On-chain information exhibits the Bitcoin Hashrate has seen a setback lately, a possible indication that miners could not consider the asset’s run would final.

Bitcoin Mining Hashrate Has Declined Since Its All-Time Excessive

The “Hashrate” refers to a metric that retains observe of the miners’ complete computing energy at the moment hooked up to the Bitcoin community. This indicator’s worth is measured by way of hashes per second (H/s) or the bigger and extra sensible, terahashes per second (TH/s).

When the worth of this metric registers a rise, it means new miners are becoming a member of the community, and previous ones are increasing their farms. Such a development implies that blockchain is a profitable alternative for these chain validators.

Alternatively, the declining indicator suggests some miners have determined to disconnect their rigs from the community, doubtlessly as a result of they’ll’t break even anymore.

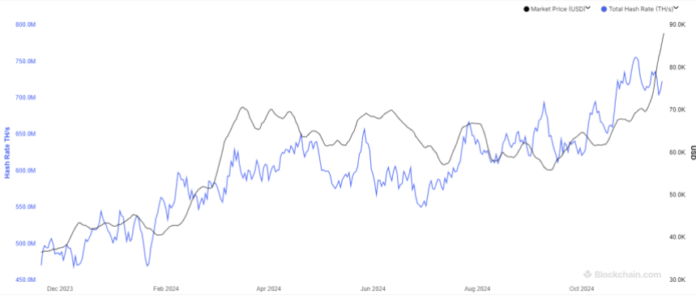

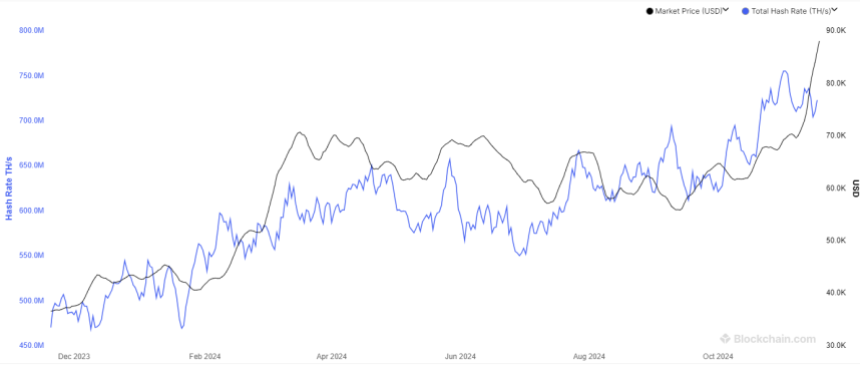

Now, here’s a chart that exhibits the development within the 7-day common of the Bitcoin Mining Hashrate over the previous yr:

As displayed within the above graph, the 7-day common Bitcoin Hashrate had sharply moved up earlier and set new information. Nonetheless, the metric has dropped since peaking close to the 755 million TH/s mark at first of this month.

The sooner uptrend within the indicator resulted from the constructive worth motion that the asset had been having fun with, as the value is straight linked to the miners’ income.

There are two ways in which these chain validators make their revenue: the transaction charges and the block subsidy. The previous depends on site visitors circumstances and may drastically change from each day. The latter, however, has very particular constraints hooked up to it.

The block subsidy stays mounted in BTC worth for about 4 years, on the finish of which an occasion known as the Halving cuts it precisely in half. These rewards are additionally given out at a roughly fixed price, which means miners’ day by day block subsidy revenue in BTC phrases all the time stays fairly predictable.

Nonetheless, one variable is free to vary, and it’s the USD worth of those rewards. Every time the value rises, so does the block subsidy income of the miners. That is why the Hashrate tends to see development in bullish durations.

Bitcoin has been exploring new highs lately, however the Hashrate has curiously stayed muted. The indicator is round 723 million, which implies it has declined by greater than 4% for the reason that peak. This development might sign that the miners anticipate the present rally to face an impediment.

BTC Worth

On the time of writing, Bitcoin is floating about $91,900, up over 8% within the final seven days.