The launch of spot exchange-traded funds (ETFs) monitoring Dogecoin in america was met with muted enthusiasm. Inflows into Grayscale and Bitwise’s ETFs had been restricted of their first week of buying and selling, regardless of the hype round the first-ever Dogecoin ETFs. However at the same time as ETF inflows sputter, some technical analysts argue that DOGE would possibly nonetheless bear a powerful worth rally, presumably all the way in which to $1, if essential assist ranges maintain.

Associated Studying

Spot DOGE ETFs Off To A Gradual Begin

When Grayscale rolled out its Spot DOGE fund (GDOG) on November 24, influx quantity clocked in at nearly $1.8 million on the primary day, far under the estimates some market members had forecasted. For instance, Eric Balchunas, senior ETF analyst at Bloomberg, predicted that the ETF will witness a $12 million quantity on the primary day of buying and selling.

In line with knowledge from SoSoValue, internet inflows throughout the DOGE ETFs by Grayscale and Bitwise added as much as simply over $2.16 million over the course of the preliminary buying and selling week. This exhibits that institutional and retail traders are considerably cautious in the case of investing within the meme cryptocurrency.

That is in distinction to the sturdy opening inflows seen by different altcoin ETFs, reminiscent of these for Solana (SOL) and XRP which had been launched up to now few weeks. Moreover, the lackluster uptake has raised doubts about whether or not the ETFs will ignite the form of renewed curiosity in DOGE that some backers hoped for.

Technical Outlook Suggests Bullish Potential To $1

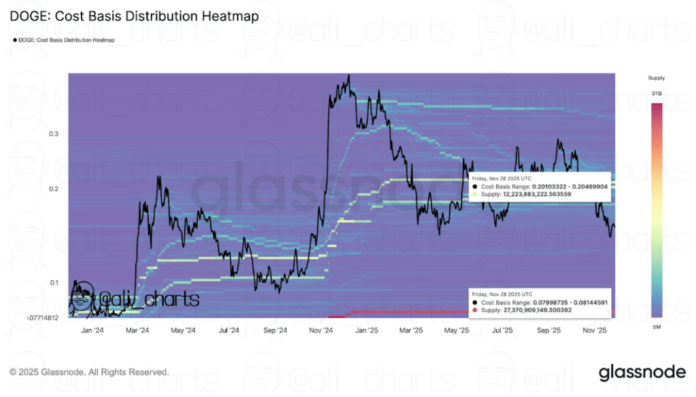

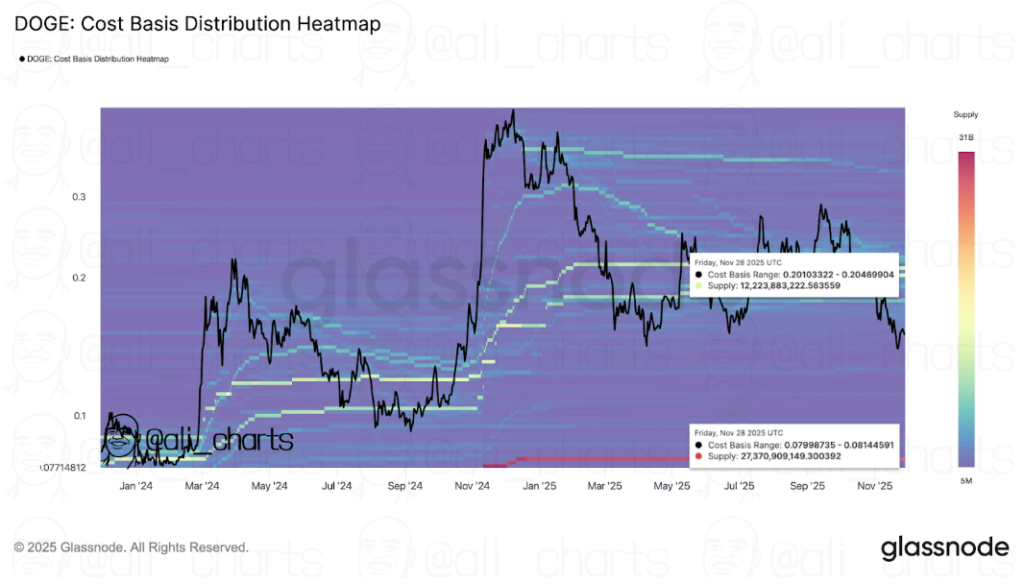

Although ETF demand is at present tepid, a number of technical outlooks level to a probably extra optimistic end result for Dogecoin. One technical outlook from crypto analyst Ali Martinez identifies key assist at roughly $0.08, with resistance round $0.20. This assist stage harkens again to a time when DOGE dipped under $0.10, earlier than launching right into a multi-month rally to $0.50 after the US elections.

Dogecoin Key Value Ranges. Supply: @ali_charts On X

Extra bullishly, a multi-week technical breakdown carried out by crypto analyst XForceGlobal means that DOGE is perhaps wrapping up a long-term corrective part and positioning for a fifth wave, which is a robust upward impulse in line with the Elliott Wave Principle. That wave may push costs properly past present ranges, with intermediate targets probably between $0.33 and $0.50, and a longer-term stretch to $1.

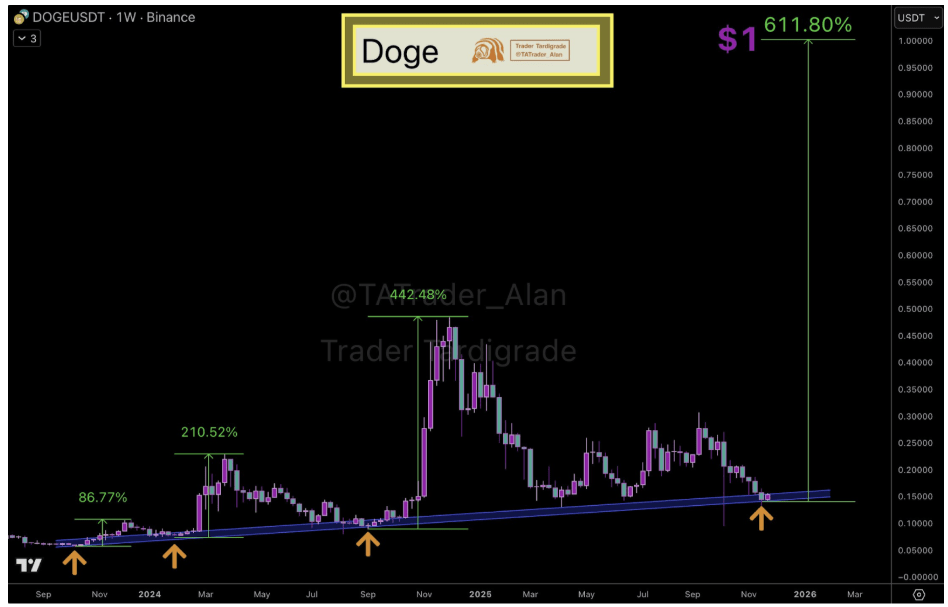

Equally, crypto analyst Dealer Tardigrade believes Dogecoin has dropped again onto the identical long-term assist zone that beforehand led to main rallies, calling it the launch pad for the following large transfer. His weekly chart highlights how Dogecoin’s worth motion has repeatedly bounced from this ascending trendline, producing good points of greater than 80%, 210%, and even over 440% since October 2023.

Dogecoin Technical Evaluation. Supply: @TATrader_Alan On X

The analyst says the sample is unbroken as soon as once more, and if the assist at $0.15 holds, Dogecoin may comply with the identical construction into a bigger growth part. Primarily based on his projection, that continuation would give Dogecoin sufficient momentum to make a gradual 610% climb to $1 by 2026.

Associated Studying

On the time of writing, Dogecoin is buying and selling at $0.15 and is near both rebounding or breaking under the assist.

Featured picture from Unsplash, chart from TradingView