This week within the cryptocurrency sector started on a major bearish word, and Bitcoin, the main digital asset, has declined strongly towards the $112,000 value degree. With the crypto king experiencing a persistent lower in value, key BTC traders are seen shifting their cash into crypto exchanges at a speedy fee.

Whales Shifting Bitcoin Into Binance

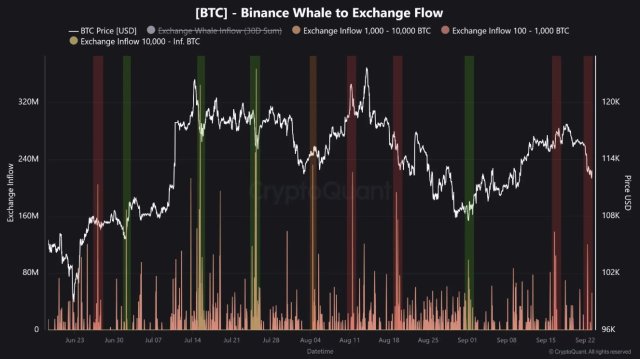

Bitcoin’s current downward development in the previous couple of days seems to have impacted the sentiment of main traders on crypto exchanges. In a current submit on X, CryptoQuant, a number one on-chain and information analytics agency, has outlined a rising shift amongst traders on Binance, the biggest crypto trade.

Presently, Bitcoin is witnessing a recent wave of investor exercise as huge whale inflows of BTC are being funneled into Binance. Such a development regularly happens earlier than intervals of elevated volatility, as whales search to both revenue from the present state of the market or put together for impending market drivers.

With massive holders presumably preparing for large buying and selling or positioning strikes, this rise in high-volume transactions signifies renewed market depth. Whereas BTC is seeing sturdy downward motion, Maartuun highlighted that whale exercise on Exchanges sometimes corresponds with these fluctuations.

In keeping with the market professional, whales proceed to have a huge effect available on the market and normally make the most of the Binance trade as their primary buying and selling platform. This means that the event may reshape BTC’s present value dynamics and trajectory within the brief time period.

Within the meantime, the professional has underscored the significance of monitoring the Whale to Binance Circulate ratio. Information reveals that inflows from massive holders to Binance reached about $120 million throughout the sell-off on September 22. After these huge deposits, an extra $52 million was noticed flowing into the platform within the early hours of September 23.

Maartuum famous that these transfers recommend that whales are always shifting a considerable portion of their cash into Binance, with the goal of executing available on the market. Combining the transfers between September 22 and 23, it marks the second-largest influx to Binance previously month, across the present excessive of $116,000.

BTC Future Open Curiosity Strikes Downward

Given Bitcoin’s decline in value, a number of key metrics are starting to exhibit bearish motion. One of many metrics highlighted by Glassnode that’s displaying a unfavorable development is the BTC Futures Open Curiosity Perpetual.

In its submit on X, the main information analytics platform reported that the metric skilled a drop from $44.8 billion to $42.8 billion, as BTC’s value pulled again to $113,000. In keeping with Glassnode, the flush in leverage displays lowered publicity to market hypothesis. Moreover, it’s regularly a wholesome reset that may scale back the chance of pressured liquidations and stabilize derivatives markets.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.