Traders ought to view Intel inventory as a hedge, and probably a worth inventory.

The prospect of tighter U.S. restrictions on exports to China and up to date feedback from presidential candidate Donald Trump knocked among the wind out of chip shares. Semiconductor shares slid because the Biden administration floated the prospect of more durable commerce restrictions on the business whereas Trump urged that if elected, he would need Taiwan to pay the U.S. for its protection. Taiwan, house to main foundry operator Taiwan Semiconductor Manufacturing (TSM -3.55%), captures about 62% of the income generated globally by chip foundries, in keeping with TrendForce. Considerations concerning the future led to a sell-off in TSMC in addition to shares like Nvidia (NVDA -2.61%) and Superior Micro Gadgets (AMD -2.69%), which rely on TSMC’s fabs for manufacturing and in addition reported important gross sales to China.

One of many few shares that responded positively to this information from the presidential candidates was Intel (INTC -5.42%), whose inventory worth spiked sharply greater in Wednesday buying and selling earlier than pulling again for a modest achieve. And whereas that surge of enthusiasm waned shortly, it was a reminder of why critical semiconductor business traders ought to have at the very least some Intel inventory of their portfolios.

The state of Intel

Admittedly, Intel’s heyday is probably going lengthy behind it. It lags behind AMD on the chip design aspect of the enterprise, and its new third-party fab operation, Intel Foundry Companies (IFS), is behind TSMC and Samsung when it comes to course of expertise.

Nonetheless, Intel has the benefit of location: Most of its foundries are exterior of East Asia. Thus, when political figures increase the prospect of commerce restrictions or say issues that intensify considerations that China may invade Taiwan, traders look to Intel as a safer wager.

The supposition that China will invade Taiwan is concept. What just isn’t speculated is that the chip foundry business is concentrated in Taiwan. To this finish, the U.S. and different Western governments are providing chipmakers tens of billions of {dollars} value of subsidies to construct extra superior fabs within the U.S. and Europe.

Such subsidies profit Intel and its plans to construct state-of-the-art fabs. Moreover, since it’s shopping for essentially the most superior chip-manufacturing tools from ASML, its potential to catch as much as its rivals quickly is best than some would possibly assume.

Making sense of Intel’s financials

On account of its investments in constructing out manufacturing capability, Intel’s financials are bettering, however nonetheless struggling. Within the first quarter, its income rose 9% 12 months over 12 months to $13 billion. That was a notable enchancment from its 14% income decline within the full 12 months of 2023.

Amid heavy investments in its future, it spent 15% extra on working bills. Regardless of that enhance, its Q1 web loss shrank to $381 million, a small fraction of the $2.8 billion it misplaced in Q1 2023.

Administration didn’t forecast important income progress for Q2. Consequently, its inventory has fallen by greater than 30% to this point this 12 months. Additionally, if there isn’t any political turmoil concerning Taiwan, traders mustn’t anticipate the semiconductor inventory to outperform the S&P 500 anytime quickly.

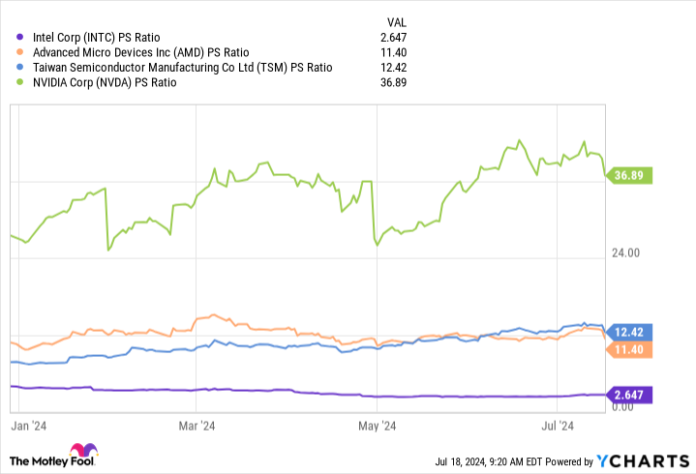

Nonetheless, this inventory trades now at a price-to-sales ratio of lower than 3 — an enormous low cost to its friends.

INTC PS Ratio information by YCharts.

Nonetheless, the last word measure of Intel’s low valuation is its price-to-book-value ratio of 1.4. This implies its complete market cap is barely 40% greater than the market worth of its belongings. Based on the Stern Faculty of Enterprise, the typical book-value a number of within the chip business is above 7, implying Intel inventory is considerably oversold.

Intel as a hedge

Given its present place, Intel is a car traders can use to hedge their positions in chip shares extra intently tied to China and Taiwan, and shares purchased now may finally end up to have been a low-cost funding in an business chief.

Admittedly, Intel inventory is unlikely to beat the indexes anytime quickly, and its large investments in itself aren’t any assure it can catch as much as its friends competitively.

Nonetheless, it’s more likely to shut a lot of the hole over time, and its present and future operations within the U.S. and Europe defend the semiconductor business from potential turmoil in East Asia. When one additionally considers its low valuation, an Intel place can defend chip inventory traders and probably produce important returns in the long run.

Will Healy has positions in Superior Micro Gadgets and Intel. The Motley Idiot has positions in and recommends ASML, Superior Micro Gadgets, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.