05 Could Bitfinex Alpha | Sturdy April Shut Units Up Bitcoin for Summer time

Bitcoin closed April with a robust 14.08 p.c month-to-month acquire, outperforming its historic April common and reversing course after a steep early-month correction. This rally, which noticed Bitcoin climb greater than 32 p.c from its April low of $74,501 to just about $98,000, highlights the asset’s resilience amid macroeconomic turbulence and shifting danger sentiment. Reclaiming the $95,000 stage—the decrease boundary of its former three-month vary—is now the key technical threshold. Holding this zone, particularly as BTC consolidates above the short-term holder value foundation of $93,340, might lay the groundwork for a transfer again towards all-time highs.

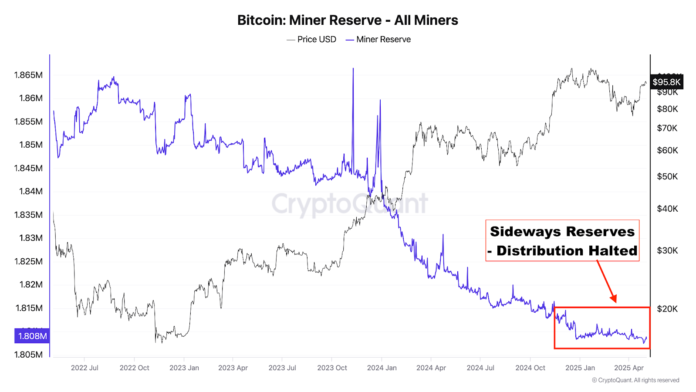

On-chain knowledge helps this narrative: miner reserves stay steady and the Puell A number of suggests little incentive for large-scale miner promoting, indicating confidence in additional upside. Whereas the near-term hinges on whether or not BTC can convert this reclaim into sustainable help, structural indicators proceed to lean bullish—setting the stage for a possible continuation of the present cycle as soon as macro circumstances stabilise.

The US economic system confirmed surface-level resilience in April, with 177,000 new jobs added and unemployment holding regular at 4.2 p.c. Labour drive participation grew, and key sectors like schooling, healthcare, and hospitality continued hiring. Nonetheless, wage progress slowed to 0.2 p.c month-to-month and three.8 p.c yearly, job openings declined, and sure industries like manufacturing and retail misplaced jobs—indicators of a cooling labour market.

These optimistic headlines masks deeper structural points, as corporations could also be “labour hoarding” after previous hiring struggles, and the roles report is more and more seen as a lagging indicator. In the meantime, client spending seems steady on the floor however reveals cracks beneath—sturdy items purchases dropped sharply, whereas nondurables and providers rose. A brief surge in gear funding lifted non-public funding numbers, however broader financial momentum stays weak. Imports soared over 40 p.c, widening the commerce deficit and dragging GDP down by 0.3 p.c in Q1, largely on account of companies front-loading items forward of tariff hikes.

Client confidence has plunged to its lowest stage since 2020, with the Expectations Index dropping to a stage traditionally linked to recessions. Rising considerations about earnings, job safety, and inflation—pushed by ongoing commerce tensions—are weighing closely on sentiment. As inflationary strain from tariffs builds and family earnings progress stalls, the US faces a precarious interval of financial deceleration.

Within the cryptosphere, Nexo has reentered the US market after a two-year exit, citing a extra beneficial regulatory local weather and political help, significantly beneath the Trump marketing campaign’s pro-crypto stance. The corporate now goals to supply a totally compliant suite of crypto-backed monetary merchandise, reflecting a broader trade shift towards cooperation with regulators. In the meantime, the Arizona Home handed two payments that might enable the state to speculate as much as 10 p.c of its funds in Bitcoin and different cryptocurrencies, probably making it the primary U.S. state to carry crypto in its treasury and retirement methods—although the result stays unsure on account of Governor Hobbs’ veto warning tied to broader finances considerations. Throughout the Atlantic, the UK authorities launched draft laws to manage crypto platforms, emphasising client safety and transparency, whereas additionally strengthening collaboration with the U.S. to ascertain a transatlantic regulatory framework. Lastly, the SEC concluded its investigation into PayPal’s stablecoin PYUSD with out enforcement motion, signalling potential regulatory readability for stablecoins and reinforcing PayPal’s place within the evolving digital asset panorama.