Success in a single key space may dramatically enhance the inventory’s long-term progress prospects.

Chipotle Mexican Grill (CMG 0.40%) has unwrapped its most severe problem because the well being outbreaks of the earlier decade. The inventory of the Newport Seashore, California-based firm is down greater than 35% since peaking in December of final 12 months, and with gross sales progress decelerating quickly, buyers appear much less tolerant of its elevated valuation.

This leaves potential shareholders in a predicament. Ought to they keep away as a result of shares are going to maintain sliding, or is it time to start out shopping for at this discounted inventory worth?

Chipotle’s struggles

Chipotle’s struggles might date again to the time former CEO Brian Niccol introduced his departure to Starbucks in August final 12 months.

Since Chief Working Officer Scott Boatwright has taken over as CEO, Chipotle’s struggles have turn out to be extra obvious. The economic system stays unsure, and fast-casual eating places comparable to Cava Group and Sweetgreen have captured elevated consideration.

That has led to comparable restaurant gross sales lowering by 4% within the second quarter of 2025, and, for the 12 months, administration has guided to flat comparable restaurant gross sales in comparison with final 12 months’s outcomes.

Consequently, income for the primary half of 2025 elevated by 5% 12 months over 12 months to only over $5.9 billion. Working prices and bills additionally rose throughout the board, inflicting its web margin for the primary two quarters of 2025 to fall to 13.9% from 14.4% one 12 months in the past. Thus, Chipotle’s $823 million in web earnings elevated by only one% throughout that interval.

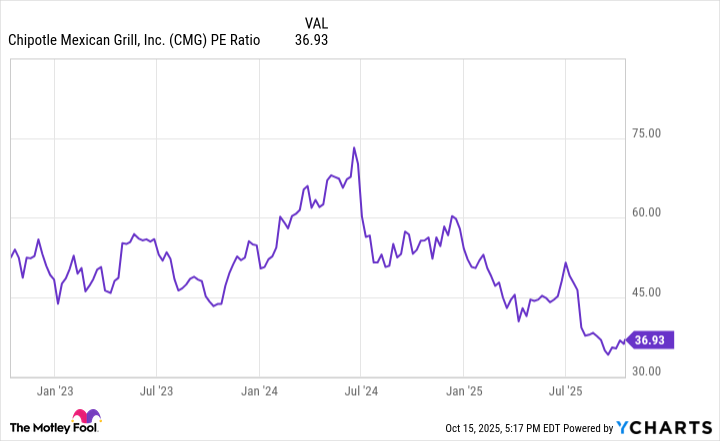

Amid that efficiency, its P/E ratio, which has hardly ever fallen under 45 over the past three years, is now all the way down to 37, a valuation it had not seen because the food-borne sickness outbreaks in the course of the earlier decade.

CMG PE Ratio knowledge by YCharts

The issue that might spark the comeback in Chipotle inventory

Buyers also needs to not lose sight of the attributes that made Chipotle so profitable for thus lengthy. The corporate confirmed the market that eating places may succeed with the fast-casual idea whereas providing meals that was wholesome and flavorful. With that, its loyal following and model recognition have fostered the expansion that has taken it to greater than 3,800 eating places.

Administration additionally believes it could actually ultimately develop to 7,000 areas in North America. This implies it is going to in all probability have optimistic progress over the following few years, even underneath extra bearish eventualities.

Nevertheless, the slowing progress means Chipotle has needed to rely upon its aggressive retailer openings to maintain income progress optimistic. To that finish, it has deliberate to open between 315 and 345 new eating places, opening 113 of these eating places within the first half of the 12 months.

Moreover, despite the fact that the corporate has capitalized on many of the alternatives to be discovered within the U.S., that nation accounts for greater than 98% of its areas.

With that, the long run progress of Chipotle inventory seemingly relies upon closely on worldwide success. It opened a small variety of areas in Canada, Western Europe, and Kuwait earlier than Niccol departed. Beneath Boatwright’s management, it plans to develop into South Korea, Singapore, and Mexico subsequent 12 months.

That would finally result in the kind of success that benefited restaurant chains like Starbucks and McDonald’s. Since every of those chains has grown to greater than 40,000 eating places, Chipotle has the chance for a large enlargement if it could actually develop a big following outdoors of the U.S.

Ought to I purchase Chipotle inventory?

Beneath present situations, buyers ought to in all probability chorus from buying Chipotle inventory, not less than for now.

Certainly, Chipotle is more likely to proceed including areas, maintaining general income progress optimistic and possibly making the inventory a maintain. Nonetheless, the true take a look at is how its worldwide enlargement will go. If it takes off overseas, it may match Starbucks or McDonald’s for the variety of areas underneath extra optimistic eventualities. So successful signifies that Chipotle has barely scratched the floor of its potential and that buyers can buy the inventory.

Nevertheless, if Chipotle fails overseas and is ultimately restricted to its 7,000-restaurant purpose in North America, the slowdown in progress may turn out to be everlasting, which may finally imply the client discretionary inventory sells at a decrease valuation.

Thus, buyers ought to both watch for indicators of success overseas or not less than maintain out for a considerable acceleration in income progress earlier than shopping for Chipotle at present ranges.

Will Healy has positions in Cava Group. The Motley Idiot has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Idiot recommends Cava Group and Sweetgreen and recommends the next choices: quick December 2025 $45 calls on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.