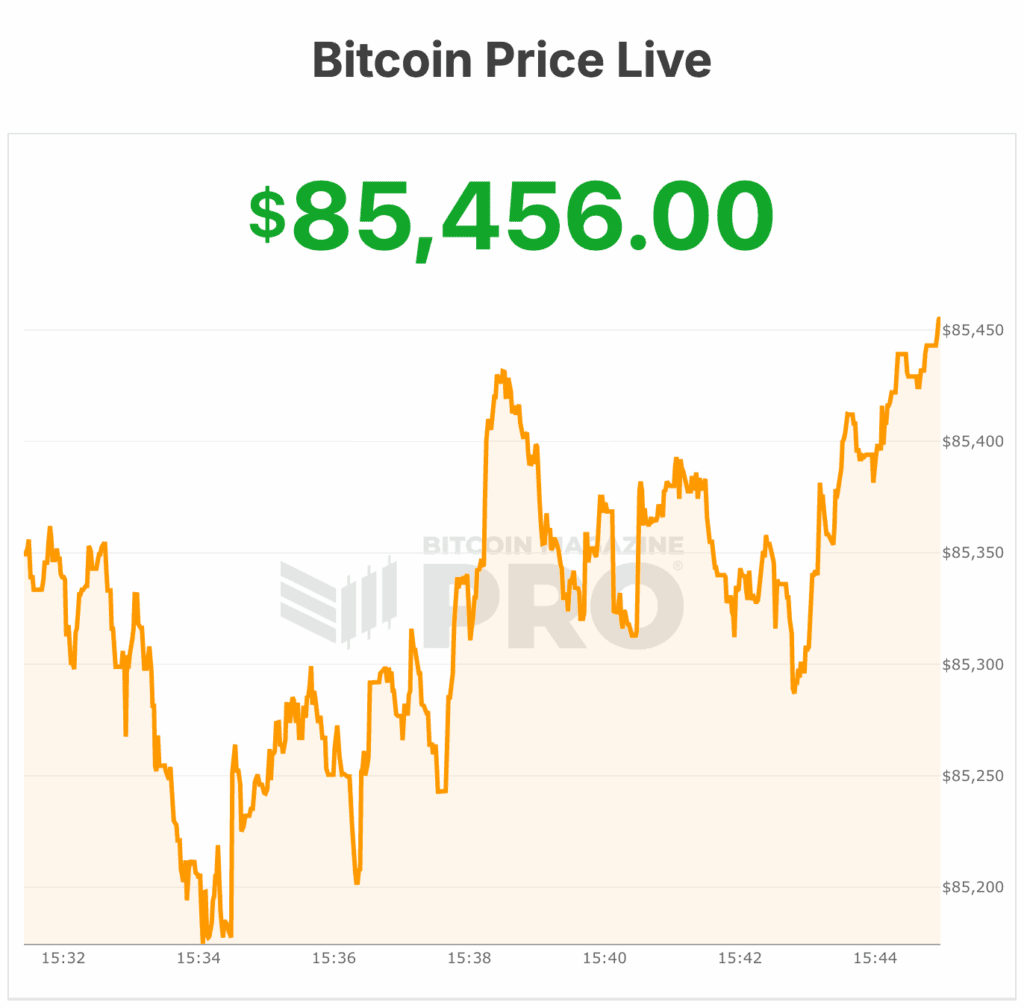

The bitcoin value stumbled into December with contemporary volatility, plunging 8% early Monday to the mid-$84,000s earlier than clawing again towards $85,456 on the time of writing.

The world’s largest digital asset is now teetering at a key $85,000 degree — a value band analysts say may decide whether or not the bitcoin value stabilizes or slides towards a deeper check of $75,000 within the weeks forward.

The pullback extends a two-month downtrend that has erased greater than 30% from Bitcoin’s October document highs. Over the previous 24 hours, BTC traded between $91,866 and $83,800, with skinny liquidity and a surge in pressured liquidations accelerating the transfer.

Bitcoin value key ranges: $85,000, $84,000 — then $75,000?

Bitcoin value closed the week and month at $90,385, displaying a short inexperienced weekly candle, however bears rapidly regained management, pushing the worth down towards $87,000.

The shut stays under key resistance at $91,400, leaving bulls with an uphill battle. Preliminary resistance checks at $91,400 and $93,000 failed, with stronger resistance anticipated between $98,000 and $103,000 if bulls regain momentum, based on Bitcoin Journal analysts.

On the help aspect, $84,000 held this previous week, although the bounce was weak. Bulls intention to defend the 0.146 Fibonacci degree at $87,000, whereas failure to carry $84,000 may open a path right down to $75,000. Additional help lies between $72,000 and $69,000, with a deeper check of $57,700 if promoting stress intensifies.

November’s month-to-month candle closed strongly bearish, taking out prior inexperienced closes from April by way of June.

Though the bitcoin value stays above the 21-month EMA, the shut confirmed a bearish MACD cross, signaling sustained subdued momentum over the following two to 3 months. This aligns with expectations of a possible high within the four-year cycle.

Within the brief time period, the bitcoin value could commerce in a variety as bears consolidate, whereas bulls try and reclaim $91,400 and $94,000. Total, the market faces downward stress, and warning is warranted for bulls in search of a reversal.

Bitcoin’s November candle erased three months of prior positive factors and cemented a bearish month-to-month momentum shift. Analysts monitoring the four-year cycle say the newest knowledge provides weight to the argument that October probably marked the cycle high.

Federal Reserve, Bitcoin value and company bitcoin strikes

The Federal Reserve’s upcoming December 9–10 assembly looms giant. Markets presently assign an 80%–87% chance of a 25-basis-point price reduce — a transfer that usually helps danger belongings and will doubtlessly carry the bitcoin value.

But when the Fed stands pat, analysts warn the crypto market may see one other wave of promoting, particularly with Bitcoin’s November shut confirming a bearish MACD cross on the month-to-month chart — a traditionally highly effective sign that always precedes multi-month side-ways buying and selling and consolidation or decline.

Bitcoin-linked equities have been additionally rattled Monday. Technique Inc. (previously MicroStrategy) introduced it created a $1.4 billion reserve to cowl at the very least 21 months of dividend and curiosity funds, aiming to quash investor fears it is likely to be pressured to promote a part of its 650,000 BTC stash.

The corporate additionally disclosed a brand new buy of 130 BTC for $11.7 million. The transfer stabilized the inventory after an early market sell-off of over 12% at instances. At present, $MSTR’s inventory is down 4% on the day.

BlackRock, in the meantime, not too long ago elevated inner publicity to its IBIT spot Bitcoin ETF, with its Strategic Earnings Alternatives Portfolio now holding 2.39 million shares price $155.8 million — up 14% since June.

JPMorgan rolled out a structured be aware tied to IBIT, providing as much as 1.5x upside by 2028.

Earlier this week, the worth of gold almost handed $2,300 an oz..

On the time of writing, the bitcoin value is $85,456. On October 6, the bitcoin value hit all-time highs above $126,000.