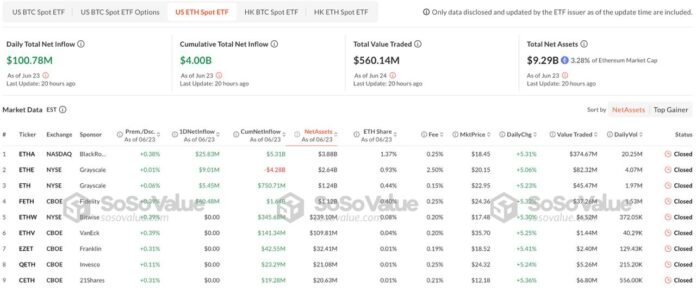

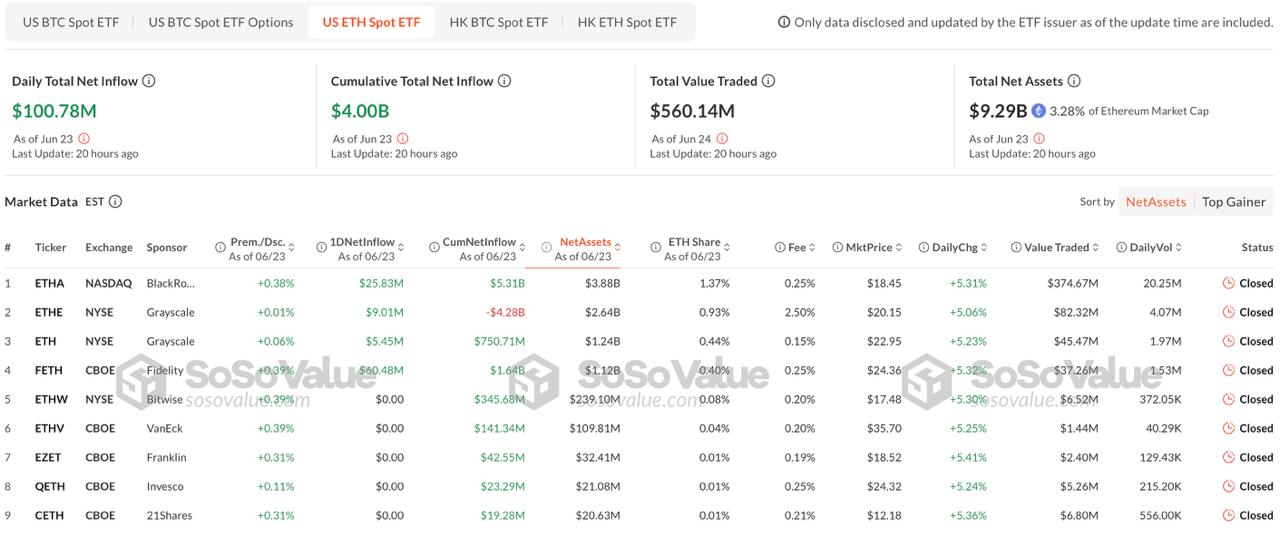

Spot Ethereum ETFs within the U.S. have formally crossed the $4 billion mark in internet inflows, and what’s stunning is how rapidly that final billion arrived. After taking 216 buying and selling days to succeed in $3 billion, it took simply 15 extra classes so as to add the subsequent billion. That sudden acceleration indicators one thing has modified in how buyers are approaching Ethereum. With Ethereum ETF inflows gaining velocity, asset managers are beginning to take discover.

The funds launched in July 2024, so that they’ve been reside for just below a 12 months. Till lately, inflows have been regular however modest. Then, someday in late Might, capital began coming in sooner. The latest surge accounted for a full quarter of all internet inflows, packed into only a small slice of the full buying and selling days.

Who’s Pulling within the Money

BlackRock remains to be main the cost. Its iShares Ethereum Belief has pulled in over $5.3 billion in gross phrases. Constancy’s fund has accomplished properly too, attracting round $1.6 billion. In the meantime, Grayscale’s older ETHE belief has seen outflows of greater than $4.2 billion.

Spot Ethereum ETFs within the U.S. have surpassed $4 billion in internet inflows simply 11 months after launch, with $1 billion added prior to now 15 buying and selling days alone. BlackRock’s ETHA leads with $5.31 billion in inflows, adopted by Constancy’s FETH and Bitwise’s ETHW. In the meantime,… pic.twitter.com/cE2ib1ylMv

— CoinPhoton (@coinphoton) June 25, 2025

That’s not a coincidence. Grayscale’s product expenses a 2.5 p.c price, which is considerably greater than the 0.25 p.c charges charged by each BlackRock and Constancy. With that type of hole, it’s not laborious to see why buyers are transferring their cash. Prices matter greater than ever now that Ethereum ETFs have gotten a long-term play somewhat than only a guess on value swings.

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2025

Why the Timing Makes Sense

A part of the latest momentum comes all the way down to a couple of key developments. Ethereum’s value has began to recuperate regarding Bitcoin, which tends to attract consideration. Additionally, new IRS steering helped make clear how staking rewards are handled inside these ETF buildings. That eliminated a whole lot of uncertainty that had been retaining wealth managers on the sidelines.

One other piece of the puzzle is that asset managers are rebalancing portfolios. That sounds technical, nevertheless it typically means huge establishments are adjusting their publicity and taking crypto extra severely as a slice of broader funding methods. As a substitute of ready to see what occurs, some are beginning to deal with Ethereum as an actual asset class value together with.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Retail Is Main for Now

A lot of the flows up to now seem like coming from retail buyers and smaller wealth advisory companies. As of March 31, institutional holdings made up lower than one third of the full ETF balances. That leaves room for way more progress, particularly as soon as the subsequent batch of quarterly disclosures comes out in mid-July. If we begin to see extra giant companies getting into the image, the tempo of inflows may shift once more.

Larger Image Is Taking Form

Ethereum ETFs will not be the one ones seeing motion. Spot Bitcoin ETFs additionally posted robust inflows across the similar time, suggesting that investor curiosity in digital belongings is broadening. And now that each asset courses can be found in regulated, low-fee codecs, some buyers could also be snug going past Bitcoin and constructing out extra diversified crypto publicity.

The query now’s whether or not this curiosity in Ethereum can maintain constructing. With charges dropping, steering clearing up, and efficiency bouncing again, the items are falling into place. If bigger establishments observe retail into these ETFs, $4 billion may not be the ceiling for lengthy.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- Ethereum ETFs within the U.S. crossed $4 billion in internet inflows, with the ultimate billion added in simply 15 buying and selling days, displaying a pointy uptick in investor demand.

- BlackRock and Constancy are main the pack with decrease charges, whereas Grayscale’s ETHE continues to see main outflows because of greater prices.

- New IRS steering on staking rewards and a recovering Ethereum value are serving to drive contemporary inflows, notably from wealth managers.

- Retail buyers are nonetheless dominating flows, however there’s rising potential for institutional adoption within the coming quarters.

- With each Ethereum and Bitcoin ETFs gaining traction, crypto is changing into an even bigger a part of diversified funding portfolios.

The put up Ethereum ETFs Rocket Previous $4 Billion After Sudden Development appeared first on 99Bitcoins.