ChargePoint’s inventory worth has completely spiraled decrease over the previous three years, however a change in technique might reverse its course.

Buyers initially purchased into the hype surrounding ChargePoint (CHPT -3.52%) and different charging infrastructure corporations. It was a logical course with the electrical automobile (EV) trade poised to increase within the coming years. In actual fact, among the greatest considerations dealing with potential EV clients are vary anxiousness and charging infrastructure availability, issues ChargePoint might help clear up.

Regardless of the rising EV market — even when it is slower than anticipated — ChargePoint has struggled to provide top-line progress for buyers. However with a latest pivot from progress to profitability, can the corporate flip its enterprise round and reward buyers?

The dangerous information

One dangerous signal for the charging infrastructure start-up is that whereas many EV trade start-ups are dealing with brutal money burn as they scale their enterprise, fewer are posting income declines. ChargePoint’s first quarter of fiscal yr 2025 recorded an 18% decline in income, from the prior yr’s $130 million all the way down to $107 million. Administration additionally lowered second-quarter income steering from a variety of $150 million to $165 million all the way down to a variety between $108 million and $113 million.

Moreover, the corporate ended Q1 fiscal 2025 with solely $262 million in money and money equivalents, and it is already elevated its shares excellent by over 30% over the previous three years. If it wants to boost extra capital, buyers could possibly be additional diluted.

With the broader EV market slowing down within the U.S., not less than quickly, ChargePoint will proceed to battle with income progress within the close to time period. However administration is pivoting its technique to give attention to profitability, quite than on costlier progress.

Software program vs. {hardware}

Extra just lately, administration has determined to give attention to its software program growth, which is sensible because it carries larger revenue margins and recurring income. The corporate has introduced a number of partnerships for its {hardware} to assist carry merchandise to market sooner and extra affordably.

One partnership that may assist drive higher outcomes for ChargePoint is its settlement to collectively develop EV charging options with AcBel, a number one energy provide producer below Kinpo Group. This settlement ought to enhance ChargePoint’s analysis and growth capabilities, cut back prices, and convey extra revolutionary merchandise and options to the market sooner.

One other partnership that ought to transfer the needle for buyers got here with LG Electronics. The 2 corporations are focusing on industrial charging options, with deliveries anticipated to start as quickly as this summer season. Basically, the deal requires ChargePoint to function LG’s charging stations with its software program, and ChargePoint customers will profit from LG’s high-quality EV chargers the place the corporate would not at the moment provide {hardware} options.

Is the inventory a purchase?

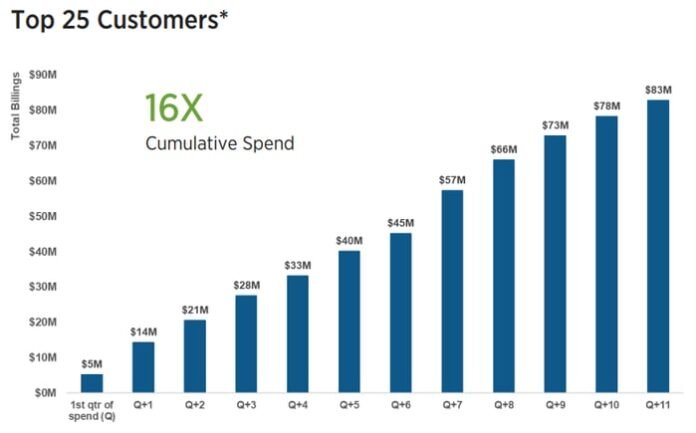

ChargePoint stands to profit with a brand new give attention to software program, because of its software-as-a-service (SaaS) for its industrial and fleet merchandise. In actual fact, in response to ChargePoint’s investor presentation, the corporate works with 74% of Fortune 50 corporations, and the income from its largest clients continues to develop organically.

Picture supply: ChargePoint investor presentation.

Lastly, with the pivot to software program and profitability over progress, administration expects to generate constructive adjusted EBITDA within the fourth quarter of fiscal 2025. This might be an enormous step for the corporate towards proving to buyers it has a long-term path to returning worth to shareholders. For buyers prepared to just accept danger that comes with a cash-burning start-up, ChargePoint is providing a less expensive entry level — it is shed greater than 90% of its worth over the previous three years — to spend money on an EV market that appears destined to proceed rising.

Daniel Miller has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.