05 Jan Bitfinex Alpha | Glimmers of Positivity within the New 12 months

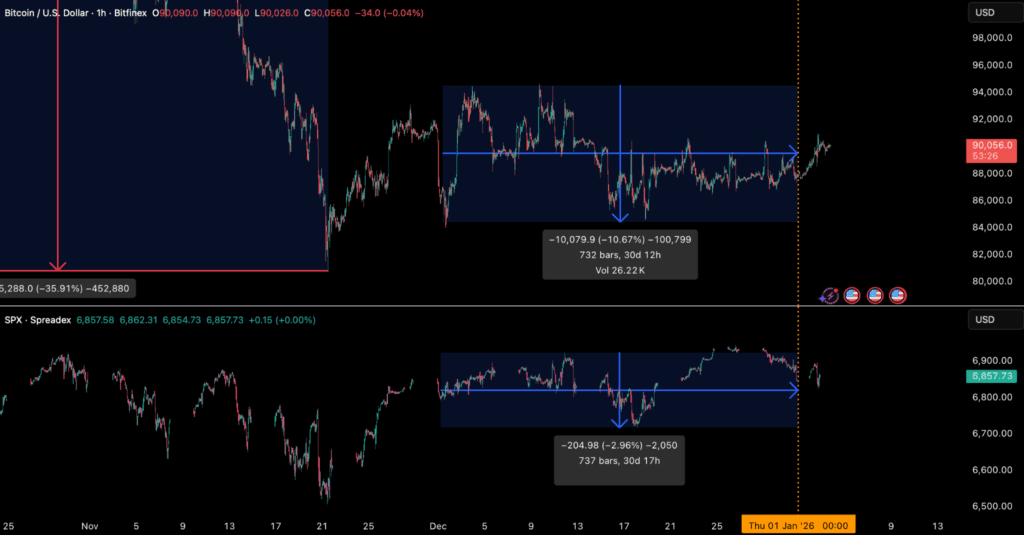

After a weak finish to the yr with late December buying and selling marked by skinny liquidity and compressed volatility, Bitcoin entered 2026 exhibiting early indicators of stabilisation. BTC consolidated in a good $85,000–$94,000 vary, underperforming equities because the S&P 500 closed 2025 close to file highs. BTC was doubtless affected by year-end tax-loss harvesting and portfolio rebalancing, as most conventional asset lessons posted sturdy annual returns whereas crypto lagged. Nevertheless, the primary buying and selling classes of 2026 have seen a modest reversal in relative efficiency, with Bitcoin up over 3 % whereas equities have softened, hinting at a possible shift in short-term dynamics.

Encouragingly, the tempo of ETF-driven promoting has slowed materially into year-end, suggesting that a lot of the de-risking might already be behind us. With liquidity situations anticipated to enhance into early 2026, upcoming ETF stream prints can be important in figuring out whether or not this nascent restoration can entice contemporary institutional capital or whether or not warning continues to dominate positioning.

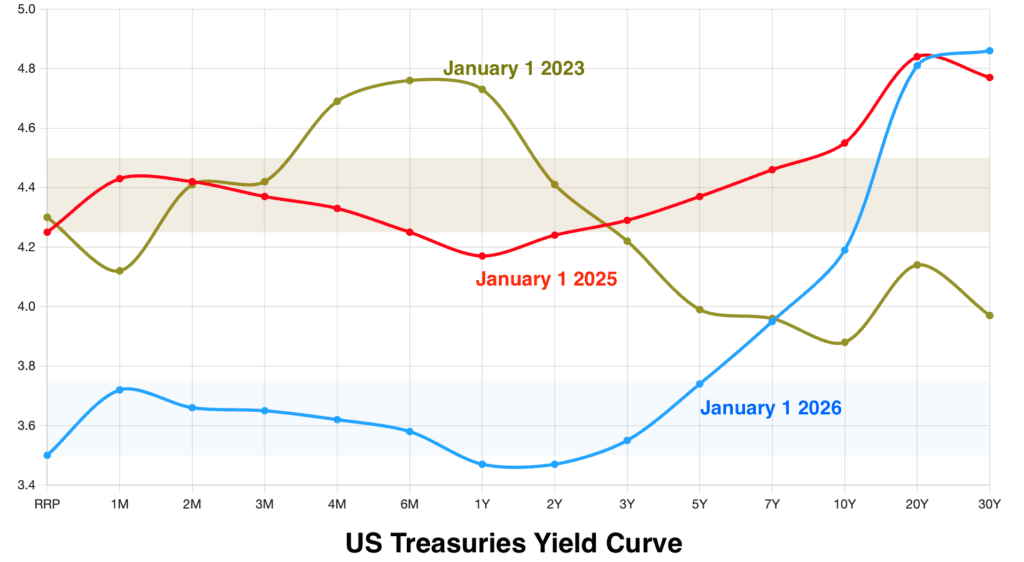

US macro situations heading into 2026 are being formed by two reinforcing tendencies: a steepening yield curve and a structurally weaker greenback. The US Treasury curve has moved decisively out of the inverted state it skilled in 2022–2024 (see chart beneath), pushed by expectations of eventual coverage easing on the entrance finish whereas long-dated yields stay elevated on account of inflation uncertainty, heavy issuance, and financial issues. This configuration displays a repricing of length and credibility threat relatively than renewed development optimism, holding monetary situations tighter than headline price cuts alone would counsel.

On the similar time, the US greenback has weakened meaningfully on a year-to-date foundation, reflecting coverage preferences for improved commerce competitiveness and a gradual reassessment of US coverage credibility.

Whereas the greenback’s structural foundations stay intact, supported by deep capital markets and sustained demand for Treasuries, the stability of dangers factors to a managed depreciation relatively than a reversal. Collectively, elevated long-end yields and a softer greenback outline a macro atmosphere the place liquidity improves solely selectively, rewarding belongings with near-term money flows, pricing energy, and actual or defensive traits, whereas constraining broad-based threat growth.

Company and sovereign engagement with digital belongings continued to broaden towards year-end. On the company aspect, treasury-led accumulation remained a dominant theme. Technique Inc. strengthened its long-term Bitcoin method with one other late-December buy, lifting its holdings to 672,497 BTC and underscoring its use of fairness issuance to systematically construct a digital reserve relatively than pursue tactical publicity. In parallel, BitMine Immersion Applied sciences deepened its dedication to Ethereum, rising its holdings to roughly 4.11 million ETH whereas increasing into staking and validator infrastructure, signalling a shift from passive accumulation towards yield-generating, on-chain methods.

Past company treasuries, digital belongings are more and more being built-in into shareholder engagement fashions, whereas on the sovereign stage, crypto adoption can be advancing, albeit cautiously. Turkmenistan launched a authorized framework allowing home cryptocurrency mining and buying and selling below central financial institution oversight, marking a notable coverage shift for one of many world’s most closed economies. Whereas the legislation formalises licensing and regulatory supervision, it stops in need of recognising cryptocurrencies as authorized tender and maintains strict controls on web entry, highlighting a selective method that seeks financial participation with out loosening financial or political management.