Constancy’s prime markets strategist has warned that Bitcoin’s October excessive of $126,000 may mark the highest of the present cycle, and buyers needs to be prepared for a tough journey in 2026.

Associated Studying

In line with Jurrien Timmer, a notable pullback is feasible subsequent 12 months with key help seen in a spread of $65,000 to $75,000. That view sits alongside information factors and dealer commentary that recall previous massive drops after sharp peaks.

Cycle Warning From Constancy

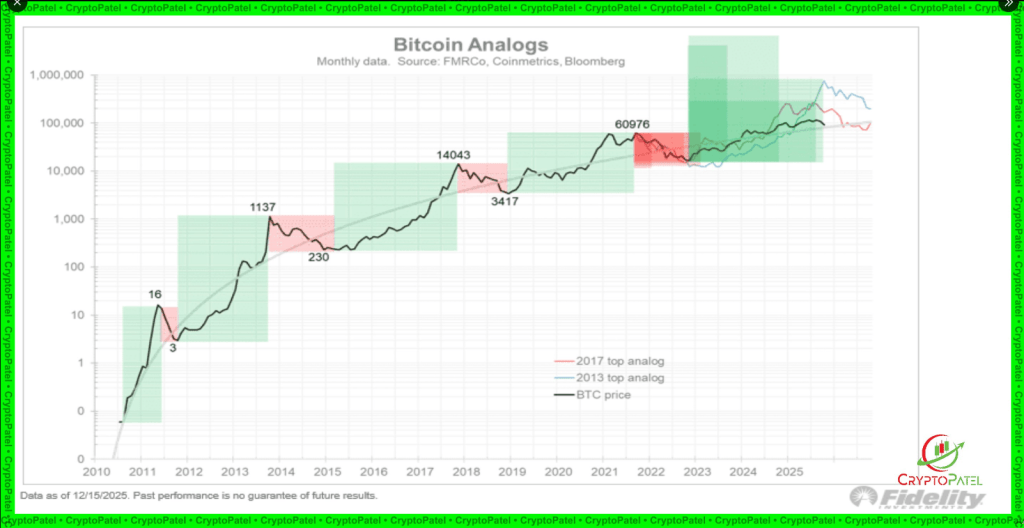

In line with Timmer, Bitcoin’s worth historical past follows a roughly four-year rhythm tied to halvings. Previous peaks have been adopted by steep corrections of about 70 to 85%.

For instance, after a excessive of $1,137 in 2013 the worth slipped to roughly $230, and the 2017 peak close to $14,050 later traded down towards $3,415. Costs surged once more after 2021, and that sample of parabolic advance then sharp retreat has been repeated. Some merchants say these falls are exams of persistence moderately than an indication the story is damaged.

Constancy Warns: #Bitcoin Cycle Peak Could Already Be In

Constancy’s Jurrien Timmer believes the $126K October excessive was the highest for this cycle. Based mostly on $BTC 4-year halving sample, He expects 2026 to be a down 12 months, with help round $65K–$75K.

Brief-Time period Ache, Lengthy-Time period… pic.twitter.com/t9wNeF5lTo

— Crypto Patel (@CryptoPatel) December 21, 2025

Historic Charts Present Parabolic Strikes

Studies have disclosed that long-term log charts assist put these swings in perspective by exhibiting proportion progress throughout cycles, which might make big-dollar strikes simpler to learn.

Market motion usually seems to be like a speedy climb to a peak, a fast drop, and a protracted interval the place costs transfer sideways and features really feel gradual. These sideways stretches are the place many long-term holders are rewarded, although it might probably take years.

BTC will hit $250k by year-end 2027. 2026 is just too chaotic to foretell, although Bitcoin making new all-time highs in 2026 continues to be potential. Choices markets are at the moment pricing about equal odds of $70k or $130k for month-end June 2026, and equal odds of $50k or $250k by year-end…

— Alex Thorn (@intangiblecoins) December 21, 2025

Galaxy Analysis has flagged overlapping macro and market dangers that make forecasting more durable for 2026, and choices and volatility tendencies recommend Bitcoin is behaving extra like a macro asset than a pure progress gamble. Galaxy Analysis continues to be bullish on a multi-year view and initiatives a path towards $250,000 by the tip of 2027.

First Quarter Patterns Could Matter

Based mostly on stories from merchants, the primary quarter has in previous cycles been a interval that always helps worth stability, though latest years have proven much less regularity. Massive inflows and treasury buys that would arrive in 2025 could be offset by early-cycle promoting from massive holders.

The stability between institutional demand and whale provide will probably present itself within the first half of 2026, making that stretch necessary for whether or not historic four-year rhythms maintain agency.

Associated Studying

2026 May Present Clues

If costs pull again into the $65,000–$75,000 space, it will match the historic correction vary and provide a take a look at of market construction. Merchants and buyers might be watching liquidity, derivatives flows, and the way rapidly spot consumers step in after any sharp declines. Persistence has paid off earlier than; the biggest features got here after prolonged calm, not proper after the low was printed.

Featured picture from Unsplash, chart from TradingView