17 Mar Bitfinex Alpha | Ready For Conviction

Bitcoin has prolonged its decline from the January twentieth all-time excessive of $109,590, falling to a low of $77,041 final week—a 29.7 p.c retracement, marking the second deepest correction of this bull cycle. Whereas historic bull markets have typically seen 30 p.c pullbacks earlier than resuming an uptrend, the present cycle had beforehand been outlined by shallower declines, largely resulting from institutional adoption and ETF-driven demand. The ongoing outflows from US spot Bitcoin ETFs, which totalled $921.4 million final week, counsel that institutional patrons haven’t but returned with ample power to counteract promoting stress.

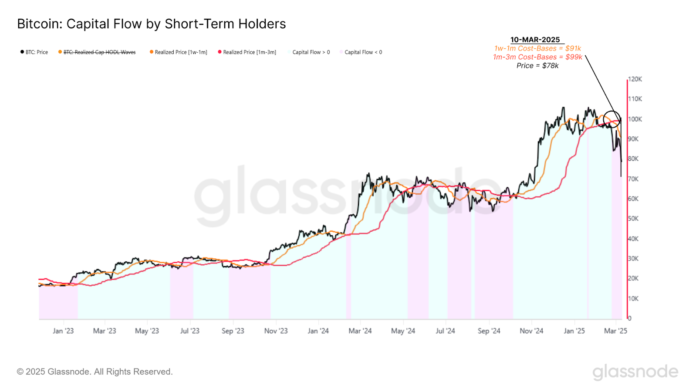

Quick-term holders are additionally persevering with to face web unrealised losses, exacerbating sell-side stress. These buyers, significantly those that purchased throughout the previous 7 to 30 days, are sometimes essentially the most prone to capitulation. Traditionally, when contemporary capital inflows sluggish and value foundation tendencies shift, it indicators a weakening demand setting. This development has turn out to be more and more evident as Bitcoin struggles to carry above key ranges. With out new patrons stepping in, Bitcoin dangers prolonged consolidation, and even additional draw back as weaker arms proceed to exit their positions.

The important thing issue to look at is whether or not long-term holders or institutional demand re-emerge at these decrease ranges. If deeper-pocketed buyers start absorbing provide, it may sign a shift again towards accumulation, probably stabilising value motion and reversing sentiment.

The US economic system can be at a crossroads, with a resilient but cooling labour market, moderating inflation, however declining client confidence. Inflation remained subdued in February, with decrease airline fares and gasoline costs offsetting greater housing prices, however provide chain disruptions and tariff-related pressures may drive costs greater within the coming months. Job openings rose in January, whereas layoffs hit a seven-month low, signalling stability. Nonetheless, underemployment is rising, and commerce uncertainty, significantly new tariffs on key imports, is weighing on enterprise sentiment. Client confidence has plunged to its lowest degree in over two years, with inflation expectations surging and financial uncertainty dampening each family and enterprise outlooks. As commerce insurance policies and inflationary dangers unfold, the Federal Reserve’s response shall be vital in figuring out whether or not the economic system stabilizes or weakens additional.

In cryptocurrency market developments final week, the Cboe BZX Trade proposed staking for the Constancy Ethereum Fund. This might encourage larger ETH ETF inflows if staking yields, which quantity to 3-4 p.c yearly, turn out to be inbuilt. Nonetheless SEC scrutiny stays a hurdle. Thailand’s SEC then again, authorised USDt and USDC for buying and selling on licensed exchanges, setting a regulatory precedent which will affect world stablecoin insurance policies. Within the US., Senator Cynthia Lummis reintroduced the BITCOIN Act to ascertain a Strategic Bitcoin Reserve, aiming to reinforce monetary safety however going through resistance from banking establishments and the Federal Reserve. In the meantime, Technique™ introduced a $21 billion inventory providing to increase its Bitcoin holdings, reinforcing institutional curiosity however drawing regulatory consideration. These developments spotlight growing crypto integration into conventional finance, and produce with them lasting market implications.