On-chain knowledge reveals the biggest of whales on the Bitcoin community have slowed down their shopping for lately. Right here’s what this might imply for BTC.

Bitcoin Accumulation Pattern Rating Suggests Cooldown For Mega Whales

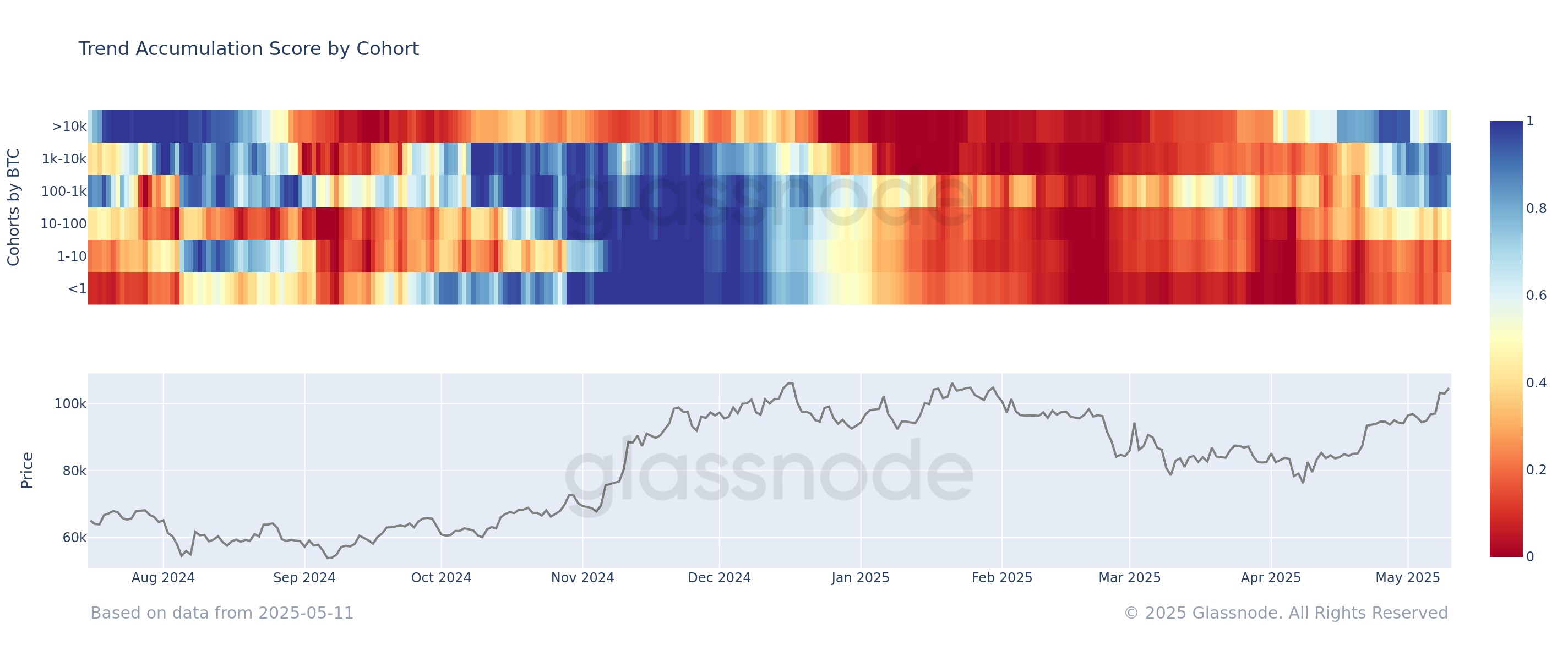

In a brand new submit on X, the on-chain analytics agency Glassnode has shared the most recent replace on the Accumulation Pattern Rating for the varied Bitcoin investor cohorts. The “Accumulation Pattern Rating” right here refers to an indicator that tells us whether or not the BTC buyers are accumulating or not.

The metric determines its worth by not solely trying on the stability adjustments occurring within the wallets of the buyers, but additionally referring to the scale of the wallets themselves. Which means that bigger buyers have the next weightage within the indicator.

When the Accumulation Pattern Rating is above 0.5, it means the massive buyers (or alternatively, numerous small holders) are in a section of accumulation. Then again, being underneath this threshold implies the dominance of distribution available in the market. These behaviors are at their strongest on the excessive factors of 0 and 1.

Now, right here is the chart posted by the analytics agency, which reveals the development within the Accumulation Pattern Rating individually for the totally different Bitcoin holder teams over the previous yr:

Appears to be like just like the conduct has been totally different throughout these teams lately | Supply: Glassnode on X

As displayed within the above graph, the buyers on the decrease finish of the market (the under 1 BTC and 1 to 10 BTC cohorts) have their Accumulation Pattern Rating underneath 0.5, which means they’re distributing.

The story is totally different for the bigger cohorts, who’re in a section of accumulation. The metric is sitting at 0.8 for the sharks (holders carrying 100 to 1,000 BTC) and at 0.9 for the whales (1,000 to 10,000 BTC), implying a robust development of shopping for.

One cohort stands out in its Accumulation Pattern Rating, nevertheless, the ‘mega whales‘ holding greater than 10,000 BTC. From the chart, it’s seen that this cohort shifted from distribution to accumulation earlier within the yr, forward of the remainder of the market and obtained a near-perfect rating on the indicator.

Not too long ago, although, the group has proven one other shift, because the metric’s worth has come right down to round 0.5 for its members. This means the cohort’s development is now impartial. It’s attainable that these humongous buyers backing off on accumulation may have a adverse influence on the continuing Bitcoin rally.

That stated, at the least for now, the sharks and whales are nonetheless supporting the run. In the course of the rally from the final couple of months of 2024, the mega whales took to mild distribution, however the remainder of the market continued to build up, offering gasoline for the run.

The rally ended when the mega whales took to heavy distribution. Identical to how the shopping for from the cohort this yr got here forward of the remainder, this selloff additionally arrived earlier than the remainder may transfer.

Contemplating this smart-money conduct from the mega whales, their Bitcoin Accumulation Pattern Rating could possibly be to regulate.

BTC Value

The Bitcoin rally has stalled throughout the previous few few days because the cryptocurrency continues to be buying and selling across the $104,000 mark.

The worth of the coin appears to have been shifting sideways lately | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.