In one of the placing moments of this cycle, gold has misplaced trillions in market capitalization, a drawdown bigger than your complete worth of Bitcoin itself. The steel that after symbolized stability is now exhibiting cracks, whereas BTC, the asset branded as unstable, has remained remarkably resilient.

What It Means For Bitcoin Subsequent Market Cycle

For many years, gold has been hailed as the last word safe-haven, and it has been rock-solid. Nonetheless, a seasoned monetary analyst, Tom Tucker, has revealed on X that Gold, the world’s oldest retailer of worth, has misplaced $2.5 trillion in market worth, which is greater than your complete Bitcoin market capitalization.

Associated Studying

In the meantime, the crypto Worry and Greed Index is flashing excessive worry, signaling that sentiment throughout digital property is close to panic ranges. Tom Tucker warns that merchants ought to keep cautious, as BTC may comply with the gold path.

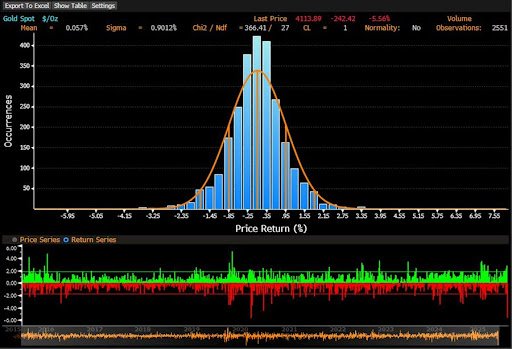

CryptoMichNL, the CIO and Founding father of MNFund and MNCapital, has noticed that gold has printed a harsh transfer, because it corrected by greater than 8% in a single day. On the similar time, Bitcoin moved up massively, however later gave again most of its beneficial properties.

In keeping with CryptoMichNL, this turbulence in gold shouldn’t be a long-lasting pattern. The volatility of gold is extraordinarily excessive, which is a direct consequence of its standing as an enormous outlier with an unimaginable parabolic run over latest months. If gold has certainly topped out, that may open the door for capital rotation in direction of different property.

Nonetheless, a delicate Shopper Value Index (CPI) print on the horizon ought to set off the potential price cuts and the tip of the US authorities shutdown. In any other case, BTC’s consolidation may begin operating as risk-on urge for food.

Why Bitcoin Will Prolong Above Its Latest Consolidation

Traditionally, Gold has seen sharp drawdowns. Senior Analyst at CoinDesk and Advisor at Coinsilium Group and ForzaBitcoin, James Van Straten, defined that the final vital gold correction happened in August 2020. On August 6, gold hit an all-time excessive of $2,035, solely to drop 5% on August 11, after which enter a 20% correction that lasted roughly seven months.

Associated Studying

Throughout that very same interval, Bitcoin was consolidating under $10,000 earlier than surging to new highs that yr, a transfer largely fueled by COVID-19-era stimulus, which acted as a robust accelerant.

Quick ahead to immediately, James Van Straten believes that as BTC’s present part is consolidating above $100,000, it might prolong mid-cycle. This is because of robust parallels that gold has as soon as once more entered a big correction, crypto liquidation occasions, the specter of a US authorities shutdown, looming price cuts, and AI-driven capex expenditure, which continues to form market sentiment and liquidity dynamics.

Featured picture from Pixabay, chart from Tradingview.com