Bitcoin has had a risky week, with its worth fluctuating between an area excessive of $69,500 and a low of $65,000. Following weeks of robust bullish momentum, the market has now cooled, and BTC is consolidating just under the essential $70,000 degree. This key threshold is seen as a set off for intensified shopping for strain if Bitcoin manages to interrupt above it.

Associated Studying

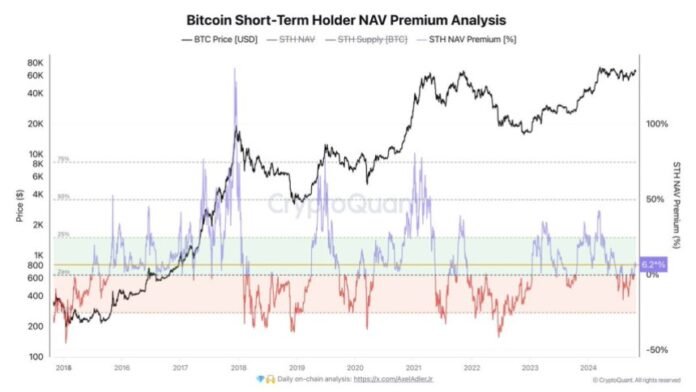

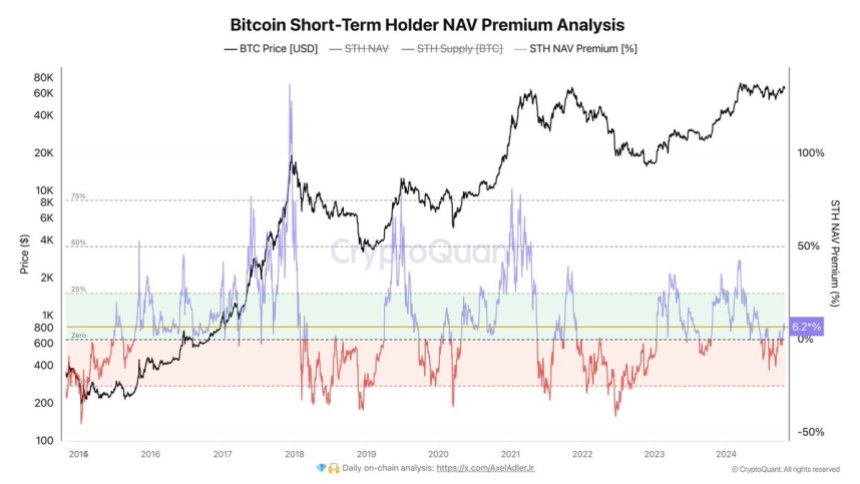

In keeping with CryptoQuant information, there’s nonetheless room for additional development, as short-term holder (STH) cash are buying and selling at a 6.2% web asset worth (NAV) premium. This premium is usually seen as a gauge of market sentiment, reflecting the optimism of short-term holders who’re keen to pay above the present market worth to accumulate Bitcoin. A better NAV premium usually means that traders anticipate continued worth appreciation and are positioning themselves for future positive aspects.

As BTC stabilizes in its present vary, all eyes are on the $70,000 mark as a possible breakout degree that would pave the best way for a contemporary rally. With optimistic market sentiment and supportive information, Bitcoin’s outlook for the approaching weeks stays encouraging, fueled by each technical alerts and powerful purchaser curiosity.

Retail Shopping for Bitcoin (Once more)

Bitcoin is experiencing rising demand from short-term holders as its worth consolidates beneath key provide ranges, near all-time highs. Analyst Axler Adler just lately shared vital insights on X, displaying that Bitcoin’s web asset worth (NAV) premium amongst short-term holders has climbed to six.2%.

This 6.2% NAV premium signifies that Bitcoin’s present market worth is buying and selling 6.2% above the common acquisition value for short-term holders. Primarily, these traders are valuing Bitcoin at a premium, suggesting optimism in regards to the potential for additional positive aspects.

Adler explains that this metric acts as a bullish sign, highlighting room for continued worth development. An NAV premium of 25% or greater usually factors to an overheated market, implying that demand has but to achieve extreme ranges.

In keeping with Adler’s evaluation, the NAV premium is a crucial gauge of market sentiment. A reasonable premium like 6.2% displays wholesome demand amongst short-term holders, aligning with an accumulation section reasonably than a peak. That is particularly related as Bitcoin’s worth consolidates below important resistance ranges, probably setting the stage for a breakout.

Associated Studying

Bitcoin’s consolidation beneath its key provide ranges and rising demand amongst short-term holders displays a good atmosphere for potential worth appreciation. If short-term holder demand continues to develop, it might gasoline BTC’s ascent to new highs.

The stability between premium demand and manageable NAV ranges might sign sustained upward momentum. There’s a potential rally on the horizon if shopping for strain strengthens at present ranges.

Technical Stage To Watch

Bitcoin is buying and selling at $66,900 after establishing strong help round $65,000. The value motion alerts resilience because it consolidates above this important degree. This help round $65,000 marks a major pivot, as holding above it displays underlying power and fuels optimism amongst traders. Nonetheless, for Bitcoin to maintain bullish momentum, a push above $70,000 is important to verify the uptrend.

If Bitcoin loses the $65,000 degree, analysts foresee a retrace towards the 200-day shifting common (MA) at $63,274. This degree is related as a long-term help zone. A pullback to this space might appeal to new patrons, reinforcing it as a significant help if examined.

Associated Studying

Traders view the 200-day MA as a key anchor for Bitcoin’s bullish construction. If BTC can maintain above $65,000 and finally break $70,000, it will point out a continuation of the present bullish section. Conversely, a dip beneath these helps would shift focus to the 200-day MA. Holding above this shifting common is essential to forestall a bearish reversal.

Featured picture from Dall-E, chart from TradingView