02 Feb Bitfinex Alpha | Crypto Undergoes Structural Reset

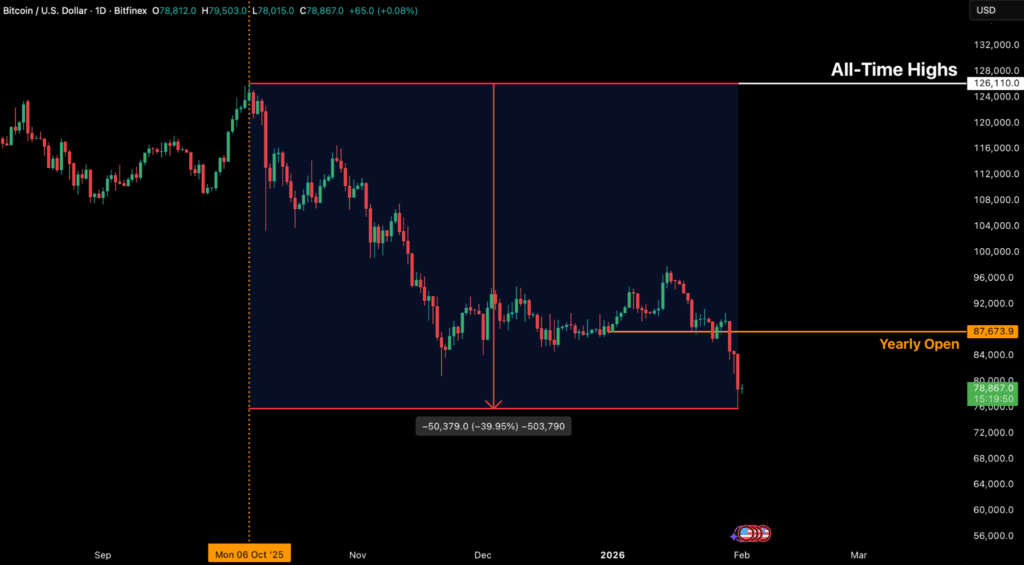

Bitcoin has led a renewed risk-off transfer throughout crypto, breaking decisively beneath $80,000 for the primary time since April 2025 and marking the deepest drawdown of the present cycle at practically 40 p.c from the October peak. Skinny weekend liquidity accelerated the sell-off, triggering a $2.5 billion liquidation wave dominated by lengthy positions, whereas US spot Bitcoin ETFs recorded their largest weekly outflows since launch at roughly $1.5 billion. The lack of key on-chain and technical helps, together with the True Market Imply, highlights the absence of marginal spot demand at a time when leverage was nonetheless elevated.

The drawdown has been pushed much less by inside crypto weak point and extra by a pointy deterioration within the macro backdrop. Hawkish implications from the proposed Fed chair succession, renewed US fiscal uncertainty, and escalating geopolitical dangers have pushed capital towards money and Treasuries, amplifying draw back volatility in digital belongings. Altcoins suffered sharper dislocations, notably Ethereum and Solana, although selective inflows into smaller-cap ETFs counsel tactical rotation slightly than broad capitulation. With leverage now materially decreased and speculative extra flushed, the market seems to be present process a structural reset. Close to-term course will hinge on whether or not value can reclaim key realised value ranges and whether or not macro strain eases sufficient to permit institutional demand to re-emerge.

The present macro and digital asset panorama displays an financial system that continues to be resilient however more and more advanced, with policymakers, traders, and establishments navigating persistent inflation dangers, shifting confidence, and structural change.

The Federal Reserve’s resolution to carry charges regular at 3.5–3.75 p.c underscores its view that US progress stays sturdy sufficient to warrant warning on slicing additional, as inflation, notably in companies, continues to run above goal, particularly as productiveness beneficial properties, whereas encouraging, have but to show sturdy.

Current information reinforces this stance: producer costs shocked to the upside, pushed by companies slightly than items; manufacturing surveys level to stabilisation slightly than a full enlargement, and rising inventories counsel progress is regular however not accelerating, leaving the Fed comfy remaining affected person until labour market situations weaken meaningfully. On the similar time, monetary markets are sending continued alerts that it’s re-setting danger, as a sharply weaker US greenback and a sustained rally in gold mirror rising considerations over fiscal self-discipline, coverage predictability, and long-term buying energy (whilst gold’s latest pullback seems extra in step with profit-taking than a reversal of the broader development). These dynamics add strain to policymakers, as a softer greenback complicates inflation management whereas rising gold costs trace at declining confidence in fiat techniques.

Towards this macro backdrop, structural shifts in digital finance are accelerating: Tether’s file earnings and big US Treasury publicity spotlight surging international demand for greenback liquidity exterior conventional banking rails. In the meantime, Japan’s transfer towards approving crypto ETFs by 2028 alerts deeper institutional acceptance of digital belongings inside regulated markets.