16 Jun Bitfinex Alpha | Markets Nervous as BTC Consolidates

Bitcoin began the week (final week) with a promising rebound, climbing 4.7 % from the weekly open and briefly retesting its prior all-time excessive of $109,590. However optimism shortly gave method to danger aversion after the sudden strike on Iran by Israel on June 13 triggered a pointy selloff throughout world markets. Bitcoin retraced a lot of its early good points with a 7.33 % drop, closing the week decrease as rising oil costs and macro uncertainty weighed closely on investor sentiment. This episode underscores how even a robust pattern may be swiftly derailed by exogenous shocks, particularly when markets are working scorching.

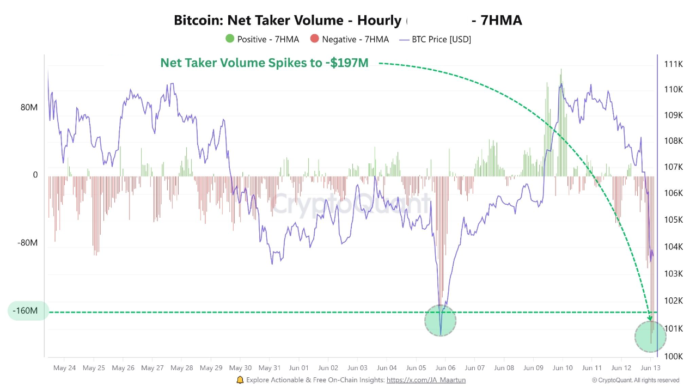

Beneath the floor, dealer behaviour revealed mounting stress. Bitcoin’s Web Taker Quantity plunged to –$197 million (see chart beneath), its lowest since June 6—signalling that sellers had seized management, aggressively offloading BTC at market costs. This promoting, nonetheless, mixed with a spike in liquidations, resembles previous capitulation—model setups that always mark native bottoms. If Bitcoin can maintain the $102,000–$103,000 zone, it might recommend that promoting strain is being absorbed and that the market might be primed for restoration—assuming geopolitical dangers don’t intensify additional.

Notably, the size of the correction has been modest, particularly in comparison with previous bull market drawdowns. A 9 % peak-to-trough pullback is properly inside regular volatility bands for Bitcoin, with almost half of all buying and selling days within the present cycle having seen deeper drawdowns. As well as, the fast slide within the Concern and Greed Index into “Concern” territory, regardless of a comparatively delicate decline, suggests market psychology stays fragile. This reflexive worry, nonetheless, may very well cut back draw back danger, as positioning stays cautious and vulnerable to fast reversals if demand reasserts. For now, Bitcoin is navigating a basic consolidation inside an uptrend—risky, however not damaged.

US inflation confirmed a gentle improve in Could, with the Shopper Value Index rising simply 0.1 % because of falling power costs. Nevertheless, this aid could also be short-lived as commerce tariffs and heightened geopolitical tensions increase the chance of renewed inflation by means of world provide chain disruptions and power market volatility. Labour market indicators are additionally turning cautious; jobless claims rose to 248,000, approaching ranges related to recession dangers, whereas persevering with claims hit their highest since 2021—suggesting it’s taking longer for displaced staff to search out new jobs. Towards this backdrop, the Federal Reserve is anticipated to carry charges regular at its upcoming assembly this week, balancing current inflation softness with energy-driven value pressures and fragile job market developments. With inflation expectations nonetheless elevated and world uncertainties mounting, policymakers are more likely to undertake a wait-and-see strategy earlier than committing to any fee cuts.

The crypto sector is witnessing a strategic pivot as main gamers embrace treasury deployment and regulatory recalibration to drive ecosystem progress. The Blockchain Group, positioning itself as Europe’s model of Technique, unveiled a €300 million at-the-market fairness program to increase its Bitcoin reserves—signalling rising investor urge for food for BTC-backed fairness automobiles amid regulatory readability below MiCA. In the meantime, Cardano is contemplating a $100 million diversification of its ADA treasury into native stablecoins and Bitcoin, aiming to deepen liquidity and strengthen its DeFi infrastructure with out counting on exterior funding. In parallel, the US Securities and Change Fee has withdrawn a number of Gensler-era proposals focusing on DeFi exchanges and custody frameworks, reflecting a broader shift towards extra innovation-friendly regulation below Performing Chair Paul Atkins. Collectively, these developments spotlight a brand new part the place blockchain foundations are actively leveraging capital to speed up adoption, whereas regulators start aligning with the decentralised nature of Web3 finance.