01 Dec Bitfinex Alpha | BTC Backside Ought to Be Close to

Bitcoin staged a notable restoration final week, rising over 15 p.c from its current lows to $93,116 after enduring the sharpest correction of the cycle, a 35.9 p.c drawdown from its all-time excessive. Nevertheless, promoting strain stays as BTC moved 4.1 p.c decrease instantly after the present weekly open.

This rebound aligns with our earlier view that the market is approaching an area backside from a time perspective, although it’s but to be seen whether or not we have now seen a backside when it comes to worth. Nevertheless, with excessive deleveraging, capitulation amongst short-term holders, and rising indicators of vendor exhaustion, we imagine the groundwork is in place for a stabilisation section to start.

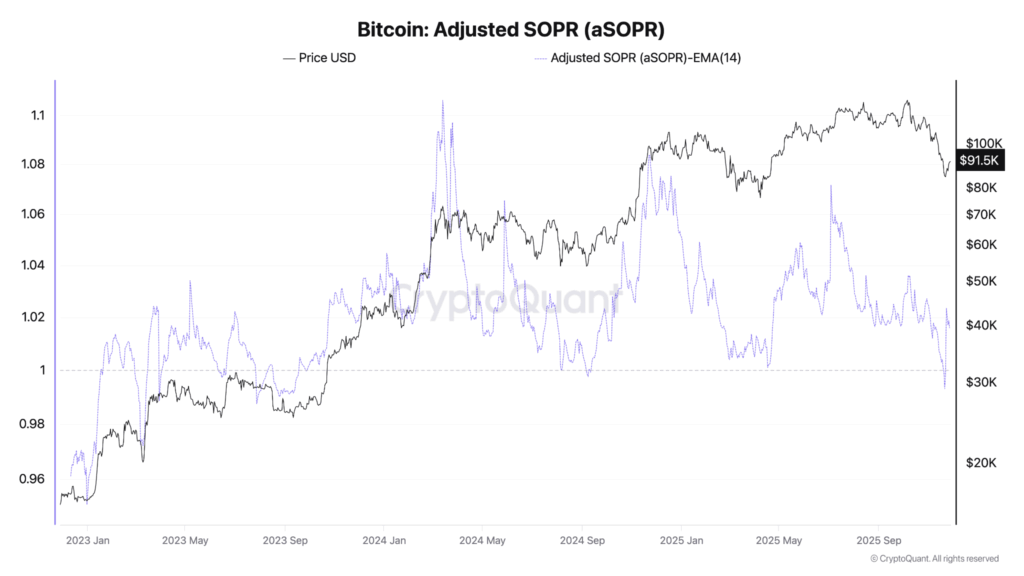

On-chain metrics additional reinforce this thesis: the Adjusted Spent Output Revenue Ratio has fallen under 1 for under the third time since early 2024, matching the identical loss-realisation dynamics noticed at prior cyclical lows in August 2024 and April 2025.

The depth of present loss-taking can also be evident in Entity-Adjusted Realised Losses, which have surged to $403.4 million per day, exceeding the losses measured by this metric at earlier main lows.

This degree of realised losses sometimes indicators that capitulation is nearing completion, slightly than the beginning of a deeper decline. In the meantime, derivatives knowledge paint the same image of a managed reset: complete BTC futures open curiosity (OI) has declined to $59.17 billion, effectively under its $94.12 billion peak, indicating that leverage has been flushed out in an orderly vogue.

The continued contraction in OI alongside rising spot costs suggests quick masking slightly than renewed speculative risk-taking, reinforcing the view that the market is transitioning right into a extra steady consolidation regime, with decreased fragility and the potential for a sustained restoration base to determine itself in This fall.

Current US macroeconomic knowledge revealed a rising divergence between softening shopper exercise and powerful enterprise funding. Retail gross sales slowed sharply in September, rising solely 0.2 p.c, whereas the GDP-relevant management group slipped into damaging territory. Elevated costs, many influenced by tariffs, and fading earnings progress weighed on households. On the similar time, wholesale inflation firmed, with PPI up 0.3 p.c on the month and power prices surging 3.5 p.c, indicating that upstream worth pressures stay sticky. Client sentiment has in the meantime deteriorated, with the Convention Board’s Confidence Index dropping to 88.7, as households develop extra cautious concerning the job market and pull again from big-ticket purchases.

In distinction, US companies are accelerating spending. Core capital items orders, an necessary gauge of enterprise funding, rose 0.9 p.c in September, matching August’s momentum and much surpassing expectations. Corporations are ramping up investments in AI, automation, and productivity-enhancing tools, at the same time as tariff uncertainty weighs on components of the manufacturing sector. This surge in enterprise funding has helped underpin a sturdy progress outlook, with the Atlanta Fed’s GDPNow mannequin estimating 3.9 p.c annualised GDP progress for Q3. The distinction between cautious shoppers and assured firms highlights a widening divide in financial behaviour, leaving the Fed to navigate December’s coverage assembly with restricted visibility and more and more uneven indicators throughout the economic system.

The previous week highlighted a transparent shift towards deeper institutional integration of Bitcoin. BlackRock’s newest SEC submitting confirmed its Strategic Earnings Alternatives Portfolio elevated its IBIT holdings by 14 p.c, bringing complete publicity to 2.39 million shares. The transfer underscores how even historically conservative bond funds are actually utilizing Bitcoin ETFs as diversification instruments, coinciding with rising structural assist for IBIT, together with a proposed enhance in choices place limits to accommodate bigger institutional methods.

On the similar time, ARK Make investments continued to lean into crypto regardless of sector-wide liquidity pressures. ARK executed greater than $93 million in single-day purchases, including to positions in Coinbase, Circle, Block, and its personal ARK 21Shares Bitcoin ETF. With Coinbase now over 5 p.c of ARKK, the agency’s aggressive accumulation displays long-term confidence in digital belongings at the same time as crypto equities face sharp month-to-month declines.

Reinforcing this institutional momentum, Texas turned the primary US state to publicly spend money on Bitcoin, allocating $5 million to IBIT as a part of its new state-level Bitcoin reserve program. Whereas modest in measurement, the transfer is symbolically important and marks the start of a transition towards direct BTC custody as soon as infrastructure is prepared.