C3.ai simply issued incredible steering for this 12 months.

C3.ai (AI 4.53%) is a polarizing synthetic intelligence (AI) inventory. It noticed quite a lot of enthusiasm in early 2023, however that has since evaporated because the inventory sits greater than 30% off its highs established in 2023. Nonetheless, that determine was as little as 55% in April, so the inventory is gaining some enthusiasm once more.

A part of that has been C3.ai’s outcomes as some elements of its enterprise are starting to show doubters flawed. However is that this sufficient to steer extra buyers to purchase this inventory?

Demand for C3.ai’s merchandise is rising

C3.ai has advanced fairly a bit as an organization since its founding in 2009. It has gone from an power administration to an Web-of-Issues (IoT) to an AI purposes enterprise. Nonetheless, its newest shift has been into generative AI, which administration believes will “change every little thing.”

The corporate supplies pre-built AI fashions that may be deployed to widespread conditions discovered in lots of industries. That is a pretty proposition to many companies, as they need not rent software program engineers to develop customized fashions. One in all C3.ai’s largest rising shoppers is the U.S. authorities, which accounted for almost half of the corporate’s bookings within the fourth quarter of its fiscal 2024, which ended April 30.

Within the press launch for its earnings, administration stated, “The curiosity we’re seeing in our generative AI purposes is staggering.” This backs up what different AI firms like Palantir Applied sciences have been saying, and it bodes effectively for C3.ai’s future. However even now, C3.ai appears to be turning over a brand new leaf.

Nice development however removed from breaking even

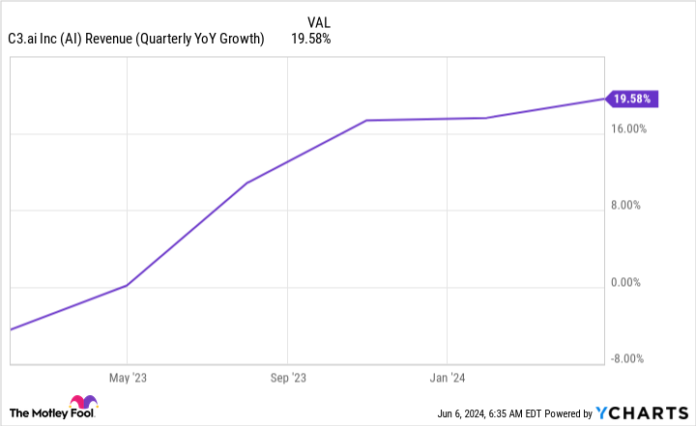

In This fall, income rose 20% 12 months over 12 months to $87 million. That is stable development acceleration in comparison with earlier quarters and is a superb signal for development buyers.

AI Income (Quarterly YoY Development) knowledge by YCharts

However This fall is not going to be C3.ai’s excessive level. Administration additionally issued incredible steering and expects the primary quarter of fiscal 2025 (ending July 31) to be about $87 million, indicating 20% development. For the total 12 months, it expects round $383 million, which might quantity to 23% year-over-year development. Clearly, administration expects its income development to speed up much more after Q1, which is music to buyers’ ears.

Nonetheless, there’s a draw back with C3.ai’s inventory. The corporate is among the most unprofitable companies within the software program business. Though it generated almost $87 million in income in Q1, the price of that income was $35 million, and its working bills totaled $134 million. Altogether, that gave C3.ai an working loss margin of 95%, that means it might take at the least double its present income to interrupt even with out growing its spending.

AI Working Margin (Quarterly) knowledge by YCharts

That is not nice for buyers and continues a development of deep unprofitability. Rising from a gap that deep can take years, and a few buyers aren’t affected person sufficient to attend for C3.ai to flip the profitability change.

Nonetheless, there’s one piece of hope: C3.ai is a small firm. Its quarterly income was solely $87 million, which is pretty small in comparison with different AI software program firms like Palantir. Because of this, its deep unprofitability is a facet impact of its desirous to seize as a lot market share as attainable. Whereas I am not a fan of its unprofitability, this makes it considerably palatable.

So, am I shopping for the inventory? Proper now, no. I am no fan of the excessive losses at C3.ai’s present development ranges. If C3.ai doubled its income 12 months over 12 months, I might be keen to look previous it. Nonetheless, C3.ai is a way more enticing inventory than only a few months in the past, because of its robust steering and income acceleration. It is beginning to emerge as a high AI decide and will even cross into shopping for territory (for me) after a couple of quarters of stable development and enhancing profitability.

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot recommends C3.ai. The Motley Idiot has a disclosure coverage.