22 Sep Bitfinex Alpha | Bitcoin Strengthens as Fed Charge Minimize Sparks Volatility

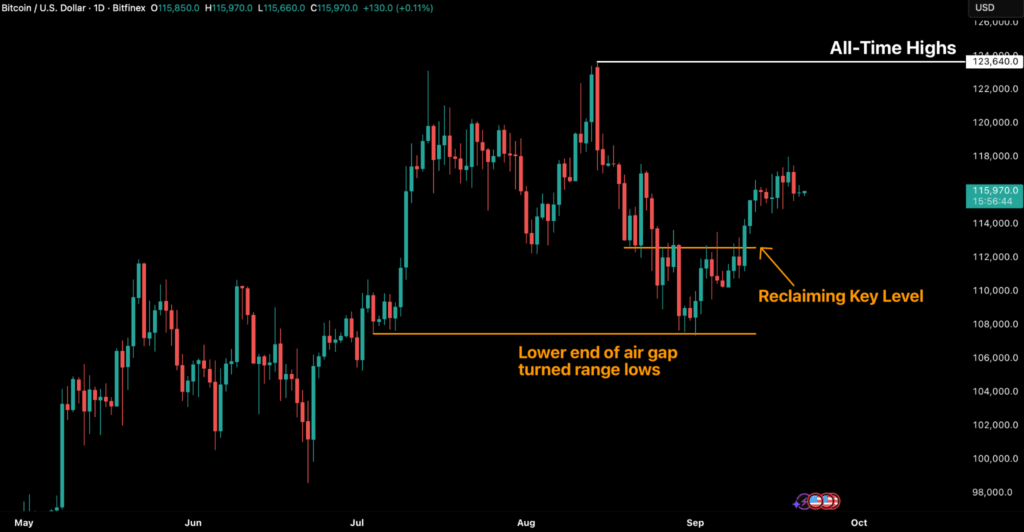

Bitcoin rallied previous $112,500 and briefly touched $118,000 following the Federal Reserve’s charge lower, pushed by brief protecting and speculative shopping for. Whereas profit-taking launched volatility, derivatives markets shifted from a risk-off stance to extra balanced positioning, easing draw back considerations.

Perpetual futures performed a central function, with open curiosity hitting a cycle excessive earlier than moderating beneath policy-driven volatility. Brief liquidations forward of the FOMC announcement triggered squeezes that fueled the rally, although subsequent lengthy liquidations highlighted the market’s sensitivity to leverage.

On-chain knowledge present that Bitcoin now trades above the associated fee foundation of 95 p.c of provide (~$115,200), restoring profitability for many holders. Sustaining this degree is vital to sustaining momentum; a drop beneath might invite renewed promoting strain and retest the $105,500–$115,200 vary.

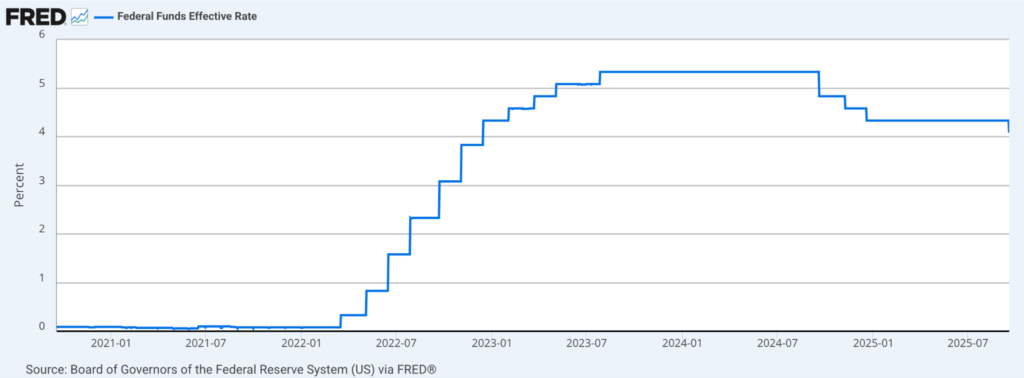

The Federal Reserve’s first charge lower since 2024 highlights its delicate balancing act between softening labour markets and cussed inflation. Chair Jerome Powell careworn that employment dangers at the moment are taking precedence, whilst dissent inside the Fed reveals divisions over how far easing ought to go. With progress slowing and inflation probably settling above goal, the Fed seems prepared to tolerate greater costs to cushion jobs, although political strain and risky market reactions proceed to cloud the coverage outlook.

These pressures are most evident in housing. New building has dropped to multi-year lows, builder sentiment stays depressed, and worth cuts are widespread as inventories swell. Whereas mortgage charges have eased, affordability stays constrained by weak job markets and tighter liquidity, leaving residential funding a drag on progress. Taken collectively, the Fed’s cautious easing, the Treasury’s funding technique, and a struggling housing market counsel that financial aid alone might not stop the financial system from dealing with extended headwinds.

The worldwide crypto panorama is being formed by a convergence of macroeconomic stress, sovereign digital foreign money initiatives, and regulatory breakthroughs that might redefine digital asset markets. Within the UK, surging authorities borrowing and rising debt prices have heightened volatility in bonds and sterling, strengthening the case for Bitcoin as a hedge towards fragile fiscal foundations.In Europe, finance ministers superior plans for a digital Euro by agreeing on frameworks for issuance and holding limits, framing the challenge as each cost modernisation and a step towards monetary sovereignty. In the meantime, within the US, the SEC’s adoption of generic itemizing guidelines for spot crypto ETFs might fast-track launches in as little as 75 days, opening the door to merchandise past Bitcoin and Ethereum. Collectively, these shifts present how crypto is more and more tied to fiscal pressures, central financial institution digital foreign money methods, and regulatory reform, dynamics that can form each progress and volatility forward.