Warren Buffett is thought for his worth method to investing, and that was on show once more in Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) third-quarter trades. It took new positions in Domino’s Pizza and Pool Corp., two strong worth performs.

Each of those shares match the traditional Buffett schema. They’re established manufacturers and leaders of their industries. Though they aim totally different demographic strata, they each play a robust position within the financial system and may face up to macroeconomic stress. However in case you’d thought these had been the one sorts of shares in Berkshire Hathaway’s portfolio, you would be mistaken. As a lot as Buffett loves a great worth, he has had some progress shares within the portfolio at occasions.

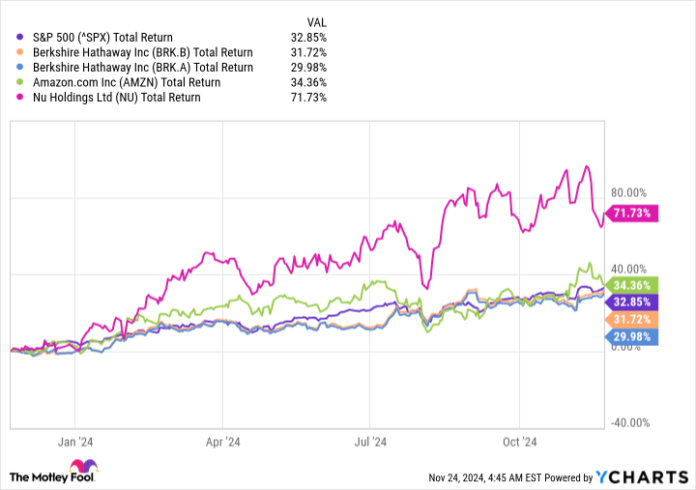

At the moment, there are no less than two shares in Berkshire Hathaway’s fairness portfolio that I’d put into the expansion field and which can be outperforming Berkshire Hathaway and the S&P 500 over the previous yr. Let’s have a look at what they’re, why Buffett would possibly personal them, and whether or not traders ought to take into account shopping for them, too.

1. E-commerce, cloud computing, and now AI

Berkshire Hathaway first took a place in Amazon (AMZN -1.02%) in 2019, effectively after it had already minted millionaires. It is not clear exactly when he purchased it, however it’s up 126% over the previous 5 years, which is across the time he took a place.

At that time limit, nobody knew a worldwide pandemic was simply months away that might change the world and the way corporations do enterprise. However what traders did know is that Amazon was, and is, the highest e-commerce firm within the U.S., and that it had already developed a second enterprise that was prime of its business in cloud computing.

These are two industries that had been rising quick then and that Amazon had an edge in, and all of that also applies at present. As a result of it has an intense tradition of innovation, it is prone to maintain its place. And at present its potential is pushed by synthetic intelligence (AI).

Buffett would not care a lot for AI. He would not deny that it might be one thing fantastic, however he has stated he would not know sufficient about it to judge it. His funding in Amazon is about its dominant place in industries that drive the financial system.

At its present worth, Amazon trades at a P/E ratio of 42, near its lowest stage in years. That also makes it seem like a great worth play.The expansion that comes from AI would possibly entice different traders, although, and having Buffett’s stamp of approval for the corporate’s different sturdy companies ought to give traders confidence that that is safer than a strict AI play.

2. A powerhouse digital financial institution

The opposite clear progress inventory within the Berkshire Hathaway portfolio is Nu Holdings (NU -2.94%). Nu is a fintech powerhouse in Latin America that gives banking and different monetary companies all on a digital app. It is headquartered in Brazil and likewise companies Mexico and Colombia with a smaller and rising platform.

Nu has demonstrated phenomenal progress since going public in 2021, and Berkshire Hathaway was an early investor, an uncommon setup for the corporate, which is thought extra for purchasing full corporations or taking positions in public corporations. Berkshire Hathaway invested $500 million in a funding spherical simply earlier than the IPO.

On the time, CEO David Velez stated, “The brand new fairness financing comes on account of Nubank’s accelerated and sustainable progress.” The important thing was that even earlier than going public and reporting optimistic internet earnings, it was already apparent that its progress was sustainable. It was already the most important all-digital financial institution on the planet with 40 million prospects, and at present it has 109.7 million and rising.

Since that point, Nu has change into sustainably worthwhile, with optimistic internet earnings each quarter because the 2022 third quarter. Though it is not the everyday Buffett inventory, it is nonetheless a financial institution inventory that performs an essential position within the financial system the place it operates and has a strong credit score and banking enterprise. It has tons of money from deposits that it makes use of to drive a wholesome lending enterprise, and that is extra of a traditional Buffett setup.

Each Nu and Amazon are outperforming the S&P 500 and Berkshire Hathaway itself over the previous yr.

Nu is by far the higher-growth inventory, however each of those shares stand out from the everyday Buffett inventory as a result of they thrive on innovation and have large progress runways versus the traditional Buffett worth inventory that has slower, steadier progress. For those who’re searching for progress inventory candidates, Amazon and Nu are each wonderful decisions.

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jennifer Saibil has positions in Nu Holdings. The Motley Idiot has positions in and recommends Amazon, Berkshire Hathaway, and Domino’s Pizza. The Motley Idiot recommends Nu Holdings. The Motley Idiot has a disclosure coverage.