Berkshire Hathaway‘s (BRK.A 0.17%) (BRK.B -0.12%) property have modified significantly in recent times. In the present day, the worth of Berkshire’s managed firms exceeds its public fairness portfolio. Even Berkshire’s money, money equivalents, and marketable securities are value greater than its inventory holdings.

Berkshire has lowered its stake in prime holdings equivalent to Apple and Financial institution of America. However one place that has stayed the identical for many years is American Categorical (AXP 0.97%) — which now makes up 14.5% of the fairness portfolio, making it the corporate’s second-largest holding behind Apple.

American Categorical has crushed the market over the long run. However 12 months up to now (YTD), it’s underperforming the S&P 500 and Nasdaq Composite.

This is why traders might need to take a more in-depth have a look at shopping for this dividend-paying worth inventory now.

Picture supply: Getty Pictures.

An elite enterprise mannequin

American Categorical has a essentially totally different enterprise mannequin than pure-play fee processors like Visa and Mastercard), which Berkshire owns smaller positions in.

Visa and Mastercard companion with banks and different monetary establishments to concern playing cards. By passing alongside the chance to those entities, Visa and Mastercard merely accumulate charges primarily based on the quantity and frequency of card utilization. It is a splendidly easy and extremely efficient enterprise mannequin resulting in regular, comparatively low-risk progress over time.

As these networks have grown in measurement and safety, retailers around the globe have grow to be extra keen to soak up the charges as a essential price of doing enterprise. Customers have purchased into the comfort and rewards of utilizing playing cards as an alternative of alternate options (like money).

American Categorical takes this similar idea a step additional by issuing its personal playing cards. It bears the chance of shoppers and small companies defaulting on their funds. American Categorical limits this threat by focusing on prosperous prospects who’re comparatively resilient to swings within the financial cycle. American Categorical additionally acts as a financial institution by providing checking accounts, high-yield financial savings accounts, and different merchandise. Once more, this strategy has extra threat than what Visa and Mastercard are doing, however when nicely managed, it gives much more progress potential.

American Categorical focuses on integrating high-quality, financially wholesome prospects into its ecosystem and inspiring them to spend so much to compensate for top charges. American Categorical playing cards usually cost larger annual charges than alternate options from Visa and Mastercard. However they provide extra beneficiant point-earning potential and perks, so shoppers and companies are incentivized to make use of the playing cards for all their purchases.

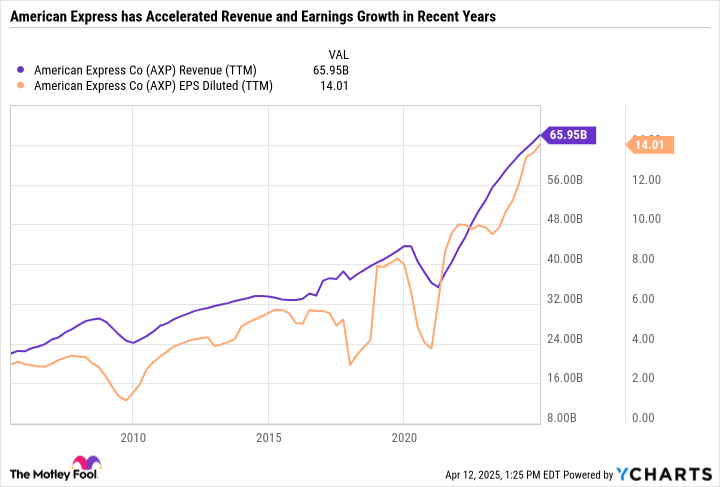

Over time, American Categorical has grown its income and earnings steadily — with a giant jolt post-pandemic as the corporate has labored arduous to enchantment to its fastest-growing age teams, Gen Z and millennials.

AXP Income (TTM) knowledge by YCharts. EPS = earnings per share.

American Categorical is an efficient worth

On condition that the enterprise is on the prime of its recreation, traders could also be questioning why American Categorical inventory has fallen a lot 12 months up to now. A part of the reply could also be its publicity to prosperous prospects. As talked about, these shoppers are extra resilient to financial downturns, however they are often particularly affected when key asset classes — like shares — fall in worth. Fast web value declines may result in pullbacks in spending for prosperous shoppers. Tariffs may additionally enhance the prices of products, providers, holidays, and many others.

Because the chart reveals, American Categorical has fallen greater than the main indexes YTD, whereas Visa and Mastercard have outperformed.

American Categorical is now down 22.9% from its all-time excessive, and the sell-off may current a compelling alternative for long-term traders keen to look previous near-term uncertainty. American Categorical has traditionally fetched an affordable valuation, with its five-year price-to-earnings (P/E) ratio averaging 18.4 on the median. The present P/E ratio is barely under that at 17.9, and the corporate’s price-to-free money circulation ratio is simply 14.8 — suggesting American Categorical is an efficient worth.

Granted, earnings may come down if American Categorical prospects pull again on spending, so traders ought to put together for the valuation to look dearer within the close to time period. Nonetheless, even when revenue progress slows, American Categorical has an ace within the gap — buybacks.

The ability of buybacks

Berkshire has held American Categorical for many years and seen its stake enhance from 10% to 21.6%, because of buybacks. The similar factor has occurred with longtime Buffett holding Coca-Cola. Buybacks permit earnings per share (EPS) to outpace web revenue progress by lowering the excellent share depend. Over the past decade, American Categorical has lowered its share depend by 30%.

As an instance how this idea works, to illustrate an organization lowered its share depend by 30% — from 100 to 70 shares — over a decade, identical to American Categorical did. On this case, an investor who owned 14 shares and by no means bought them began with 14% possession within the firm. However now that there are solely 70 shares, they personal 20%. If the corporate’s web revenue is $1,000, it might be $10 in earnings per share for 100 shares, however $14.29 if there have been 70 shares — making the corporate a greater worth from a P/E standpoint.

That is how Berkshire has elevated its stake in American Categorical over time with out shopping for extra shares. American Categorical can afford buybacks due to its excessive revenue margins and regular money circulation. American Categorical can be recognized to make sizable dividend raises. Its most up-to-date dividend enhance — introduced in March — was a 17% enhance, boosting the quarterly payout to $0.82 per share for a yield of 1.3%.

At first look, American Categorical’ low yield might not appear spectacular. However contemplating the majority of the capital return program is concentrated on buybacks, not dividends, the decrease yield is comprehensible.

A high-conviction purchase

American Categorical showcases the effectiveness of high quality over amount within the fee processing business. Regardless of issuing magnitudes fewer playing cards than Visa and Mastercard, the affluence and loyalty of American Categorical prospects result in a lot larger spending on common per card.

American Categorical has executed a masterful job interesting to shoppers in a number of age brackets and increasing its providers. The inventory is an efficient worth and a good supply of passive revenue.

Add all of it up, and American Categorical is a no brainer purchase amid the broader inventory market sell-off.