07 Jul BTC Consolidates as Whales Ease Holdings and New Consumers Step in

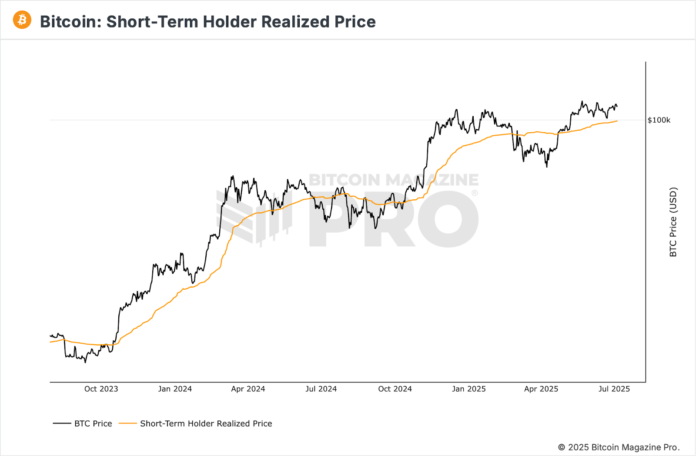

Bitcoin stays locked in a good consolidation vary between $100,000 and $110,000, as market individuals await a decisive catalyst to find out path. The value motion continues to respect the January all-time excessive of $109,590 as resistance, whereas drawing constant help from the Quick-Time period Holder Realised Worth (STH-RP) round $98,220–$99,474. Regardless of a current rebound from sub-$100K ranges, the broader pattern has stalled, and the present market setup displays a fragile equilibrium: profit-taking pressures have eased, however the lack of sustained momentum suggests consumers are additionally hesitant.

Importantly, the market’s repeated defence of the rising STH-RP underscores continued structural energy. This key on-chain stage has traditionally acted as a pivot for pattern continuation, and its resilience in current weeks signifies that bulls nonetheless maintain management of the broader construction. The rising price foundation displays ongoing accumulation, seemingly by institutional gamers by way of ETFs and company inflows providing a extra sturdy basis than in prior cycles. Nonetheless, the shortage of follow-through on the vary highs, and up to date drawdowns in mixture open curiosity and whale holdings, spotlight rising warning, notably amongst skilled market individuals.

The US macroeconomic panorama is more and more marked by indicators of pressure, with current information underscoring a labour market dropping momentum amid broader financial headwinds. June payrolls confirmed a headline acquire of 147,000 jobs, but almost half stemmed from authorities hiring linked to seasonal components, whereas non-public sector job creation weakened to its slowest tempo in eight months. Sectors like manufacturing and wholesale commerce shed jobs, and the general drop in labour drive participation masked the rise in long-term unemployment.

Wage development softened, the common workweek shrank, and mixture hours labored fell, reflecting cautious employer sentiment and hinting at subdued shopper demand forward. Manufacturing, too, stays beneath stress; the ISM PMI stayed beneath the 50 mark for the fourth consecutive month, with companies grappling with provide chain bottlenecks and commerce uncertainty, additional clouding prospects for a restoration. Whereas job openings rose, largely in lower-wage leisure and hospitality roles, hiring lagged, exposing the delicate underpinnings of labor demand. In opposition to this backdrop, the Federal Reserve seems set to carry charges regular within the close to time period, with markets eyeing potential easing towards year-end.

In parallel, the cryptocurrency sector is capturing rising institutional curiosity, with developments which can be in distinction with the tentative macroeconomic temper. The debut of the primary Solana staking ETF, SSK, marked a milestone, drawing $33 million in quantity on its first day and providing 5–7 % staking yields, positioning Solana as a reputable participant in regulated capital markets. Equally, company Bitcoin treasury methods are accelerating: Spain’s Vanadi Espresso pivoted dramatically from its café enterprise to amass Bitcoin holdings, aiming for €1 billion in BTC publicity, although there’s concern concerning the firm’s technique given its general monetary fragility. In the meantime, Tokyo-based Metaplanet has intensified its Bitcoin accumulation technique, now holding a complete of 15,555 BTC following its newest buy of two,205 BTC, with ambitions to succeed in 210,000 BTC by 2027 and solidify its function as Asia’s main company Bitcoin holder. Collectively, these crypto strikes spotlight a rising divergence: whereas conventional markets wrestle with uncertainty, digital belongings are more and more seen as a car for yield, treasury diversification, and inflation hedging — signalling shifting priorities in institutional capital deployment.