Ethereum continues to be engaged on a complementary plan for parallel EVM, however Bitcoin could be quickly anticipating its personal parallel VM layer 2.

Let’s firstly perceive why Ethereum can’t obtain parallel EVM.

To take care of community consistency and safety, EVM has a vital characteristic in its design: transactions are executed sequentially. Sequential execution ensures that transactions and good contracts could be executed in a deterministic order, making it simpler to handle and predict the blockchain’s state. This design alternative prioritizes safety, decreasing potential complexities and vulnerabilities related to parallel execution. Nonetheless, beneath excessive a great deal of transaction requests, this sequential execution can result in community congestion and delays, just like a single-lane freeway.

Is it possible to easily add lanes? Referencing present options of so-called parallel VMs, together with sharding chains like Close to. These chains proposed to scale blockchain by introducing extra VMs to scale good contracts. Primarily the workload of 1 good contract nonetheless lies in a sure VM. If all good contracts on this chain devour an equal quantity of TPS, then the issue is solved. Nonetheless, if only some contracts, akin to Aave and Uniswap protocols, devour over 90% of block house, having contracts working on a single shard means solely scaling on the chain degree with out benefiting from the enhancements introduced by sharding. Including lanes with out the power to change lanes represents the present dilemma of parallelization of VMs.

The Parallel EVM entails slicing or caching information on the information layer. Nonetheless, restricted by EVM’s programming mannequin, Solidity, as the preferred good contract programming language, can’t maximize the potential of parallel blockchain structure. It is akin to not programming with SQL on NVIDIA’s GPU. Solidity lacks expressions for parallel architectures like Relay Execution and lacks an outlined ultimate atomicity for parallel transactions.

True parallelism in blockchain structure requires reaching the outcome that transactions of 1 good contract can run on a number of VMs concurrently. A programming mannequin like CUDA is required to completely leverage a parallel mannequin in blockchain structure.

BitReXe mentions Bitcoin introduces Turing-complete parallel VM Layer 2 to offer underlying infrastructure assist for actual functions within the Bitcoin ecosystem and an unique programming mannequin for parallel VMs, PREDA.

How BitReXe achieves Parallel Vms on Bitcoin

Parallel VMs

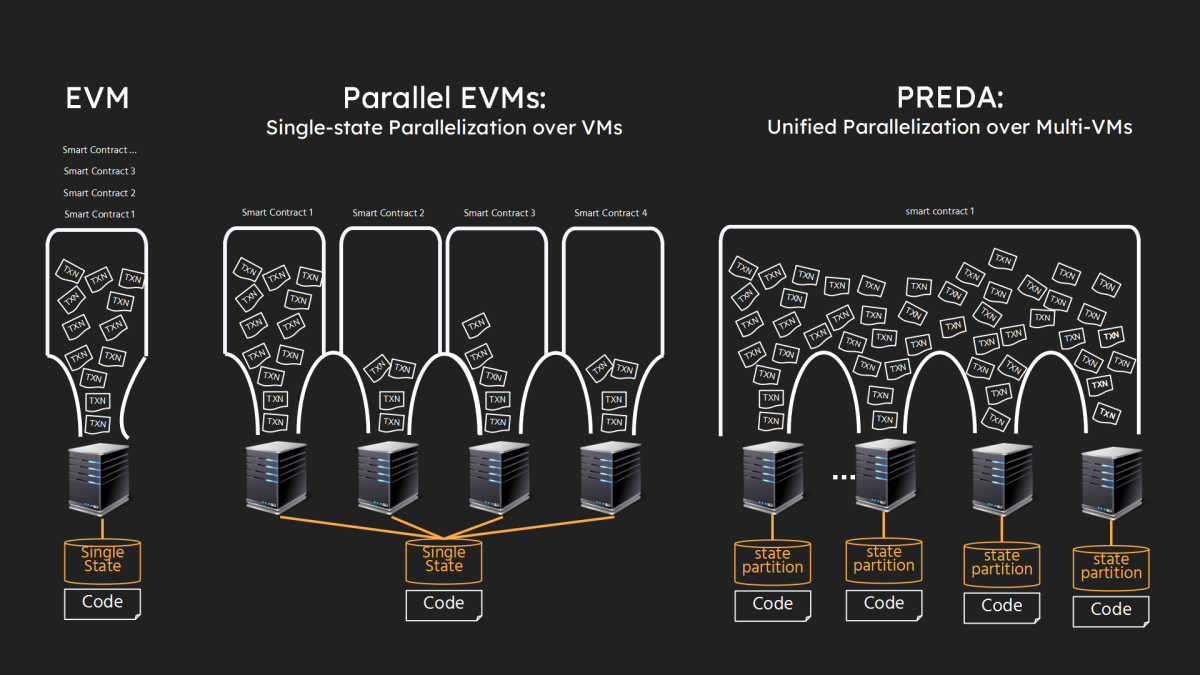

The next illustration highlights the distinctions between BitReXe and different initiatives selling Parallel VMs. As proven within the leftmost section of the determine, Ethereum adheres to a single-machine state mannequin, whereby all codes (good contracts) and states (information) are replicated and managed by every blockchain node by its Ethereum Digital Machine (EVM). The extant tasks make the most of Parallel EVMs, as proven within the center part of the determine, the place a single good contract is deployed on a devoted VM (or VMs inside a chosen shard to uphold consensus). All transactions pertaining to the good contract are processed by the VM (or VMs of the shard in a completely duplicated method).

In BitReXe’s unified parallelization mannequin, as proven within the rightmost section of the determine, all good contracts are deployed throughout all VMs of the community. The states of a sensible contract endure partitioning and distribution throughout distinct VM situations, guaranteeing non-overlapping allocation. Correspondingly, transactions of the good contract are segmented and distributed for impartial and parallel processing throughout VMs. Within the splendid case, this method facilitates a linear scaling of general transaction throughput and state capability with an growing variety of VMs.

The first problem lies in effectively managing the dependencies between execution logic (code) and contract state (information) whereas enabling impartial VM execution and avoiding synchronization, because the complete execution logic of a transaction could entail entry to a number of segments of contract states, every residing in separate VMs after state partitioning.

PREDA

We current Parallel Relay-Execution Distributed Structure (PREDA), a groundbreaking programming mannequin designed to scale out good contracts on sharding blockchains, parachain methods, and layer-2 blockchains. PREDA helps a parallel structure: if Solidity for Ethereum is likened to program on a single-core CPU, PREDA’s parallel structure for BitReXe is akin to CUDA for NVIDIA’s GPU.

The PREDA mannequin introduces two key elements: (1) “Programmable Contract Scopes”, enabling programmers to outline contract state partitioning primarily based on the appliance’s information entry sample, narrowing information entry vary and minimizing information dependency; and (2) “Asynchronous Practical Relay”, permitting programmers to articulate transaction logic with implicit information dependencies for versatile execution throughout a number of execution engines (VMs). Applied as an prolonged Solidity language, PREDA consists of extra syntax for programmable contract scopes and statements for asynchronous useful relay.

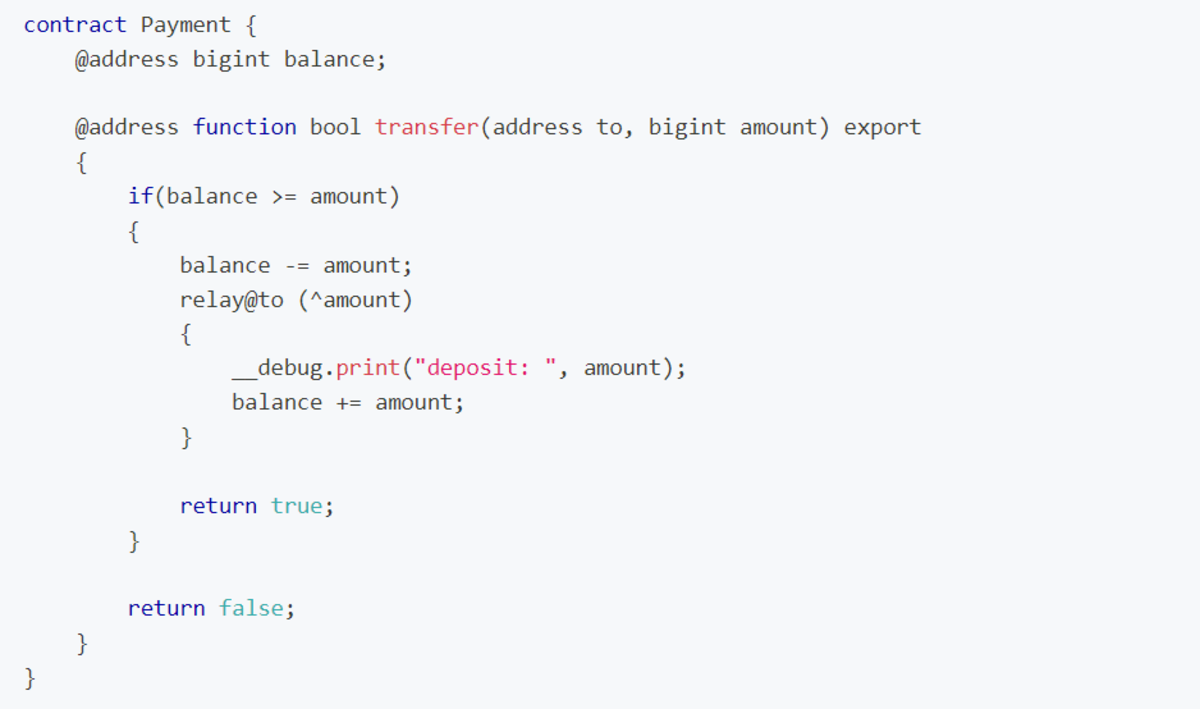

The determine illustrates the PREDA model of a simplified ERC20 contract. The “@handle” key phrase defines the scope of customers’ balances, equal to Solidity’s map definition however specifies fine-grained and separable states for partitioning by handle. At runtime, states partitioned by handle are managed by a set of VMs within the BitReXe chain. Totally different states should not maintained by completely different units of VMs. The switch operate throughout the “@handle” scope, invoked by payers (i.e., consumer addresses initiating switch transactions), initiates a ” relay” for depositing to the payee. This relay, executed by a VM internet hosting the payee’s handle states, provides funds to the payee’s steadiness.

In PREDA, a sensible contract can have a number of scopes with variables and capabilities outlined. A number of capabilities and variables of arbitrary varieties together with containers could be outlined in a scope. A number of relays, conditionally or unconditionally, could be initiated in a single operate name, permitting recursive initiation and enabling transaction execution circulation to be moved multi-hops throughout completely different VM situations. This relay-execution method decomposes a transaction into a number of Micro-Transactions, guaranteeing restricted state entry in a single digital machine and avoiding race situations. Within the PREDA switch good contract, decomposing the transaction right into a “withdraw” micro-transaction and a “deposit” micro-transaction permits parallel execution of those two kinds of micro-transactions, so long as their targets (addresses on this case) are mapped to completely different digital machines.

BitReXe organizes digital machines into a number of consensus teams, every independently working a consensus protocol (PoW-based within the implementation) to succeed in consensus on executed transactions. Throughout-group consensus is applied to keep up correctness and consistency for asynchronous useful relays, applied as relay transactions in BitReXe.

Bitcoin Layer 2

Asset issuance paradigm on Bitcoin layer like inscription is consistently exploiting a vulnerability in Bitcoin, says Luke. Whereas cash by no means sleeps, simply as inscriptions could by no means die. Bitcoin is in determined want of a really scalable layer 2 that may launch such strain and save the ledger measurement from rising too quick which can weaken the decentralization. Such a objective could be very unlikely to be achieved by an EVM+Bridge answer.

BitReXe proposes Parallel VMs and PREDA to scale bitcoin. In the meantime, it adapts to the safety of bitcoin. It makes use of BTC as gasoline price, shares the safety of Bitcoin, and supplies a trustless asset settlement between the 2 chains.

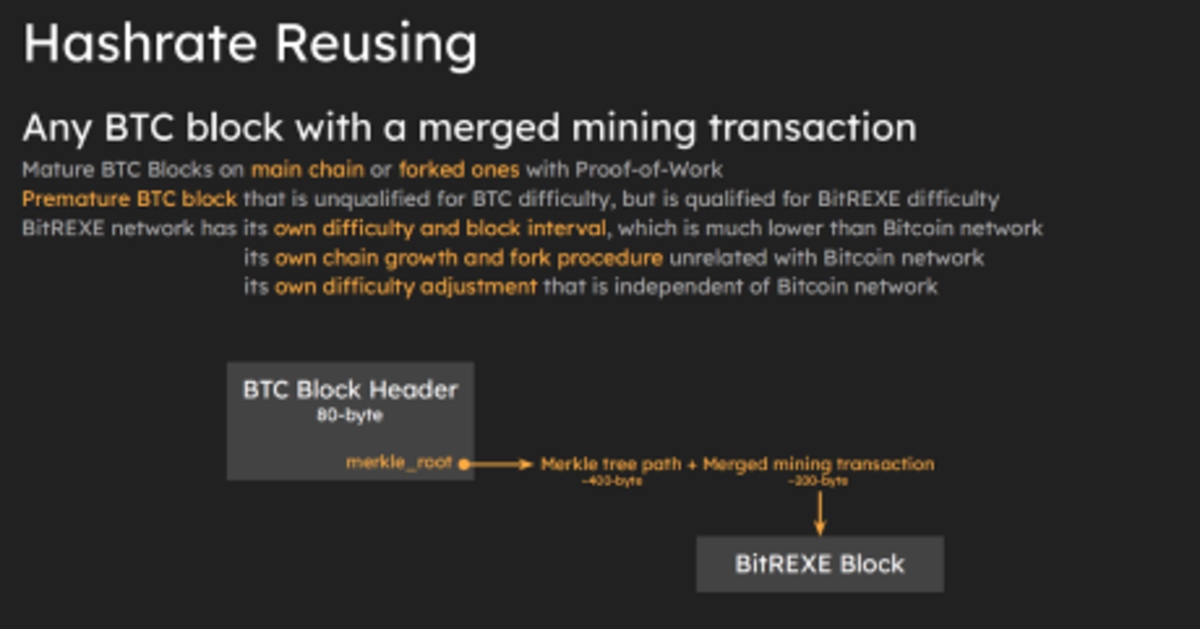

BitReXe reuses hashing computing energy by the Bitcoin community which is carried by on-chain blocks, orphan blocks, and untimely blocks as proof-of-work to create legitimate blocks within the layer-2 community with out modifying the Bitcoin protocol. Merge miners obtain rxBTC as rewards, a 1:1 pegged bitcoin on the BitReXe community. Customers pay gasoline charges with rxBTC for transactions, interacting with good contracts, and different on-chain actions. Fullnodes lab, the dev workforce of PREDA and BitReXe is about to introduce a trustless asset settlement bridge answer between Bitcoin and BitReXe, the place rxbtc peg-out is on the identical time somebody’s BTC peg-in. Official peg-out addresses are now not required, thus belief assumption is subsequently eradicated.

Our excessive expectations for the Bitcoin ecosystem stem from its potential to unravel issues that Ethereum – as Bitcoin’s testnet – has not addressed.

@Bit_ReXe believes that this challenge stems from EVM missing parallel mechanisms resulting in blockchain trilemma and goals to straight resolve it on Bitcoin Layer 2.

If this challenge could be resolved on Bitcoin, then TVL benchmarking and even surpassing Ethereum by greater than 3 times on Bitcoin Layer 2 would current a elementary breakthrough.”

This can be a visitor publish by BitPNova. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.