Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin spent Tuesday flirting with territory final seen in early March this yr, printing an intraday peak of $90,532. The transfer extends BTC’s surge over the previous two days, making it a 7.6% rallye since Sunday’s low. The rise unfolds amid the greenback plumbing three‑yr lows, developments merchants extensively hyperlink to renewed commerce‑struggle brinkmanship in Washington.

The macro backdrop is unusually binary. On one aspect, Wall Road benchmarks are off roughly 16% from their February highs as buyers digest President Donald Trump’s determination to impose—after which partially droop—“reciprocal” tariffs on allies whereas ratcheting levies on Chinese language items to 145 %.

Two weeks into the 90‑day pause, negotiators from Seoul, Tokyo, Brussels and Beijing nonetheless don’t have any agreements in hand, and contemporary talks convene in Washington later this week. “The session course of is probably not simple,” South Korea’s appearing president Han Duck‑soo conceded forward of his delegation’s departure.

Why Is Bitcoin Up?

Capital continues emigrate towards traditional secure havens. Spot gold blasted by $3,400 an oz on Monday—its fourth document in as many weeks—lifting the metallic’s market worth above $20 trillion for the primary time. The yellow metallic has added roughly $6 trillion in market cap yr‑to‑date, thrice Bitcoin’s worth at its personal January peak.

Associated Studying

Bitcoin’s newest leg larger has been greased by a burst of institutional demand. US spot‑Bitcoin ETFs absorbed a web $381 million on Monday, the most important single‑day haul since February and a pointy reversal from the online outflows that dogged the complicated in March and early April.

A full of life debate is raging on X over what, precisely, is powering Bitcoin’s outperformance versus danger property. Hedge‑fund supervisor Benn Eifert argues the reply is basically arithmetic: “Bitcoin is NASDAQ denominated in a basket of worldwide currencies, not USD, and USD is collapsing.”

Associated Studying

Macro commentator TXMC contests the favored narrative that an upswing in international cash provide is the dominant driver. In a thread rebutting “World M2” overlays, he agreed with Eifert: “That is fairly an correct mind-set about BTC’s efficiency. And it’s the identical motive individuals’s World M2 fashions have gave the impression to be skyrocketing despite the fact that the M2 knowledge is 1-2 months old- as a result of they’re overreacting to forex strikes and don’t perceive their fashions.”

The place Is BTC Headed Subsequent?

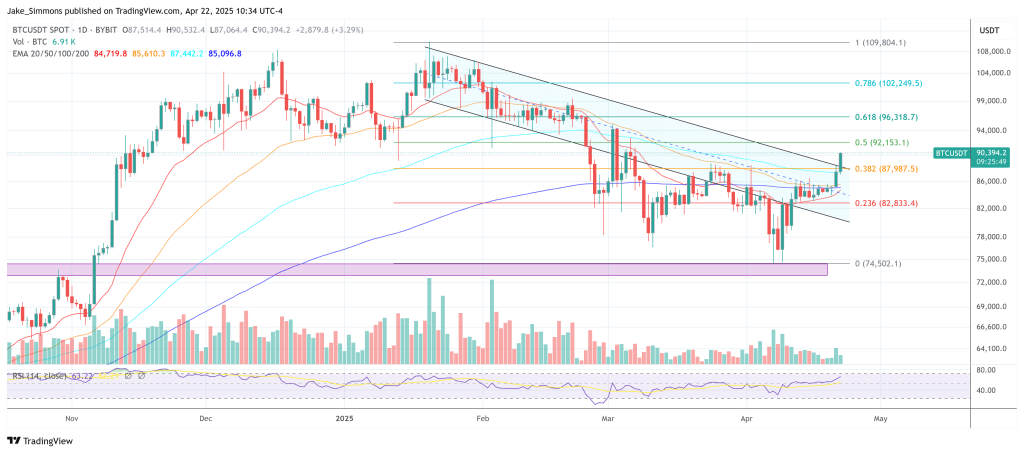

Brief‑time period merchants are fixated on a slim resistance shelf that has capped each rally since late February. Analyst Jelle calls the world the “primary occasion,” including: “Reclaim $92,000 and #Bitcoin sends larger. Loads larger.”

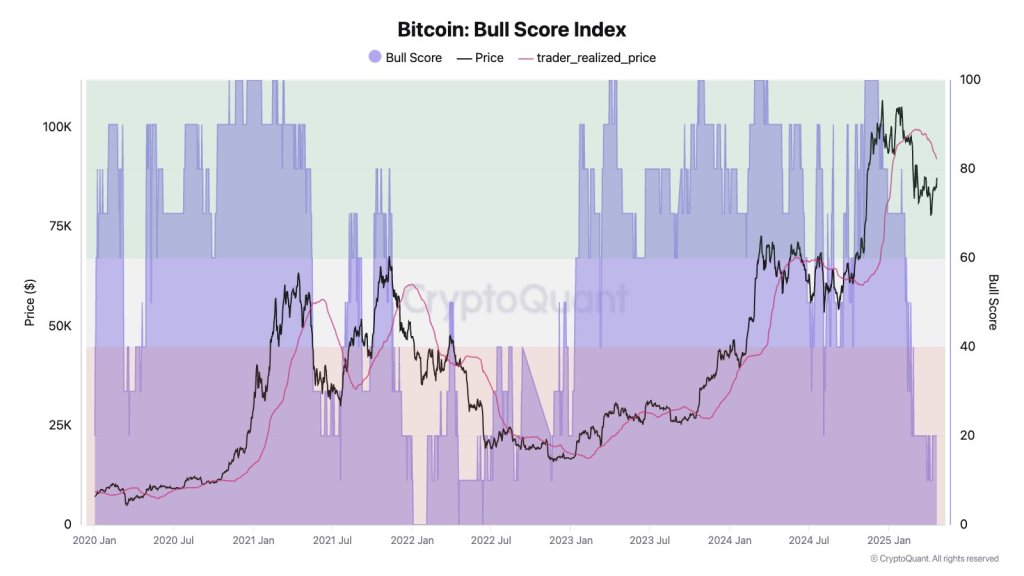

On‑chain metrics paint an analogous image. Julio Moreno, head of analysis at CryptoQuant, notes that Bitcoin is urgent into the Merchants’ Realised Worth band at roughly $91k–$92k. “The dealer’s Realized Worth acts as help when market circumstances are bullish (inexperienced space, bull rating >= 60), and as resistance when market circumstances are bearish (crimson space, bull rating <= 40). We’re presently nonetheless within the second state of affairs,” he cautions.

Momentum gauges have begun to thaw. Chilly Blooded Shiller flagged a “first RSI 50 crossover on BTC in 3 months,” including “if we’ve bought counter-trend juice, that is the place it ramps up.”

That optimism is tempered by structural hurdles. Daan Crypto Trades reminds followers that Bitcoin is “closing in on the massive $90k–$91k horizontal space which acted because the earlier vary low… That is additionally the place the Each day 200MA is positioned.” A decisive push a “few %” larger would, in his view, go away the chart “fairly nice. Bulls know what to do.”

At press time, BTC traded at $90,394.

Featured picture created with DALL.E, chart from TradingView.com