Based on the newest on-chain knowledge, liquidity within the cryptocurrency markets has reached an all-time excessive. Right here’s the implication of the rising liquidity on the value of Bitcoin and its future trajectory.

Stablecoin Market Cap Hits New Highs — Affect On Bitcoin Worth

In its newest report, CryptoQuant revealed that liquidity within the crypto market hit a report excessive in late September, sparking conversations concerning the Bitcoin bull market resuming. Based on the on-chain analytics agency, crypto market liquidity is measured by stablecoin worth and market capitalization, which now stands at round $169 billion.

Knowledge from CryptoQuant exhibits that the overall market capitalization of main US dollar-backed stablecoin has elevated considerably to this point in 2024, rising by 31% (equal to $40 billion) year-to-date. Many of the development, although, was triggered by the 2 largest stablecoins, Tether’s USDT and Circle’s USDC.

Supply: CryptoQuant

Unsurprisingly, USDT and USDC proceed to dominate the stablecoin trade, with market shares of 71% and 21%, respectively. Based on knowledge from CryptoQuant, USDT’s market capitalization has grown by 30% in 2024 (about $28 billion) whereas USDC’s market cap is up by 44% (equal to $11 billion) year-to-date.

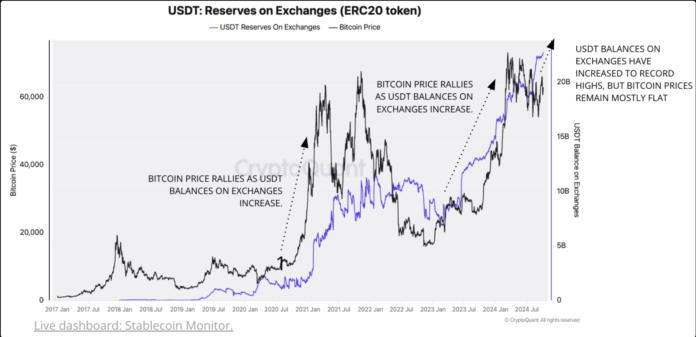

One other sturdy sign of rising market liquidity is the record-high stablecoin balances on centralized exchanges. Particularly, this development is pushed by USDT (ERC20 on the Ethereum), which has seen its balances on exchanges hit a report excessive of twenty-two.7 billion in October. This displays a 54% improve (about $8 billion) to this point in 2024.

Traditionally, rising balances of stablecoins on exchanges are positively related to increased crypto market costs, particularly the Bitcoin worth. It’s because the bigger shops of stablecoins can sign extra shopping for energy for buyers, as they will rapidly commerce stablecoins for different cryptocurrencies on exchanges (recognized to supply these buying and selling providers).

Bigger stablecoin balances on exchanges may sign the readiness of buyers to accumulate crypto belongings. In the end, this shopping for strain tends to push asset costs to the upside, particularly as buyers usually buy anticipating upward worth motion.

With the rising liquidity out there, buyers have been led to marvel concerning the Bitcoin bull run resuming quickly. It’s price noting that the overall quantity of USDT (ERC20) on exchanges has risen by 146% from $9.2 billion to $22.7 billion since January 2023, when the present cycle formally began.

Nonetheless, buyers would possibly need to decrease expectations, contemplating that these USDT balances have elevated by 20% since August 2024 whereas Bitcoin’s worth has remained comparatively quiet.

Bitcoin Worth At A Look

As of this writing, Bitcoin is valued at round $62,750, reflecting an virtually 3% improve prior to now day.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView