The cryptocurrency derivatives market has been hit exhausting by the most recent bearish continuation in Bitcoin and others as mass liquidations have hit exchanges.

Crypto Liquidations Have Neared $1 Billion Over The Final 24 Hours

In line with information from CoinGlass, an enormous quantity of liquidations have occurred within the cryptocurrency derivatives market throughout the previous day. A “liquidation” happens when an open contract exceeds a sure loss threshold outlined by the trade and undergoes forceful closure.

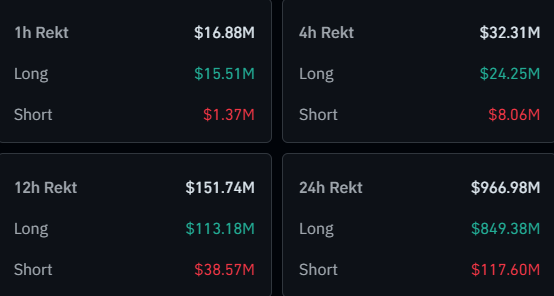

Because of the volatility that Bitcoin and different property have skilled during the last 24 hours, an enormous quantity of contracts have crossed this threshold. Under is a desk that breaks down the related numbers associated to those liquidations.

As is seen, cryptocurrency liquidations have totaled at $967 million inside this window, which is a fairly important quantity. For the reason that worth motion up to now day has majorly been within the bearish path, the positions most affected can be the bullish bets. And certainly, as the information reveals, $849 million of the liquidations, representing virtually 88% of the entire, concerned lengthy traders.

Ethereum has lately been dominating speculative exercise out there, and it appears the asset has topped the charts throughout this derivatives flush as properly, with $309 million in liquidations. Bitcoin has come second with round $246 million.

A mass liquidation occasion like this newest one isn’t a uncommon prevalence within the cryptocurrency sector, primarily on account of two causes: cash could be risky on the common and excessive quantities of leverage could be simply accessible. Such an occasion, the place a cascade of liquidations happens, is named a squeeze.

As longs have been the social gathering most significantly affected within the newest squeeze, the occasion can be termed as an extended squeeze. That is the second lengthy squeeze that the market has suffered this week, with the opposite one arriving throughout Bitcoin’s Monday plummet to $112,000.

Here’s a chart shared by on-chain analytics agency Glassnode that reveals how the earlier lengthy squeeze in contrast in opposition to this newest one for Bitcoin:

In line with Glassnode, the 2 massive lengthy squeezes might truly assist forestall extra such occasions within the close to future. “This flush of leverage displays a broad deleveraging occasion, typically resetting market positioning and easing the chance of additional cascades,” explains the analytics agency.

It now stays to be seen whether or not the liquidations can be sufficient to deliver a relaxed to the market, or if there’s extra volatility forward for Bitcoin and others.

Bitcoin Worth

On the time of writing, Bitcoin is buying and selling round $109,200, down greater than 6% during the last week.