18 Aug Bitfinex Alpha | Bitcoin ATH Results in Consolidation

Bitcoin briefly pushed to a brand new all-time excessive of $123,640 final week earlier than retreating 5.4 p.c as hotter-than-expected US inflation knowledge curbed threat urge for food. The transfer highlights the market’s sensitivity to macro headwinds, with BTC now consolidating between its ATH and native vary lows. Till stronger catalysts emerge, corresponding to dovish Fed indicators or renewed ETF inflows, value motion is prone to stay range-bound, reflecting digestion quite than outright weak point.

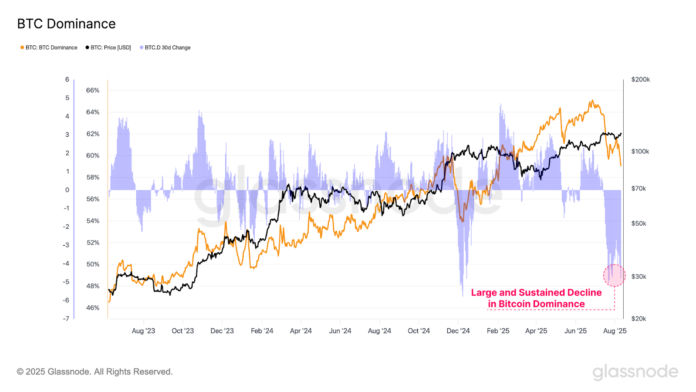

Ethereum has been the standout, climbing from $1,386 in April to $4,783 final week, inside attain of its 2021 peak of $4,864. Its power is fuelling threat rotation into higher-beta property, mirrored in Bitcoin dominance slipping from 65 p.c to 59 p.c over the previous two months.

Whereas this shift underscores rising speculative urge for food, it additionally will increase fragility throughout altcoins, the place rallies stay short-lived with out structural inflows. The majors proceed to anchor institutional flows, leaving the broader market at a vital inflection level.

The most recent US inflation experiences underscored the persistence of value pressures, with each the Client Value Index (CPI) and Producer Value Index (PPI) highlighting how tariffs and repair prices proceed to pressure households and companies. July’s CPI confirmed headline moderation, largely as a result of falling gasoline costs, however core inflation climbed at its quickest tempo in six months, pushed by service-sector will increase and tariff-linked items.

In the meantime, the July PPI revealed a good sharper squeeze on producers, with enter prices rising greater than anticipated and outpacing shopper value progress. This widening hole between producer and shopper costs signalled that revenue margins are tightening, as companies battle to soak up tariff-related bills whereas demand softens. Collectively, the experiences depict a cycle of inflationary stress constructing from each provide and demand sides, complicating the Federal Reserve’s path forward of its September coverage assembly. Whereas markets initially targeted on the softer headline CPI, the deeper particulars of the report recommend inflation is removed from subdued, and expectations for swift fee cuts might show optimistic as tariff-driven prices and service-sector stickiness weigh on the outlook for progress and company earnings.

In the meantime, final week underscored how digital property have gotten extra entrenched in world finance. Within the US, Treasury Secretary Scott Bessent confirmed plans for a Strategic Bitcoin Reserve constructed on confiscated property, halting authorities BTC gross sales whereas exploring “budget-neutral” methods to develop holdings—a transfer that decreased provide overhang however spiked market volatility.

Hong Kong’s SFC, in the meantime, rolled out a few of Asia’s hardest custody guidelines for licensed exchanges, mandating cold-wallet protections, whitelisted withdrawals, and real-time monitoring. The overhaul strengthens investor belief and goals to place Hong Kong as a number one regulated gateway for institutional crypto adoption.

On the company entrance, Gemini, the centralised change, filed for a Nasdaq IPO regardless of steep losses, revealing a restructuring that shifts US customers to Florida and a $75M stablecoin credit score line from Ripple. The itemizing would make it the third publicly traded US change, elevating transparency and aggressive benchmarks throughout the sector. Lastly, the Federal Reserve ended its particular oversight program for banks engaged in crypto and fintech, folding them again into common supervision. Alongside related strikes by the FDIC, SEC, and OCC, this indicators a shift towards mainstreaming digital-asset exercise inside the conventional banking framework, clearing the best way for deeper institutional integration.