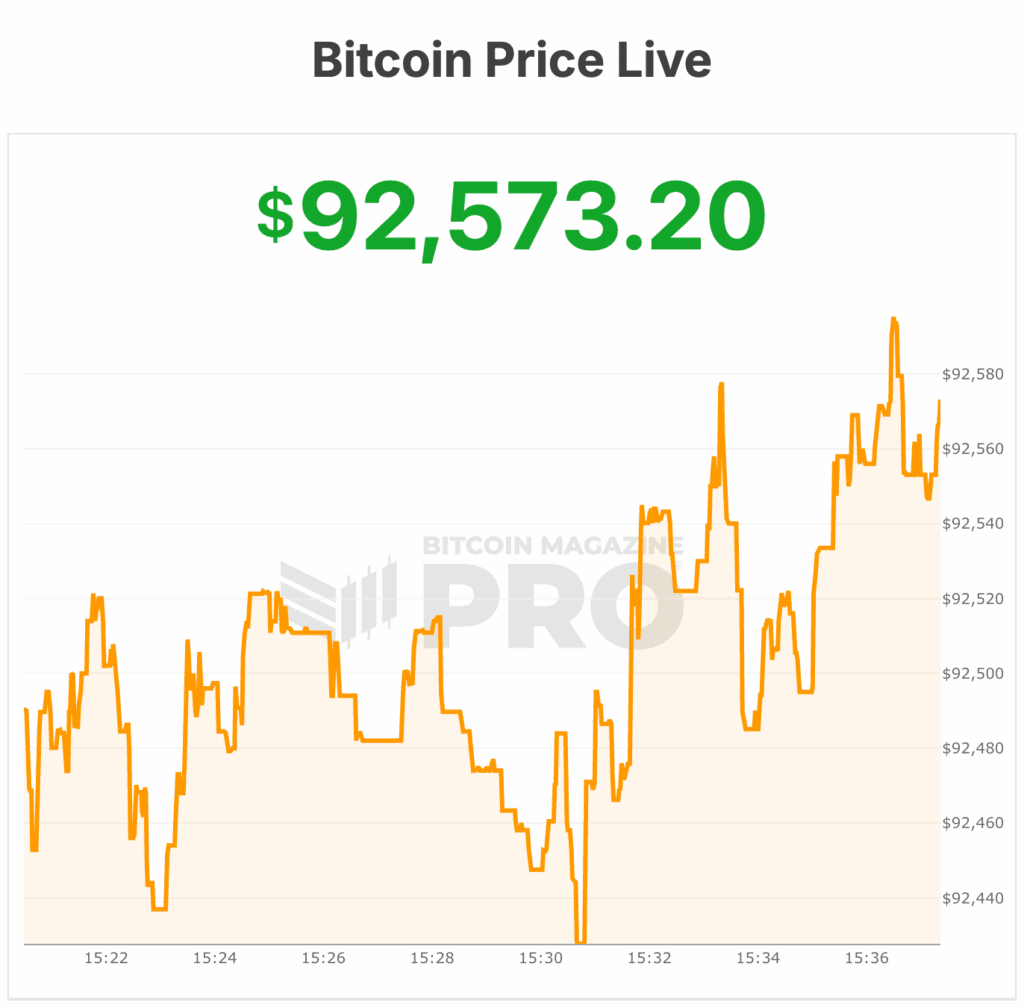

Bitcoin hovered close to $92,000 on Tuesday as analysts and merchants pointed to bettering technical and macro alerts suggesting the cryptocurrency could have put its brutal fourth-quarter sell-off behind it.

The value motion comes after months of volatility that noticed bitcoin fall as a lot as 35% from its October peak above $126,000, amid pressured liquidations and promoting stress from long-term holders. Whereas the asset ended December down for a 3rd consecutive month — a traditionally uncommon sample — a number of analysts argue the setup now favors a rebound.

“We imagine with affordable confidence that Bitcoin and broader digital asset markets have bottomed,” Bernstein analyst Gautam Chhugani and his group stated in a notice printed Tuesday, figuring out the late-November lows close to $80,000 because the possible trough of the cycle.

Bernstein pushed again in opposition to considerations that bitcoin has already peaked inside a standard four-year cycle, calling such fears “overstated” in a market more and more pushed by institutional participation quite than retail hypothesis.

“As now we have highlighted earlier, we imagine the market concern on the four-year cycle sample is unwarranted within the present market context, the place institutional demand is driving adoption,” the analysts wrote.

Bitcoin to $200k by 2027?

Bernstein reiterated its long-term bullish outlook, sustaining value targets of $150,000 for bitcoin in 2026 and $200,000 in 2027. The agency argues {that a} broader “digital belongings revolution,” together with tokenization and controlled monetary infrastructure, is extending the present bull market past historic norms.

Regardless of bitcoin’s roughly 6% decline in 2025, Chhugani famous that the 12 months was broadly constructive for the crypto sector, notably for crypto-related equities and preliminary public choices.

Trying forward, Bernstein expects a tokenization “supercycle” led by companies corresponding to Robinhood, Coinbase, Determine, and Circle to proceed drawing institutional capital into the house.

Different market observers echoed the view that draw back momentum has eased. On Sunday, 10X Analysis stated technical indicators now recommend bitcoin has entered a bullish pattern, following weeks of range-bound buying and selling via the vacation interval.

“There’s a good alternative for a tactical rally,” stated Sean Farrell, head of digital belongings at Fundstrat, in feedback on Monday. Farrell pointed to bettering liquidity circumstances, together with enlargement of the Federal Reserve’s steadiness sheet and a drawdown within the U.S. Treasury Basic Account, as supportive elements for danger belongings corresponding to bitcoin.

Fundstrat sees potential for bitcoin to check the $105,000 to $106,000 vary underneath favorable circumstances, although Farrell cautioned that his base case nonetheless consists of the danger of a significant drawdown within the first half of the 12 months earlier than a stronger rally later in 2026.

Bitcoin technical evaluation

From a technical perspective, bitcoin closed final week close to $91,500, simply above short-term resistance round $91,400. Analysts say holding that degree may open the door for one more try at $94,000, a ceiling that has capped costs since mid-November. A sustained breakout may deliver $98,000 into focus, with heavier resistance extending up towards the $103,500 to $109,000 zone.

On the draw back, merchants are watching assist close to $87,000, adopted by a stronger band between $84,000 and $72,000 if promoting stress resumes. Market sentiment has shifted from outright bearishness to a extra impartial stance as costs stabilize.

Bernstein additionally highlighted potential knock-on results for bitcoin proxy equities, notably Technique. The analysts stated a restoration in bitcoin’s value ought to assist restore Technique’s premium to internet asset worth, which has compressed considerably over the previous 12 months.

“As considerations over MSTR’s liquidation occasion get resolved, we count on a robust restoration in MSTR premium to NAV in direction of its historic common,” the analysts wrote. Technique has traditionally traded at a median multiple-to-net asset worth of 1.57, in contrast with roughly 1.02 this week.

Technique has continued to finance bitcoin purchases via a mixture of fairness issuance and most popular inventory choices, whereas not too long ago constructing a $2.25 billion “USD Reserve” to pre-pay dividend obligations.

Nonetheless, the corporate faces dangers, together with potential exclusion from MSCI indices, which may set off index-related outflows.