12 Jan Bitfinex Alpha | Cautious Optimism Builds, however Headwinds Stay

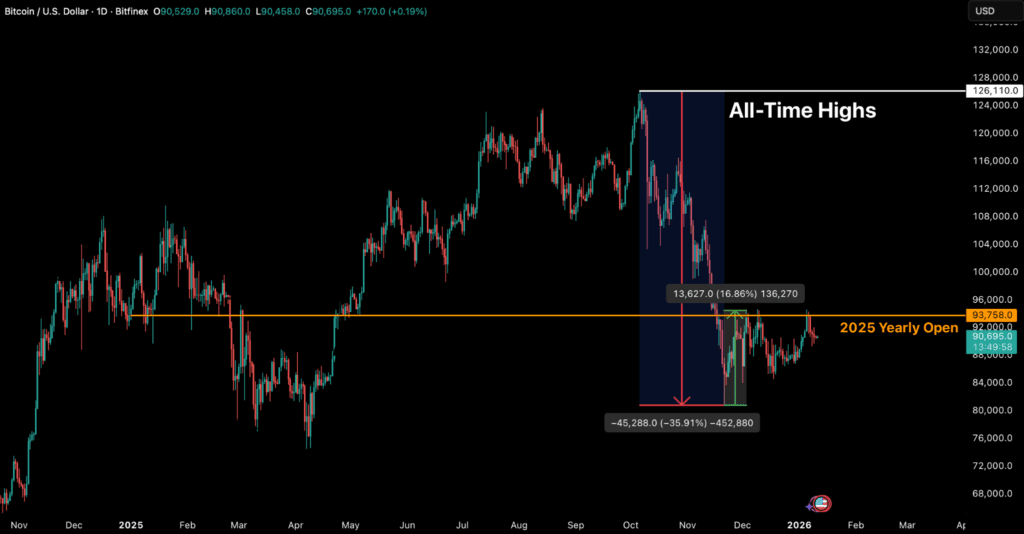

Bitcoin continues to check the important thing $93,500–$95,000 resistance zone following its rebound from the late-November low close to $80,800.

Whereas the medium-term outlook for 2026 stays constructive amid expectations of bettering international liquidity, near-term value motion continues to be capped by geopolitical uncertainty, combined ETF flows, and the necessity for a transparent acceptance above this resistance band to shift market construction decisively larger.

The sharp year-end reset in choices open curiosity has cleared legacy positioning, leaving a cleaner derivatives panorama that displays cautious optimism: longer-dated upside positioning alongside near-term draw back hedging, and implied volatility remaining compressed however step by step firming.

On the similar time, Bitcoin is now advancing right into a dense provide zone outlined by current prime patrons, whose price foundation spans roughly $92,100 to $117,400. As value revisits this space, breakeven promoting strain is prone to improve, as holders who endured the drawdown look to exit with out losses. This creates significant overhead resistance and means that additional upside would require time and sustained spot demand to soak up distribution. Till this provide is labored by, the market is prone to stay range-bound, with danger urge for food rebuilding step by step moderately than transitioning instantly right into a renewed impulsive uptrend.

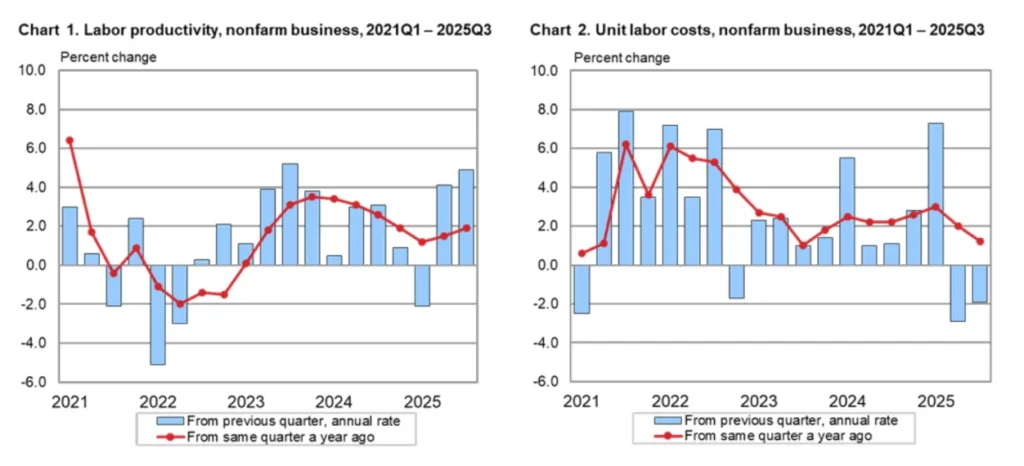

Current US macro information level to an economic system that’s slowing in exercise however not but slipping into outright weak spot, with development more and more formed by productiveness and commerce dynamics moderately than labour enlargement.

The labour market is displaying a transparent hiring pause, as job creation has slowed markedly whereas unemployment stays low, reflecting a “sluggish rent, no hearth” surroundings during which companies retain staff however keep away from including headcount. Rising productiveness is permitting companies to maintain output and margins with fewer hours labored, reinforcing expectations that the Federal Reserve will hold charges unchanged within the close to time period whereas remaining cautious about easing later within the yr.

On the similar time, the US commerce deficit has narrowed sharply, pushed largely by falling imports moderately than broad-based energy in home demand, at the same time as exports reached file ranges. Whereas the improved commerce stability might assist headline development within the brief run, the underlying drivers level to softer consumption, dangers to move and logistics employment, and potential strain on small companies, suggesting that financial momentum is changing into extra uneven beneath the floor.

Throughout main economies, digital belongings are transferring decisively towards integration with established monetary techniques, marking a shift from fragmented crypto markets to institutionally ruled infrastructure. In Japan, policymakers have signalled 2026 as a strategic inflection level, with plans to route cryptocurrency buying and selling by regulated exchanges, align main tokens with securities-style oversight, and introduce a flat capital beneficial properties tax to assist wider retail and institutional participation. This regulatory convergence is echoed in america, the place a politically related crypto enterprise has sought a nationwide belief financial institution constitution to internalise stablecoin issuance and custody underneath federal supervision, underscoring how stablecoins are more and more intersecting with core banking capabilities regardless of heightened scrutiny. Taken collectively, these developments replicate a broader international transition towards regulatory readability, exchange-based entry, and institutional frameworks as the inspiration for the subsequent part of digital asset adoption.