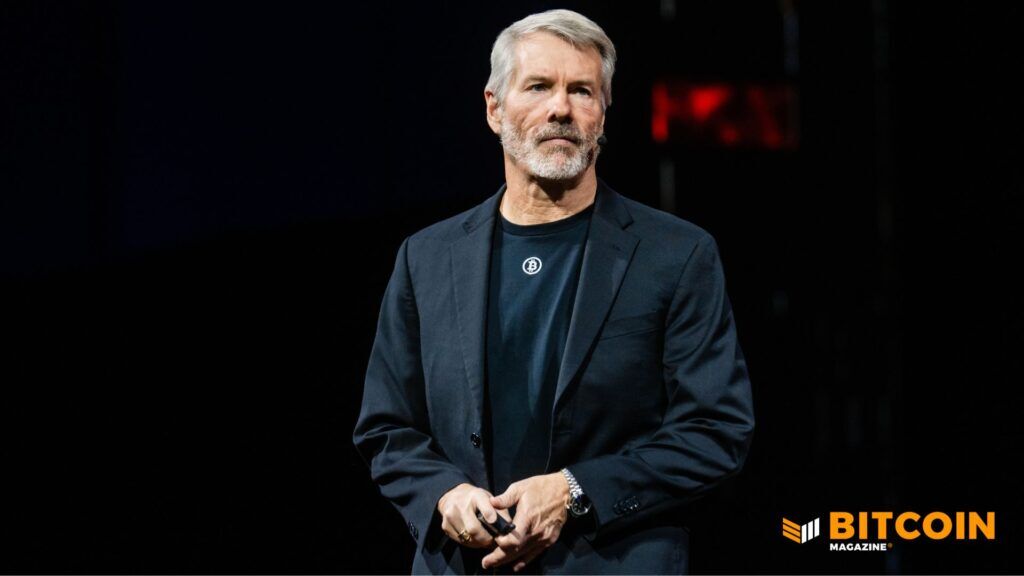

Billionaire Bitcoin advocate Michael Saylor’s firm, Technique Inc., elevated its U.S. greenback reserves by $748 million final week, lifting whole money liquidity to $2.19 billion, in accordance with a regulatory submitting launched in the present day.

The replace confirms that the corporate continues to carry 671,268 bitcoin, leaving its whole BTC place unchanged through the reporting interval from Dec. 15 to Dec. 21.

Technique stays the most important company holder of bitcoin, with an combination buy worth of roughly $50.33 billion.The rise in money stems from gross sales carried out beneath the corporate’s at-the-market fairness providing program.

In the course of the week, the corporate bought roughly 4.54 million shares of its Class A typical inventory, producing $747.8 million in internet proceeds after commissions. No most well-liked inventory was issued, regardless of a number of most well-liked share courses remaining obtainable on the market.

As of Dec. 21, Technique reported greater than $41 billion in remaining capability throughout its widespread and most well-liked inventory ATM packages.

The submitting exhibits that the corporate didn’t buy any bitcoin through the interval. Its holdings remained regular at 671,268 BTC, acquired at a median worth of $74,972 per coin, inclusive of charges and bills. The dearth of accumulation marks a pause following a big bitcoin buy earlier in December.

Technique has traditionally relied on fairness and debt issuance to fund bitcoin acquisitions. The absence of recent purchases suggests a tactical pause, quite than a change in long-term technique.

Technique’s greenback reserves

The corporate first disclosed the institution of a devoted U.S. greenback reserve on Dec. 1, when the stability stood at $1.44 billion. The reserve is meant to assist most well-liked dividend funds, service debt obligations, and handle short-term volatility.

The rise to $2.19 billion strengthens Technique’s near-term monetary flexibility.

Administration didn’t specify how or when the money will probably be deployed. In prior filings, Technique has mentioned capital raises are designed to assist long-term bitcoin accumulation whereas sustaining ample liquidity to function via market cycles.

The continued use of at-the-market choices underscores Technique’s energetic engagement with capital markets.

Whereas bitcoin holdings have been unchanged through the week, the corporate reiterated its dedication to transparency by publishing common updates via its investor dashboard and SEC filings.

MSCI and Technique

All that is taking place whereas MSCI considers a rule change that would reshape how crypto-heavy corporations are handled in international fairness markets. MSCI is weighing whether or not to take away companies like Technique from its main indexes if greater than 50% of their belongings are held in digital belongings, arguing that these corporations resemble funding funds quite than working companies.

Underneath the proposal, companies categorized as “Digital Asset Treasury” corporations could be excluded to protect benchmark integrity and restrict volatility. Technique, the most important company holder of bitcoin, sits on the heart of the controversy, however a number of different corporations with comparable balance-sheet methods is also affected.

Technique has formally pushed again, calling the 50% threshold arbitrary, discriminatory, and unworkable. The corporate argues it’s an working know-how enterprise constructing digital credit score and monetary infrastructure, not a passive crypto automobile.

Analysts and business members have additionally criticized the proposal, warning that exclusion may pressure index funds to promote billions of {dollars}’ value of shares.

Estimates counsel potential outflows of $2.8 billion to $9 billion for Technique alone, and $10 billion to $15 billion throughout the sector. MSCI is predicted to determine by January 15, 2026, forward of a possible February index implementation.

The end result of this resolution may ship shockwaves via the market and doubtlessly impression Bitcoin worth efficiency over the approaching months.

Earlier in the present day,