On-chain analytics agency Glassnode has identified how giant entities drove Bitcoin accumulation throughout the November-December bottoming section.

Massive Entities Amassed BTC, Whereas Smaller Buyers Offered

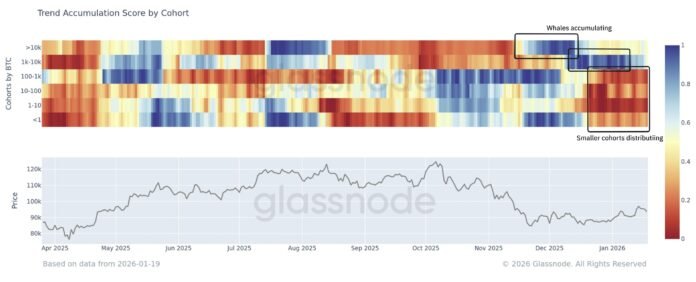

In a brand new publish on X, Glassnode has talked in regards to the current Bitcoin investor conduct. “Throughout the November–December bottoming section, provide accumulation was primarily pushed by bigger entities, whereas smaller cohorts had been distributing,” famous Glassnode.

To showcase the development, the analytics agency has cited the Accumulation Development Rating, an on-chain indicator that tells us about whether or not BTC addresses are accumulating or distributing. The indicator makes use of two elements to calculate its worth: the stability adjustments taking place within the wallets of the traders and the dimensions of the wallets themselves. Which means that bigger entities have a stronger affect on the metric.

When the worth of the Accumulation Development Rating is bigger than 0.5, it means giant entities (or alternatively, numerous small entities) are accumulating. The nearer is the indicator to 1.0, the stronger is that this conduct. Then again, the metric being below the edge implies that distribution is the dominant conduct amongst traders. The zero stage acts as the acute level for this aspect of the size.

The Accumulation Development Rating can be individually calculated for particular Bitcoin segments to get a extra granular view of conduct. Under is the chart shared by Glassnode, doing precisely this for the varied BTC investor teams.

As is seen within the graph, the Bitcoin Accumulation Development Rating was near a worth of 1.0 for 10,000+ BTC traders throughout the bottoming interval that adopted the worth crash in November. The traders on this pockets vary are sometimes dubbed as “mega whales,” similar to the biggest of entities on the community.

The traditional whales, holding cash within the 1,000 to 10,000 BTC vary, began accumulating a bit later, as their Accumulation Development Rating turned blue in December. The whales have since maintained internet shopping for, however the mega whales switched to a impartial conduct round mid-December.

Apparently, whereas the whales have been displaying accumulation, the identical hasn’t been true for the smaller investor teams. All cohorts carrying lower than 1,000 BTC have displayed various levels of distribution throughout the previous couple of weeks, with the 1 to 10 cash group particularly displaying a near-perfect promoting conduct.

“This divergence seems to be pushed partially by exchange-related pockets reshuffling, and in addition by giant holders shopping for the dip,” defined the analytics agency. It now stays to be seen how lengthy the distribution from smaller Bitcoin entities will proceed.

BTC Worth

Bitcoin has been falling for the reason that week began as its value is now buying and selling round $88,900.