Bitcoin has remained trapped in a decent vary between $115K and $120K for the previous 10 days, signaling an prolonged part of worth compression. With bulls unable to push the value above the $120,000 resistance, analysts are more and more warning {that a} correction could also be imminent. The approaching days are anticipated to be decisive, as each technical and on-chain fundamentals level to a possible surge in volatility.

Associated Studying

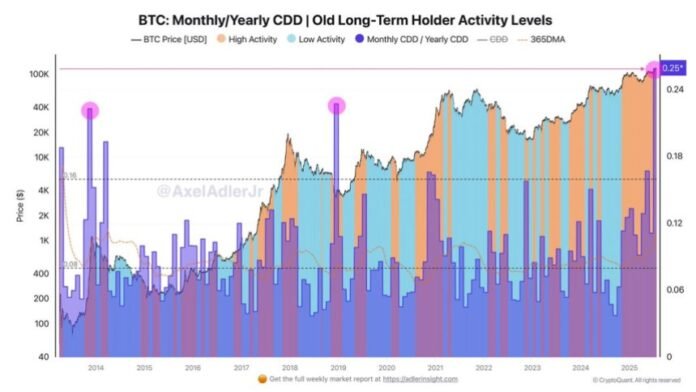

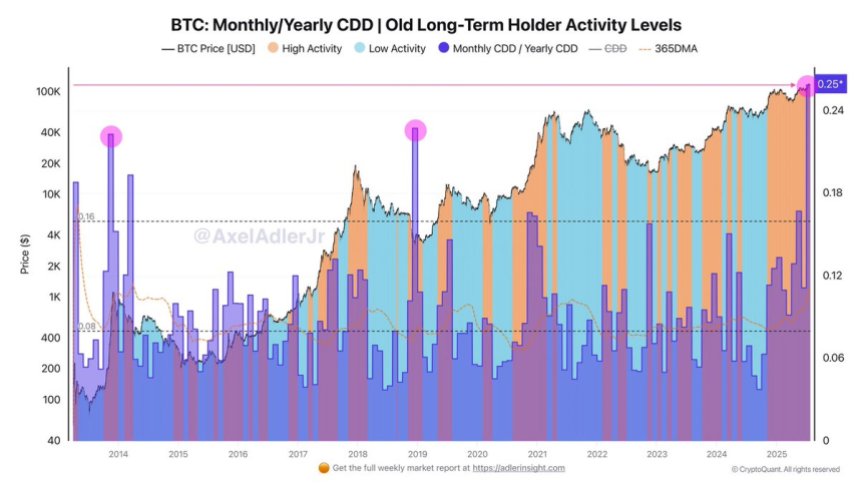

Based on information from CryptoQuant, a key long-term metric—the Month-to-month Cumulative Days Destroyed (CDD) to Yearly CDD ratio—has reached an anomalously excessive stage of 0.25. That is occurring inside the $106,000 to $118,000 worth vary, a zone that has seen heavy long-term holder exercise. Traditionally, comparable CDD spikes had been noticed through the 2014 macro peak and the 2019 corrective part, each of which marked durations of intense market distribution.

This uncommon on-chain conduct displays heightened motion of long-dormant cash, suggesting that skilled holders could also be taking income at present ranges. Whereas this doesn’t verify an instantaneous development reversal, it reinforces the concept Bitcoin’s present consolidation is a essential inflection level—one that would both result in renewed upside or set off a deeper correction if bulls fail to regain momentum quickly.

Lengthy-Time period Holders Start Distributing, However Rally Nonetheless Intact

Prime analyst Axel Adler has shared insights highlighting a key shift in Bitcoin market conduct: the sharp rise within the Month-to-month CDD to Yearly CDD ratio signifies that long-term holders (LTHs) are starting to actively transfer dormant cash again into circulation. Traditionally, such elevated CDD ranges have marked durations of heightened exercise from skilled traders, usually signaling a distribution part the place income are realized after extended holding.

These spikes are important as a result of they counsel that cash held for years are actually re-entering the market. Based on Adler, this sort of exercise isn’t random—it usually comes from holders with deep market information who acknowledge potential turning factors. Nevertheless, this doesn’t essentially imply the rally is over. Whereas it might cap short-term upside and introduce volatility, present macro and institutional traits present a strong counterbalance.

Treasury demand stays robust, and Bitcoin ETF inflows are nonetheless flowing steadily, appearing as a buffer in opposition to extreme downward strain. This structural help is essential in sustaining general bullish momentum, at the same time as some distribution unfolds.

Associated Studying

Sideways Motion Persists Beneath $120K Resistance

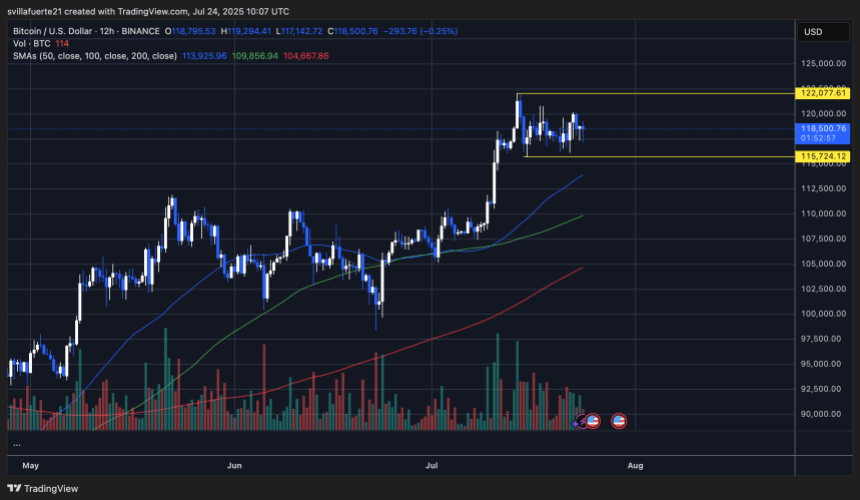

Bitcoin (BTC) continues to consolidate in a decent vary, as proven within the 12-hour chart. Worth motion stays compressed between the $115,724 key help and the $122,077 resistance stage. After a powerful impulse earlier this month, momentum has clearly cooled, with BTC now oscillating inside this horizontal channel for over 10 days.

Notably, the value is presently hovering close to $118,500—proper across the 50-period shifting common (blue), which has acted as dynamic help since early July. The 100-period (inexperienced) and 200-period (crimson) shifting averages stay effectively beneath the present worth, indicating that the broader development stays bullish regardless of the pause in upward motion.

Associated Studying

Nevertheless, quantity has steadily declined throughout this consolidation part, signaling indecision and a possible lack of conviction amongst patrons at present ranges. A breakout above $122,000 might renew bullish momentum, opening the door for a run towards new highs, whereas a breakdown beneath $115,700 would expose BTC to deeper retracement ranges, seemingly focusing on the 100 MA close to $109,800.

Featured picture from Dall-E, chart from TradingView