13 Jun Chart Decoder Sequence: Bollinger Bands – Find out how to Commerce Volatility Like a Professional

Welcome again to the Chart Decoder Sequence, the place we break down technical charting instruments Bitfinex gives.

To this point, we’ve lined:

Now let’s dive into Bollinger Bands, a versatile software that helps merchants learn volatility and spot extremes in worth.

What Are Bollinger Bands?

Bollinger Bands encompass three strains:

- Center Band: A 20-period easy transferring common (SMA)

- Higher Band: The SMA + 2 commonplace deviations

- Decrease Band: The SMA – 2 commonplace deviations

They stretch and contract primarily based on market volatility.

When the bands are far aside: excessive volatility

Once they’re tight: low volatility (and infrequently an enormous transfer is coming)

Find out how to Use It:

- Worth exceeds the Higher Band

This usually indicators overbought circumstances. A brief-term pullback or reversal might comply with, although sturdy momentum can drive additional features. - Worth dips under the Decrease Band

This will point out oversold circumstances. A bounce is feasible, nevertheless it’s finest confirmed with extra indicators like RSI or quantity. - Worth strikes carefully alongside the Higher Band

Often called “strolling the band,” this often displays a powerful pattern. Whereas it could possibly persist, merchants ought to watch carefully for fading momentum. - Bands contract considerably

A squeeze suggests the market is in a low-volatility section. These durations usually precede sharp breakouts in both path. - Bands start to widen

Signifies rising volatility. The market could also be transitioning right into a extra energetic section with bigger worth swings.

Instance in Motion:

Let’s break down what we’re seeing on a 1-hour BTC/USD chart on Bitfinex, utilizing Bollinger Bands (BB 20, 2) as your most important indicator.

- Present worth: 105100

- Center Bollinger Band (20 SMA): 104978

- Higher Band: 105619

- Decrease Band: 104337

On this instance, BTC is sitting simply above the Center Band, exhibiting tentative indicators of power. That is usually a neutral-to-bullish zone, the place worth is deciding whether or not it desires to make a transfer or hang around sideways for some time longer.

What’s attention-grabbing is that the Bollinger Bands had been wider earlier, reflecting some sharp strikes (clearly seen from the latest dips and spikes). However now they’re beginning to contract, hinting that the market could possibly be getting into a consolidation section.

What Might Occur Subsequent?

- Bullish Situation:

If BTC can maintain above the Center Band and we see a number of sturdy candles push greater, a take a look at of the Higher Band (~105619) is probably going. A clear break above it may sign an incoming breakout (control quantity). If the worth climbs with out sturdy participation, it could simply be a fake-out. - Bearish Situation:

If BTC slides again under the Center Band and quantity picks up on pink candles, we may revisit the Decrease Band (~104337) fairly shortly. This could hold BTC in a short-term downtrend channel. - Sideways Drift:

Essentially the most possible situation for now: consolidation. The slight tightening of the Bands suggests diminished volatility, that means BTC may simply vary between the Center and Higher/Decrease bands whereas merchants anticipate a macro catalyst.

Bollinger Bands work finest when used with confirming indicators. Should you’re severe about catching breakouts or reversals with extra confidence, attempt pairing this with:

- RSI for overbought/oversold affirmation

- Quantity for power validation

- Candlestick patterns close to the bands for entry indicators

BTC/USD Replace with RSI + Bollinger Bands

Present RSI (14): 51.47

This places us proper within the impartial zone between overbought (70) and oversold (30). No clear momentum but, however…

- RSI has been slowly climbing out of a latest low and simply broke above 50.

- This could generally be seen as a shift in short-term momentum, the place bears are shedding management and bulls are cautiously stepping in.

Proper now, the chart says: neutral-to-hopeful. BTC is crawling again from latest lows, with RSI nudging towards bullish territory. Nonetheless a ready sport.

Professional Suggestions:

- Use Bollinger Bands with RSI or MACD to verify indicators

- Don’t assume each contact of the bands = reversal. Context is vital

- Bollinger Band “squeezes” are sometimes adopted by highly effective strikes

- Look ahead to worth – band divergence. That is when the worth makes a brand new excessive however the band doesn’t widen. This might imply the pattern is shedding power and a reversal or slowdown could also be close to.

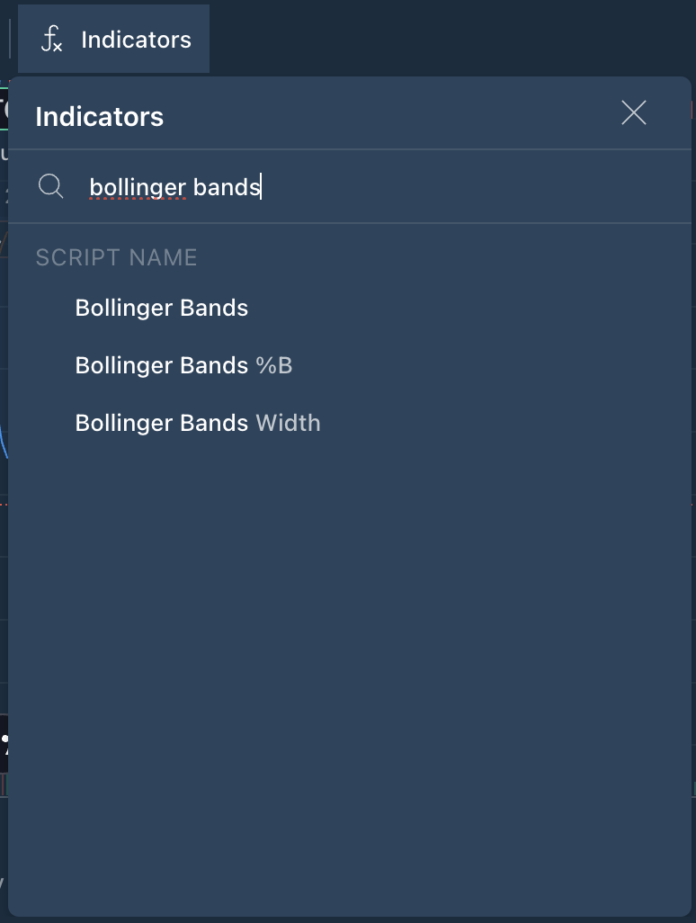

Strive Bollinger Bands on Bitfinex:

- Log into Bitfinex

- Open any buying and selling pair chart

- Add Bollinger Bands from the indications menu

- Search for worth breaking the bands, tight squeezes, or sturdy traits “strolling the band”

Subsequent within the Chart Decoder Sequence: Fibonacci Ranges – spot pure worth targets utilized by execs and algorithms alike.

Bitfinex. The Authentic Bitcoin Alternate.