Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has slid by a fraction of a proportion up to now 24 hours to commerce at $88,300 as of 11p.m. on a 20% surge within the each day buying and selling quantity to

That is as CFTC Chair Michael Selig appoints Amir Zaidi as his chief of employees, marking an early management transfer because the company prepares for brand new regulatory challenges. Zaidi beforehand labored on the CFTC from 2010 to 2019, holding senior roles together with head of the Division of Market Oversight, the place he managed main derivatives insurance policies.

He was instrumental in introducing CFTC-regulated Bitcoin futures throughout Donald Trump’s first time period, an vital step in bringing crypto-linked merchandise underneath federal oversight. The appointment comes as Congress considers digital asset laws that would increase the CFTC’s authority.

🚨BREAKING: CFTC Chair Selig appoints Amir Zaidi as Chief of Workers, highlighting his prior function in approving Bitcoin futures. pic.twitter.com/X5MfbfuK4o

— Coin Bureau (@coinbureau) December 31, 2025

Selig highlighted Zaidi’s expertise as crucial for guiding the company by means of these potential adjustments and serving to it adapt to new tasks.

The Division of Market Oversight, beforehand led by Zaidi, supervises futures, choices, and swaps markets, screens compliance, and oversees exchanges and clearing companies. Zaidi has a Juris Physician, earned cum laude from the College of Maryland College of Regulation, and a bachelor’s diploma in enterprise administration, summa cum laude, from Boston College.

As chief of employees, Zaidi will handle inner coordination, coverage planning, and operational oversight. He goals to deliver stability to the fee as derivatives and crypto markets evolve. Supporting the chairman’s agenda and making certain clean regulatory operations will likely be central to his function.

Zaidi’s return underscores the significance of expertise and institutional data on the CFTC, significantly because it prepares for an expanded mandate over digital property. His appointment positions the company to take care of sturdy oversight and adapt successfully to adjustments in each conventional and crypto markets.

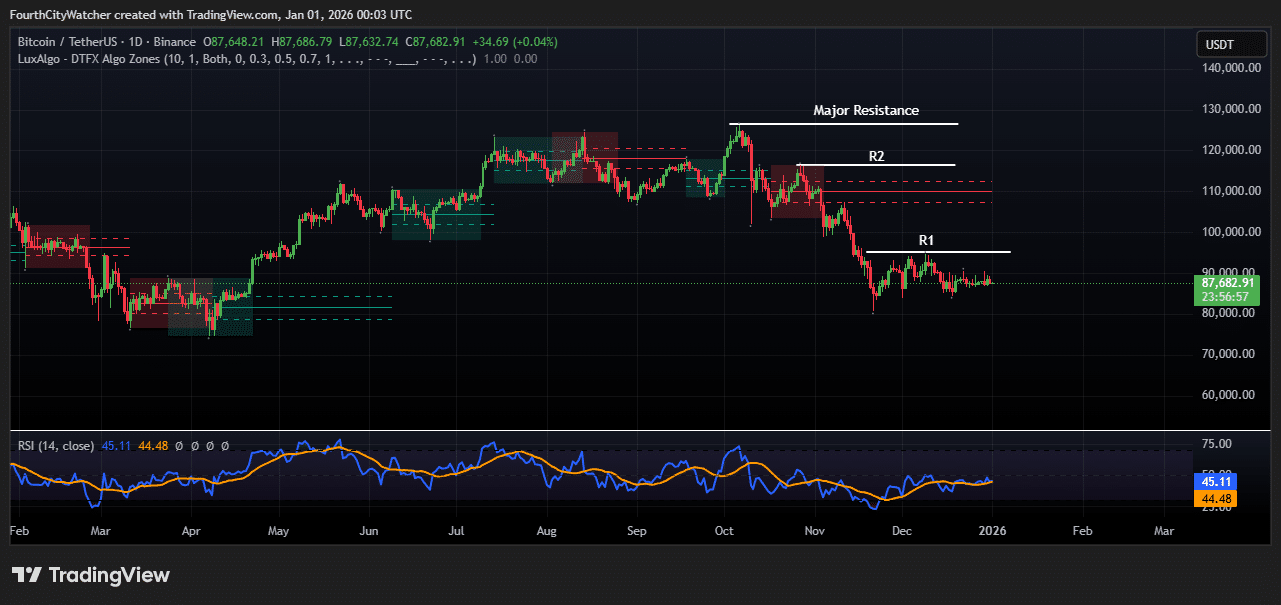

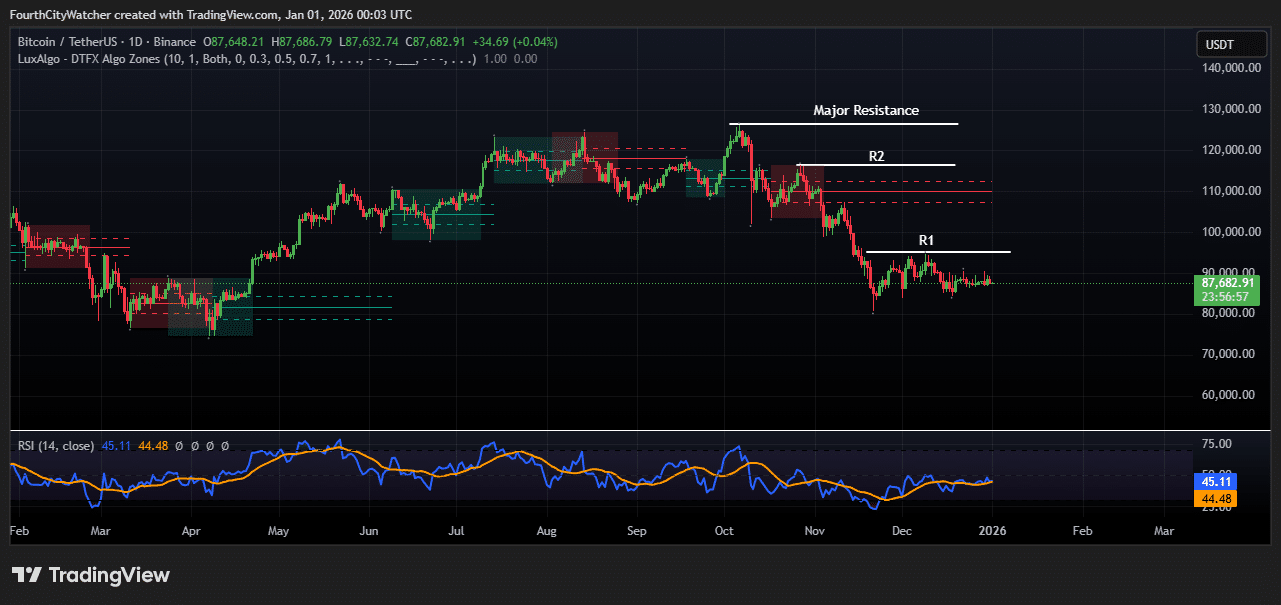

Bitcoin Sideways Motion Alerts Market Pause After October Drop

Bitcoin is at the moment buying and selling round $87,632, displaying sideways motion after its drop from earlier highs. On the chart, there are three notable resistance ranges: R1 at roughly $90,000, R2 close to $110,000, and a significant resistance degree between $125,000 and $130,000.

At this stage, R1 is essentially the most speedy and significant degree to observe. A profitable break above this might open the trail towards R2; nonetheless, the gap from the present worth suggests any upward momentum could also be gradual.

The latest slender buying and selling vary signifies a steadiness between patrons and sellers. This sideways motion means that the market is pausing after the sharp decline in October, with neither bulls nor bears holding clear management. Buyers look like ready for a decisive sign earlier than committing to important positions.

The RSI (Relative Power Index) is at the moment at 44.90, just under the impartial 50 mark. This displays gentle promoting strain with out indicating an oversold situation. An increase above 50 would counsel growing bullish momentum, whereas a fall under 40 might point out stronger promoting strain. Merchants ought to take note of how Bitcoin reacts across the $90,000 R1 degree, as it could decide the near-term pattern.

Technically, this consolidation section might function a basis for a rebound or sign a continuation of the downtrend if key assist ranges fail. If Bitcoin struggles to surpass $90,000, the subsequent helps lie round $85,000 and $80,000. Worth motion close to these ranges will likely be essential in gauging whether or not the market finds stability or faces additional draw back strain.

Total, Bitcoin stays in a cautious section, with speedy resistance at $90,000 and RSI pointing to gentle bearish sentiment. Merchants are intently watching the R1 zone to evaluate potential strikes.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection