ETH shaped a rounded backside sample, signaling a gradual accumulation section. This construction allowed worth to rally towards the higher resistance zone across the $3,300–$3,350 area, which had beforehand acted as a robust provide space. Nonetheless, repeated rejections from this resistance zone indicated weak bullish follow-through, suggesting that sellers remained firmly in management.

Following the rejection, ETH broke beneath the foremost help degree close to $2,950–$3,000, which had acted as a requirement zone throughout prior consolidation. This breakdown is technically important, as former help has now flipped into resistance. The transfer was impulsive, confirming a bearish breakout fairly than a false transfer or liquidity sweep.

ETHUSD Chart Evaluation. Supply: Tradingview

Momentum indicators reinforce the bearish bias. The RSI (14) has dropped towards the decrease vary, hovering close to oversold territory however with out displaying bullish divergence. This means that promoting stress stays lively, and any short-term bounce could possibly be corrective fairly than trend-reversing. The RSI failing to reclaim the 50 midline additional confirms bearish management.

Structurally, ETH is now forming decrease highs and decrease lows, a traditional downtrend sign on the 4-hour chart. The bearish candle growth following the help break additionally factors to robust promoting participation fairly than weak retail-driven strikes.

Wanting forward, the following key space to watch lies across the $2,650–$2,700 area, which might act as a short lived demand zone or pause space. If this degree fails to carry, draw back threat could lengthen towards deeper liquidity zones beneath. On the upside, any restoration makes an attempt are more likely to face resistance close to the damaged $2,950–$3,000 help band.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection