Knowledge reveals that Bitcoin short-term holders have seen a lower of their realized revenue, an indication that their urge for food for harvesting good points could also be diminishing.

Bitcoin Quick-Time period Holders Are Realizing A lot Fewer Earnings Now

As defined by CryptoQuant creator Axel Adler Jr in a put up on X, the BTC short-term holders have been realizing a lot decrease quantities of income not too long ago. The “short-term holders” (STHs) right here discuss with the Bitcoin buyers who purchased their cash inside the previous 155 days.

Statistically, the longer an investor holds their cash, the much less doubtless they develop into to promote them. Because the STHs are the brand new entrants available in the market, they’re unlikely to carry for too lengthy.

Due to this weak resolve, the buyers of this cohort have a tendency to simply panic promote each time one thing notable occurs within the sector, like a rally or crash.

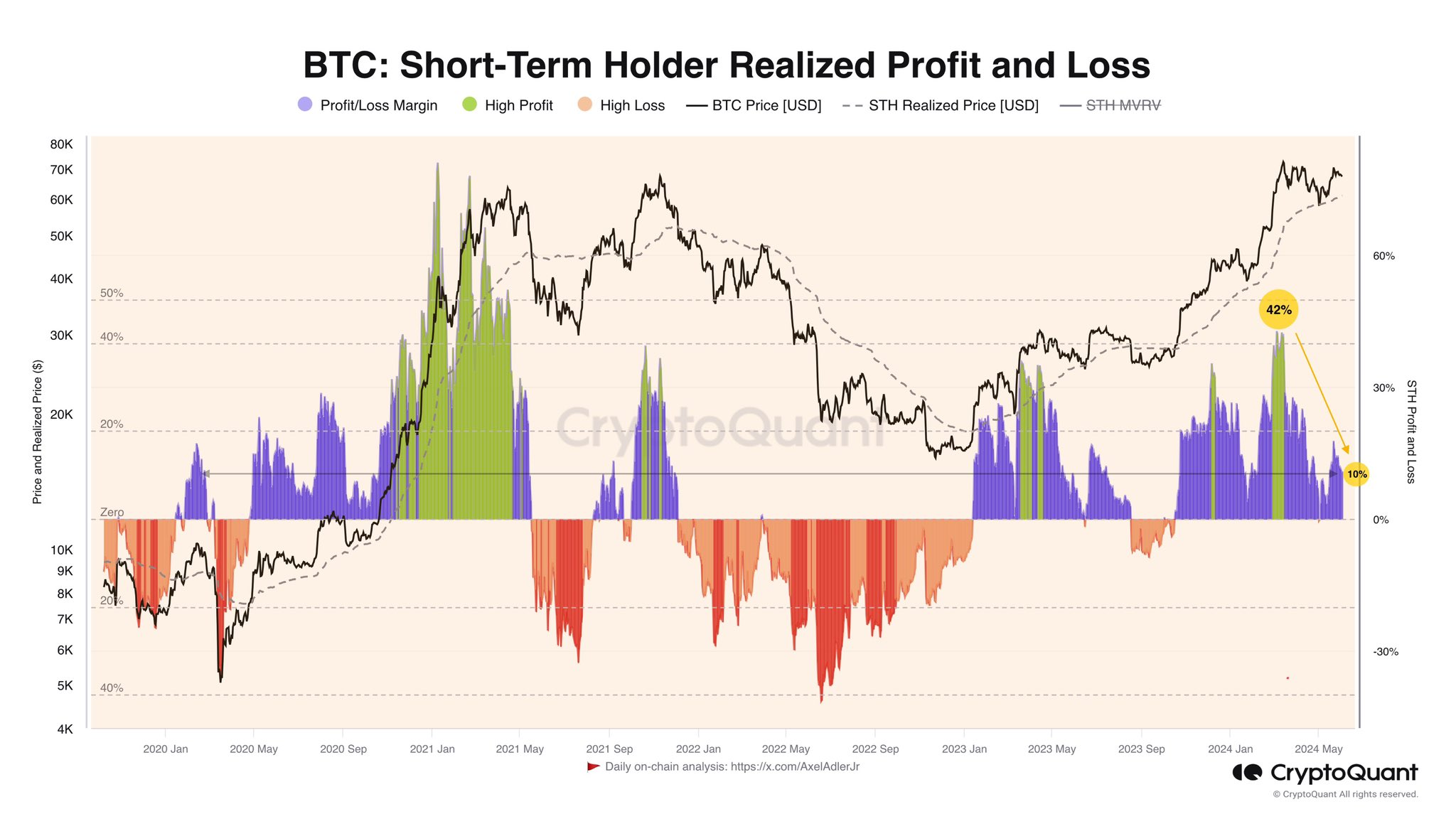

Naturally, the latest run in the direction of the all-time excessive (ATH) additionally noticed these fickle-minded holders promoting. The chart under reveals the pattern within the “Realized Revenue and Loss” indicator for this group, which tells us concerning the internet quantity of revenue or loss that they’ve been harvesting not too long ago.

The worth of the metric appears to have noticed a decline in latest months | Supply: @AxelAdlerJr on X

As is seen within the graph, the Bitcoin STH Realized Revenue and Loss metric spiked to extremely optimistic ranges when the rally in the direction of the ATH value occurred. Extra significantly, the indicator’s worth hit the 42% mark on the peak of this profit-taking spree.

Since then, because the cryptocurrency value has struggled, the indicator’s worth has dropped to only the ten%. Because the analyst notes,

The realized revenue of short-term holders has fallen by 32%, signaling a scarcity of investor want to lock in income at present ranges, primarily anticipating additional progress.

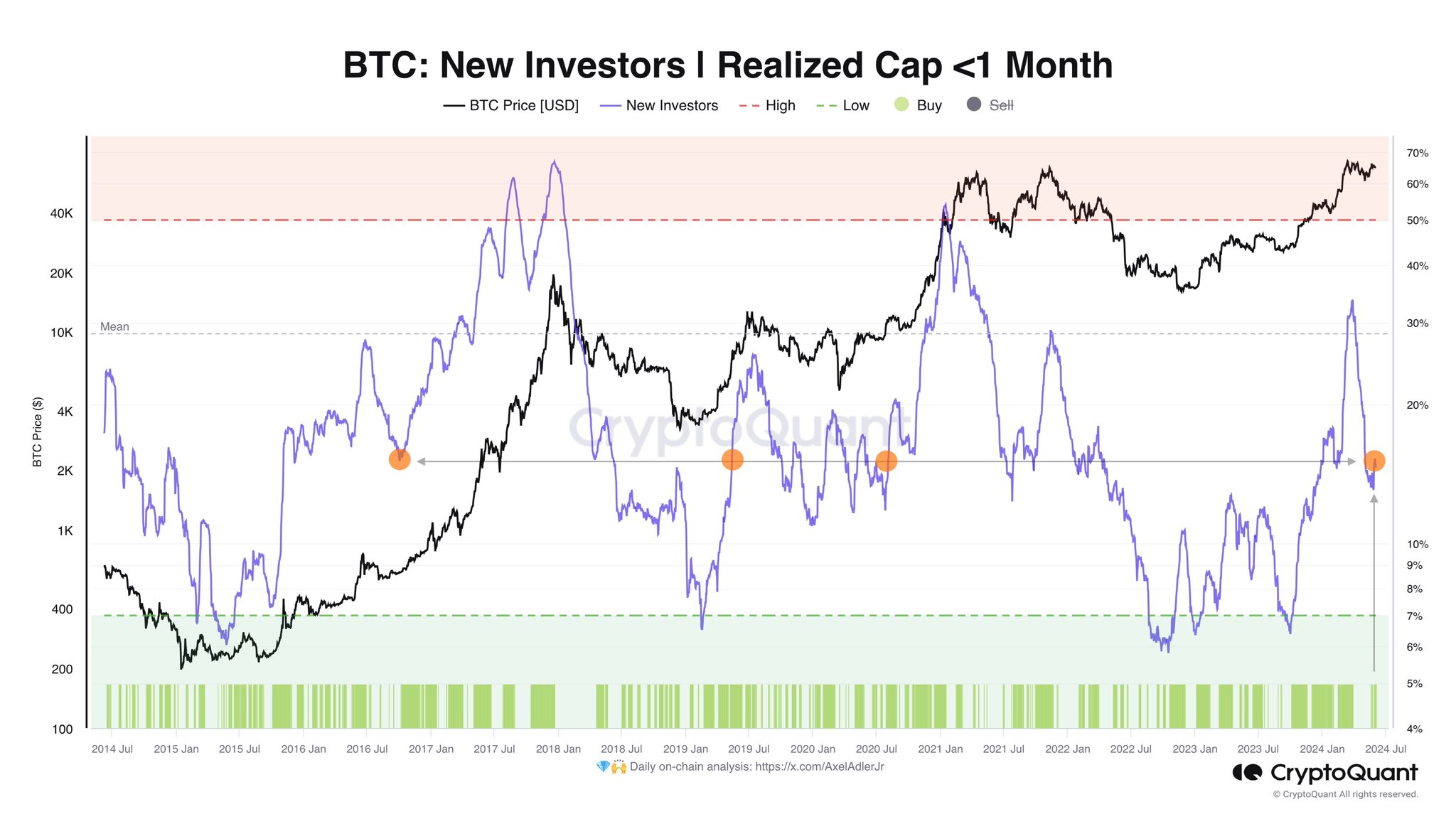

This improvement is probably not the one optimistic one for Bitcoin not too long ago. As Axel identified in one other X put up, the Realized Cap of the buyers holding for lower than a month has been on the rise.

The “Realized Cap” right here principally refers back to the whole quantity of capital that the buyers have used to buy the asset, as decided by information obtainable on the blockchain.

Because the chart under reveals, this metric had earlier been declining for these younger buyers, even among the many STHs, suggesting that recent curiosity within the asset had been waning.

Seems like the worth of the indicator has rotated in latest days | Supply: @AxelAdlerJr on X

The Realized Cap for this cohort has not too long ago discovered a reversal, a possible signal that some new demand is now flowing into the cryptocurrency.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $69,200, down over 1% previously seven days.

The worth of the asset seems to have continued its pattern of sideways motion in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com