The Bitcoin value stays in a slender however pivotal buying and selling vary close to $67,000–$68,000, with the market wrestling between sustained consolidation, escalating draw back danger, and thematic narratives from technical and fundamentals that body the close to time period.

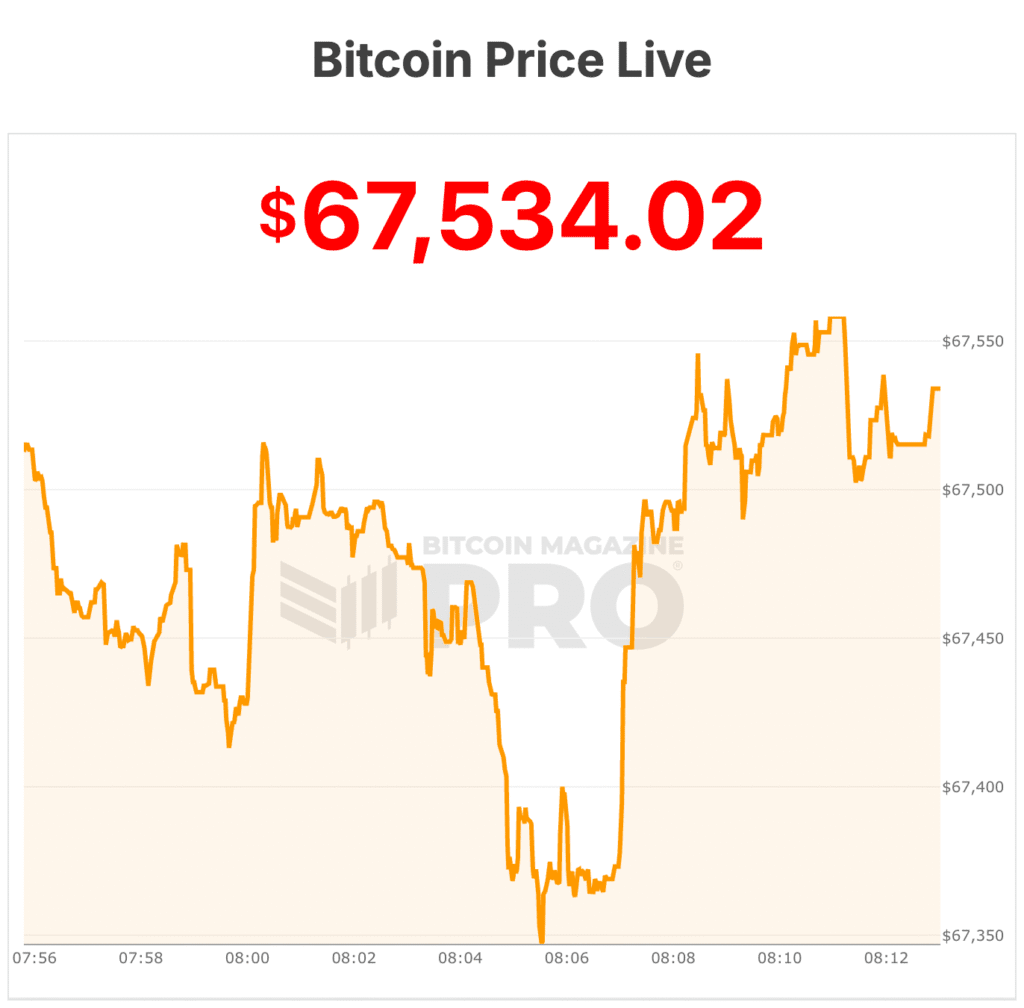

Present dwell information monitoring from Bitcoin Journal Professional reveals the Bitcoin value buying and selling under $68,000, with slight declines during the last 24 hours reflecting a scarcity of dominant drivers in both course.

“Macro information has been intently correlated with crypto’s danger profile the final 12 months,” mentioned Paul Howard, senior director at market maker Wincent, in line with Bloomberg.

Howard mentioned Bitcoin might enter a consolidation section because it appears to be like for brand new catalysts to form market sentiment. He famous {that a} U.S. Supreme Court docket resolution on tariffs anticipated Friday might have a much bigger affect than the Fed’s assembly minutes or upcoming inflation information.

The asset has held between roughly $65,100 and $72,000 following a Feb. 5 selloff that pushed costs to their lowest level since October 2024. Whereas volatility has eased from the sharp decline earlier this month, the market has but to indicate a decisive breakout in both course.

Bitcoin value evaluation

Bitcoin’s value motion has been semi-muted during the last week, with a bounce from a bitcoin value of $60,000 failing to interrupt resistance at $71,800 and as a substitute dipping to assist close to $65,650 earlier than closing round $67,000.

Bears stay in management as consumers have proven little follow-through, and a day by day shut under $65,650 might open the door to $63,000 and probably the important thing Fibonacci stage close to $57,800.

On the upside, bulls would wish to reclaim $71,800 to focus on $74,500 and better resistance round $79,000. For now, the bias stays bearish, with the bitcoin value probably ranging between the low $60,000s and the mid-$70,000s except assist ranges fail.

However some massive establishments are persevering with to purchase into bitcoin publicity.

Abu Dhabi’s Mubadala Funding Firm elevated its stake in BlackRock’s iShares Bitcoin Belief (IBIT) to 12.7 million shares value about $630 million as of Dec. 31, up 46% from the prior quarter.

Al Warda Investments additionally raised its IBIT holdings to eight.22 million shares, persevering with its transfer into regulated bitcoin ETF publicity.

Collectively, the 2 Abu Dhabi funds held greater than 20 million IBIT shares valued at over $1.1 billion at year-end 2025.

Technique purchased one other 2,486 BTC for $168.4 million final week, bringing its complete holdings to 717,131 BTC amassed at a mean value of $76,027.

With the bitcoin value buying and selling close to $68,000, the corporate is sitting on an unrealized lack of roughly $5.7 billion however continues to border its aggressive accumulation as a long-term treasury technique.