21 Oct Chart Decoder Sequence: StochRSI – The Dealer’s Edge in Precision Market Timing

Welcome again to the Chart Decoder Sequence, the place we flip advanced buying and selling instruments into actionable methods.

Our journey thus far:

At present, we’re diving into Stochastic RSI, the hybrid oscillator that mixes the perfect of RSI momentum evaluation with Stochastic timing precision.

The Evolution of Momentum Evaluation

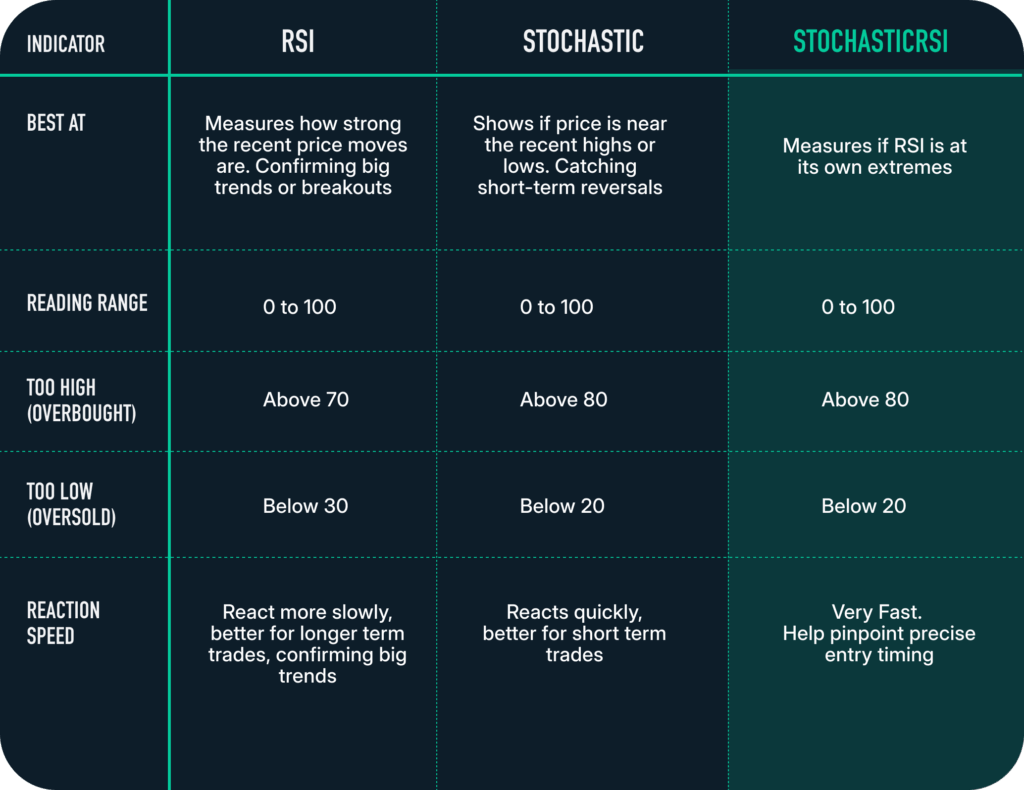

Technical analysts have lengthy sought the right momentum indicator. Relative Energy Index (RSI), launched by J. Welles Wilder in 1978, grew to become the gold commonplace for figuring out overbought and oversold situations. But merchants observed a limitation: throughout sturdy tendencies, RSI may hover in impartial territory for prolonged durations, offering little actionable info.

The Stochastic Oscillator, developed earlier by George Lane, provided totally different insights by measuring the place worth sat inside its latest vary. It was extra delicate than RSI however may generate extreme alerts in uneven markets.

Within the Nineties, Tushar Chande and Stanley Kroll mixed the perfect facets of each the Stochastic Oscillator and Relative Energy Index. The outcome was Stochastic RSI – an indicator that applies the Stochastic formulation to RSI values slightly than worth.

As an alternative of asking “the place is worth relative to its vary?” (Stochastic) or “how sturdy is momentum?” (RSI), StochRSI asks: “the place is the momentum studying itself relative to its personal latest extremes?” This extremely delicate indicator reveals refined shifts in market dynamics.

Find out how to Interpret It

The Twin-Line System:

StochRSI shows two strains, just like the Stochastic Oscillator:

- %Ok Line (quick line): The primary StochRSI calculation – extra reactive to momentum modifications

- %D Line (sign line): A transferring common of %Ok – supplies smoothed affirmation

Crucial Zones:

- Overbought (>80): Market momentum stretched too excessive. Reversal or consolidation might comply with.

- Oversold (<20): Market momentum stretched too low. Bounce might comply with.

- Crossovers: When the quick StochRSI line crosses the sign line in these zones, it typically precedes sharp strikes.

- Midline (50): Momentum steadiness level. Buying and selling above suggests bullish stress, under suggests bearish.

Why StochRSI Issues for Buying and selling

Enhanced Sensitivity: Conventional RSI may keep in impartial territory (30-70) throughout trending markets, offering few alerts. StochRSI generates extra frequent overbought/oversold readings, giving merchants extra alternatives.

Early Warning System: StochRSI can sign potential reversals earlier than they change into apparent on worth charts or commonplace RSI, offering a timing benefit.

Development Affirmation: The twin-line system (%Ok and %D) supplies affirmation by crossovers, decreasing false alerts in comparison with single-line oscillators.

Instance in Motion

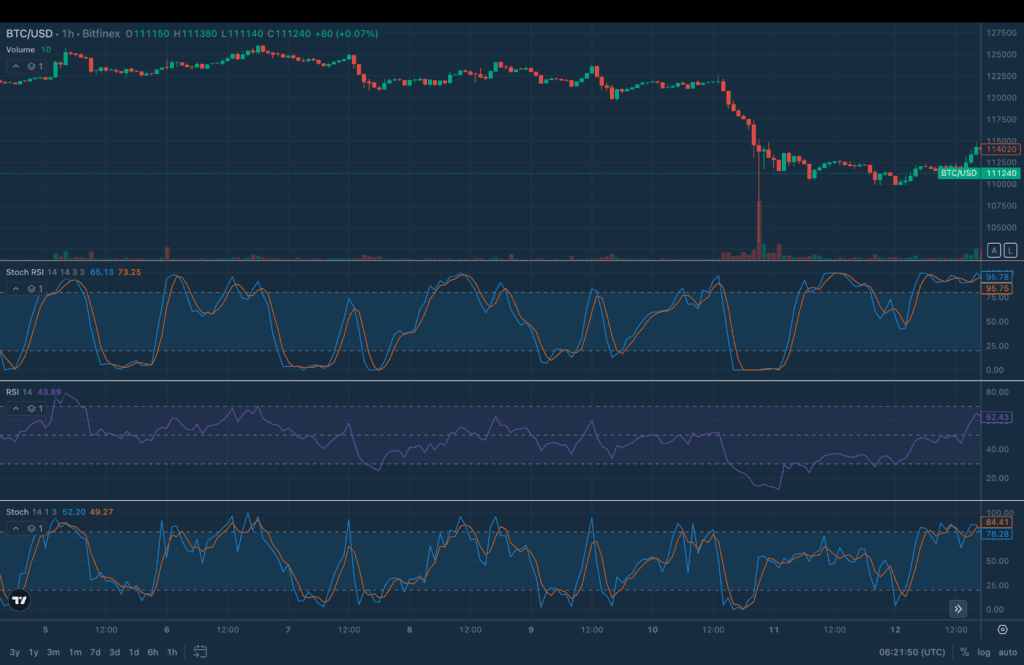

As of Oct 12:

- Worth: $111,240

- Stoch RSI: 85.19 %Ok, 73.25 %D (overbought)

- RSI: 43.89 (impartial to barely bearish)

- Stochastic: 62.20 %Ok, 49.27 %D (impartial)

What every indicator revealed:

RSI (purple line, third panel): All through your entire interval between Oct 5-12, RSI remained principally in impartial territory with a number of exceptions on Oct 5 the place RSI hit overbought and BTC’s sharp drop on Oct 10, the place RSI dipped to oversold. Merchants watching solely RSI would have minimal actionable alerts through the different important worth actions throughout this era.

Stochastic (blue/orange, backside panel): Generated a number of oversold and overbought cycles all through the interval. Extra responsive than RSI, exhibiting clear extremes through the main drop round Oct 11 and subsequent restoration.

StochRSI (blue/orange, second panel): Probably the most lively of all three indicators, oscillating dramatically between 0-100 a number of occasions. Discover how StochRSI reaches a lot deeper into excessive zones than common Stochastic, offering earlier and extra pronounced alerts:

- Oct 5-6: StochRSI hit overbought (80+) previous a pullback of $3000 in worth

- Oct 7: Dropped to oversold (under 20) previous a bounce of over $2000 in worth.

- Oct 8-9: Reached overbought a number of occasions once more, every time precedes a pull again of round $1000 every.

- Oct 10 (the crash): Plunged to excessive oversold (close to 0) as BTC dropped 18%.

- Oct 12: Surged to overbought (85+) as BTC recovers

Key second (Oct 12):

- BTC recovering from sharp drop, hovering at $111,240

- RSI at 43.89 (impartial, exhibiting weak momentum regardless of restoration)

- Stochastic at 62.20 (impartial, transferring towards overbought)

- StochRSI at 85.19 (overbought with %Ok effectively above %D at 73.25) This present setup exhibits StochRSI in overbought territory with the %Ok line considerably above the %D line, suggesting the latest bounce could also be shedding steam.

Merchants who purchased instantly when StochRSI first hit oversold on Oct 10 would have confronted important stress. The indicator stayed in oversold territory for an prolonged interval as BTC continued crashing from ~$122,000 all the way down to ~$103,500. This highlights an important lesson: throughout main macro occasions (information, coverage modifications, and so forth), technical indicators can stay at extremes far longer than anticipated. A superbly timed StochRSI sign means nothing in case you’re preventing towards a serious macro catalyst.

Superior StochRSI Methods

1. Multi-Timeframe Development Alignment

Use larger timeframes to outline the pattern and decrease timeframes to fine-tune your entries.

- Step 1: On the every day chart, establish the general market route — uptrend, downtrend, or sideways.

- Step 2: On the 4-hour chart, search for StochRSI alerts that align with that pattern.

- Buying and selling tip:

In an uptrend, solely take into account oversold alerts (under 20).

In a downtrend, solely take into account overbought alerts (above 80).

This straightforward alignment filter helps you keep away from counter-trend trades and enhance your win price in comparison with buying and selling each sign blindly.

2. Confluence With Different Indicators

StochRSI + RSI: RSI confirms the broader pattern whereas StochRSI pinpoints actual entry timing. Solely commerce when each indicators align. For instance, when StochRSI crosses upward from 18 and RSI is concurrently rising from 35, you will have double affirmation.

StochRSI + Quantity: Reversal alerts accompanied by quantity enlargement point out institutional participation. For example, if StochRSI crosses upward from 12 as quantity surges, it suggests a high-probability lengthy entry supported by sturdy shopping for stress.

StochRSI + Assist/Resistance: The very best-probability setups happen when StochRSI alerts align with key worth ranges. If BTC bounces from a $120,000 assist zone whereas StochRSI dips to 12, that confluence of worth stage and momentum exhaustion creates an excellent lengthy entry level.

Fibonacci Ranges + StochRSI: Fibonacci retracements supply one other layer of affirmation. Merchants typically draw them on latest swings and observe how StochRSI behaves close to key ranges like 38.2%, 50%, or 61.8%. When worth approaches a Fibonacci stage and StochRSI reaches an excessive studying (under 20 or above 80) with a crossover forming, that overlap can create significantly compelling technical setups.

3. Divergence Buying and selling

Bullish Divergence:

When the worth makes a decrease low however StochRSI makes a better low, this alerts that downward momentum is weakening regardless that the worth continues to be falling. This implies the promoting stress is exhausted and a reversal could also be coming. Think about an extended entry when StochRSI crosses upward from the oversold zone.

Instance: Bitcoin drops to $110,000, then falls additional to $108,000 (decrease low in worth). Nevertheless, StochRSI reads 15 on the first drop, then rises to 25 on the second drop (larger low in momentum). This bullish divergence (cheaper price however stronger momentum) typically alerts an upcoming upward reversal.

Bearish Divergence:

When the worth makes a better excessive however StochRSI makes a decrease excessive, this alerts that upward momentum is weakening regardless that the worth continues to be rising. This implies the shopping for stress is exhausted and a reversal could also be coming. Think about a brief entry when StochRSI crosses downward from the overbought zone.

Instance: Ethereum peaks at $4,500, then rallies to $4,550 (larger excessive in worth). Nevertheless, StochRSI peaks at 92 on the first high, then solely reaches 78 on the second high (decrease excessive in momentum). This bearish divergence (larger worth however weaker momentum) typically precedes downward reversals.

Bonus Learn: StochRSI + Bollinger Bands in Motion

Taking a look at this ETH/USD chart on the 1-hour timeframe, we are able to see the highly effective mixture of StochRSI with Bollinger Bands and quantity evaluation.

Present readings (Oct 10):

- Worth: $4,347.9

- Bollinger Bands: Worth consolidating close to center band ($4,343.9)

- StochRSI: 52.46/%Ok, 50.78/%D (impartial zone)

- Stochastic: 43.04/%Ok, 37.02/%D (impartial)

- Quantity: Declining after latest spikes

Decrease Bollinger Band Contact (Oct 7): ETH touched the decrease Bollinger Band round $4,280, indicating worth reached a volatility excessive. Concurrently, each StochRSI and common Stochastic dropped into oversold territory (under 20). This confluence created a high-probability lengthy entry. Discover the quantity spike that accompanied the bounce – this confirmed institutional shopping for curiosity on the excessive. ETH subsequently rallied over $100 within the following hours.

Higher Bollinger Band Rejection (Oct 8-9): Worth prolonged to the higher Bollinger Band close to $4,580 whereas StochRSI reached excessive overbought ranges (above 80). The mixture of volatility excessive and momentum exhaustion signalled potential reversal. The next pullback validated this sign, with ETH declining again towards the center band.

Center Band Assist (Oct 10): After the decline, ETH discovered assist on the center Bollinger Band. StochRSI hit oversold ranges round 20, suggesting momentum exhaustion to the draw back.

The Bollinger Bands are contracting (discover the narrowing distance between higher and decrease bands), which generally precedes a volatility enlargement and directional transfer. The subsequent high-probability commerce setup will happen when:

- Worth touches both the higher or decrease Bollinger Band (volatility excessive)

- StochRSI reaches excessive territory (<20 or >80)

- Quantity expands considerably (20%+ above latest common)

Frequent Errors to Keep away from

Overtrading Each Sign

StochRSI generates frequent alerts. Some are false alarms. Solely commerce alerts with a number of confirming components (assist/resistance, quantity, pattern alignment).

Combating the Development

Taking overbought alerts in sturdy uptrends or oversold alerts in sturdy downtrends results in repeated losses. Additionally, StochRSI can stay overbought for days throughout highly effective uptrends or oversold throughout downtrends. At all times establish the prevailing pattern first. Use StochRSI for entry timing inside tendencies (shopping for dips in uptrends, promoting rallies in downtrends) slightly than counter-trend reversals.

Utilizing Low Timeframes

1-minute and 5-minute charts include extreme noise. Think about using a minimal 15-minute for day buying and selling, 4-hour for swing buying and selling. Increased timeframes produce fewer however considerably extra dependable alerts.

Ignoring Context

Coming into positions instantly upon crossover with out checking assist/resistance, quantity, or information occasions dramatically will increase threat. Think about using a pre-trade guidelines verifying pattern route, worth construction, quantity affirmation, and occasion schedule.

Dismissing Quantity

StochRSI alerts with weak quantity typically fail. Indicators with quantity spikes point out institutional involvement and real conviction.

Strive StochRSI on Bitfinex

- Log in to Bitfinex and choose your pair.

- Go to Indicators, search StochRSI.

- Look ahead to crossovers within the overbought/oversold zones.