Bitcoin lastly shattered the $100,000 barrier, reaching an all-time excessive of $103,600. The milestone marked a historic second for cryptocurrency as traders and lovers celebrated its journey to 6 figures. Nevertheless, the euphoria was short-lived. Inside hours, BTC skilled a pointy reversal, plunging to $92,000 in a dramatic sell-off that left the market reeling.

Prime analyst Axel Adler took to X to clarify the sudden drop, pointing to an awesome variety of high-leverage positions as the primary perpetrator. Based on Adler, as BTC surged previous $100K, a cascade of liquidations was triggered, resulting in a swift correction. Leverage, a double-edged sword in crypto markets, amplified the downward strain as merchants who had borrowed closely had been pressured to exit their positions.

Whereas the retracement shook the market, BTC stays above essential ranges, with analysts debating its subsequent transfer. Some consider this pullback is a wholesome reset, paving the way in which for a extra sustainable rally. Others fear it may sign additional volatility. As BTC consolidates after this historic surge and sharp correction, all eyes are on whether or not it may reclaim the $100K degree and maintain it as assist within the days to return.

Bitcoin Open Curiosity Is Exhibiting Us One thing

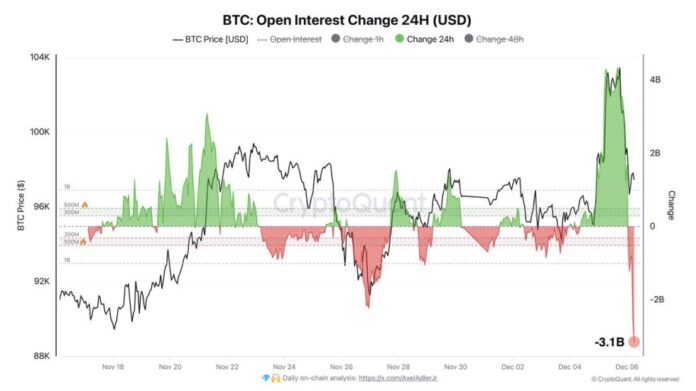

Bitcoin has skilled certainly one of its most risky days on this cycle, plunging from $103K to $92K in lower than 24 hours. This sharp reversal has left many traders questioning what induced such a drastic transfer after the euphoria surrounding Bitcoin’s new all-time excessive. Based on key knowledge from CryptoQuant analyst Axel Adler, the sharp decline could be attributed to a big deleveraging occasion within the futures market.

Adler defined that the liquidation of lengthy positions performed a vital position in driving the worth down. As BTC surged previous $102K, many merchants had been holding extremely leveraged positions, and when the market turned towards them, pressured liquidations created a cascading impact.

This deleveraging pushed the worth again down from $102K to $90K, as merchants rushed to shut positions and reduce their losses. Adler described this as a mandatory “shake-up,” noting that the market had been transferring too easily for the bulls, resulting in a pure correction.

With BTC now buying and selling decrease, the subsequent few days will likely be essential in figuring out its course. Whereas the correction could possibly be seen as a wholesome pullback, there’s the danger that this might mark a neighborhood prime for BTC, particularly if it fails to regain key ranges like $100K.

Buyers and analysts are watching intently to see if BTC can stabilize above these ranges or if additional draw back is on the horizon. The volatility and speedy worth swings spotlight the dangers inherent in buying and selling BTC, particularly throughout such a high-stakes interval.

Indecision Hitting The Market

Bitcoin is presently buying and selling at $98,000 after yesterday’s risky worth motion, the place it surged to new all-time highs earlier than retracing. The market is now experiencing indecision as bulls proceed to push to drive the worth above latest highs, whereas bears consider it might be time for a correction. This tug-of-war between consumers and sellers is creating uncertainty within the brief time period.

For Bitcoin to substantiate a continuation of its bullish development, it wants to carry above the essential $95,000 mark within the coming days. If this assist degree holds, BTC will doubtless retest its all-time excessive of $103,600, because the bullish momentum stays intact. A profitable break above this degree may pave the way in which for even larger worth targets.

Nevertheless, if Bitcoin fails to carry above $95,000, it may sign a shift in market sentiment, resulting in a possible correction. A lack of assist at this degree would counsel that the bears have taken management, and the worth might retrace additional. The subsequent few days will likely be essential to figuring out whether or not BTC can proceed its rally or if the market will enter a interval of consolidation or decline. Buyers will likely be intently watching this worth motion for indicators of a transparent course.

Featured picture from Dall-E, chart from TradingView